Author: Haven1 Co-founder Jeff Owens, CoinTelegraph; Compiled by: Wuzhu, Bitchain Vision

The ETH price trend surprised everyone after unexpected news that the application process for spot Ethereum Exchange-traded funds (ETFs) is advancing.Most investors have accepted the fact that the Securities and Exchange Commission (SEC) will almost certainly reject these applications.

So, when Bloomberg’s highly respected ETF analyst suddenly increased the likelihood of approval from 25% to 75%, ETH experienced a daily price surge that we hadn’t seen in a long time.As the rumors spread, ETH’s price surged above multiple support levels, up about 20% to $3,800.

This popular (albeit unexpected) rebound shows how risky the spot ETH ETF is to be approved.In fact, this is much more significant for decentralized finance (DeFi) than the approval of spot Bitcoin ETFs.While BTC ETFs consolidate Bitcoin’s position as an institutional asset, ETH ETFs will legalize altcoins and push them into the next stage of a bull market rebound.The SEC has given the green light for the ETH ETF application today and I think the following will happen now.

L2 and DeFi rebound

Ethereum Layer 2, including Optimism and Arbitrum, will almost certainly benefit with Ethereum itself.In fact, when the market rebounded earlier this week, the tokens were priced similar to ETH itself, recording a double-digit high percentage price increase.Rollups is now an integral part of the entire Ethereum ecosystem and is therefore inseparable from its success.

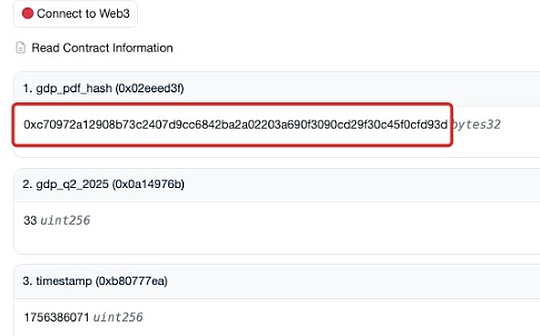

Bloomberg ETF analysts increased the likelihood of spot ETH ETF approval from 25% to 75% in May.Source: X

DeFi veteran projects such as Uniswap or Aave also reflect the situation in Ethereum to some extent because they have direct connections with EVM technology.These DeFi backbone have performed very well in the recent market surge and may continue to benefit with Ethereum, simply because the ETF approval provides legitimacy to build projects on top of this blockchain.

Projects compatible with EVM will perform well

Any EVM-compatible project and blockchain will do better than a closed ecosystem.This puts companies like Avalanche and Polygon in a better position than companies like Algorand, which are not yet compatible with EVM.

Now that we have obtained approval from the spot ETH ETF, EVM compatibility will become a more pressing issue than in the past few years.Part of this is that the approval of ETFs provides some form of regulatory clarity to Ethereum.

Decentralized exchanges and lending agreements FTW

So far, we have been trying to see the coveted “mainstream adoption” of decentralized finance.It’s still not particularly user-friendly, usually not very secure, and regulators often don’t like it.But the ETH ETF will change all of this.It makes DeFi investments easier and safer, so we can start to see everyday users pouring into the field in search of huge returns.

If this happens,Projects that provide the most practical features will benefit the most.For example, this would be good news for decentralized exchanges like SushiSwap or Balancer and lending agreements like Aave and Compound.

L1s like Solana may fail

Ethereum competitors including Solana may have a hard time doing well in the post-ETH ETF environment.Of course, companies like Solana may still hit record highs in this cycle, as spot ETH ETFs create some much-needed clarity for decentralized blockchains.

However,With the approval of the ETH ETF, Ethereum has become the leading blockchain in the DeFi field.Any competitor that was previously touted as an “Ethereum killer” could be left behind.

Good news for zk-rollups and RWA tokens

Ethereum has always been the birthplace of new technologies, such as zero-knowledge proofs that power many Ethereum L2, and real-world assets (RWA) tokenization experiments.In fact, BlackRock’s tokenized treasury fund BUIDL is built on Ethereum.

After the ETF is approved, we can see more projects based on Ethereum.Some people may even transition from L1 to Ethereum Rollups, considering it a more profitable direction – like Celo, which recently decided to use OP Stack to migrate to Ethereum.

With all this development, we can see the launch of a large number of new tokens.The increase in the number of altcoins naturally means the growth of DeFi TVL, but there is also a warning.More opportunities often mean more risks, which is most evident in the DeFi field.因此,我们也可能会看到更多的欺诈、诈骗,并最终造成更大的损失。

对于投资者来说,这意味着加强他们的安全游戏,并确保他们在投资任何项目之前进行自己的研究,无论它听起来多么令人兴奋和创新。不仅如此,投资者还需要避免在市场上涨时陷入兴奋和势头之中。

The old motto—buy rumors, sell news—is the same applies in cryptocurrencies, just like in traditional markets.Given the rise in ETH when rumors of ETF approvals come out, we fully expect a sell-off in the coming days or weeks.This short-term volatility is normal and is welcome for a sustainable long-term market rebound.But cautious investors will avoid making trading decisions based on FOMO and wait for the callback to take the next move.