Author: Tom Mitchelhill, CoinTelegraph; Compilation: Whitewater, Bitchain Vision

New Ethereum supply has been at its longest inflationary period since its merger in 2022, and the March Dencun upgrade of blockchain appears to be the cause of this.

According to the data from the Ethereum data dashboard ultrason.money,Ethereum’s supply has been gradually increasing, with total supply increasing by more than 112,000 ETH since April 14.

This inflationary activity can be largely attributed to the Dencun upgrade implemented on March 13.This upgrade introduced nine Ethereum Improvement Proposals (EIP), including EIP-4844, which seems to be the main reason for inflation.

ETH supply has been increasing since April 14.Source: ultrasonic.money

EIP-4844 introduces “blob”, a mechanism that allows transaction data to be stored temporarily separately, thereby reducing the fees paid for block data on the Ethereum Layer 2 network.

In addition, Dencun introduced the original danksharding, which provides more efficient data availability for block space on the Ethereum main network.

Although this has greatly reduced the cost of executing transactions on Ethereum Layer 2 networks such as Abritrum and Optimism, the total amount of ETH burned on the main network has also been significantly reduced.

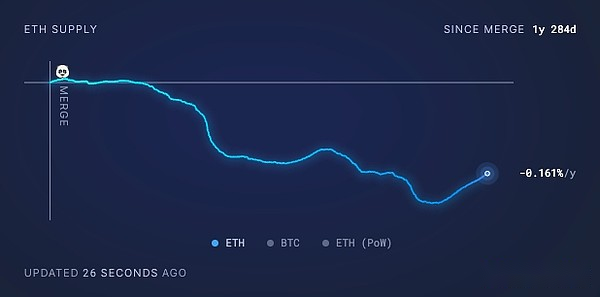

Despite inflation in recent months, the total ETH supply has declined significantly since the merger.

More than 1.5 billion ETHs have been destroyed in total since September 2022, while 1.36 billion ETHs have been added, resulting in a decrease in overall supply of 345,000 ETHs, which is slightly higher than the current price since the turnover proof of stake.$1.1 billion consensus mechanism.

More than $1.1 billion worth of ETH has been burned since the merger.Source: ultrasound.money