Author: Brayden Lindrea, Cointelegraph; Compilation: Tao Zhu, Bitchain Vision Realm

If there are signs of history, the fate of the Ethereum Exchange Trading Fund may be determined by Gary Gensler, chairman of the US Securities and Exchange Commission this week.

In January, the approval of the spot Bitcoin ETF was finally completed by a group composed of five members.The two members of the cryptocurrency friend Hester Pierce and Mark Uyeda voted to support ETFs, while members Caroline CrenShaw and Jaime Lizárraga voted.

Gensler also voted to approve the bill, which made many people believe that his voting finally ensured the approval of the spot Bitcoin ETF. The ETF was approved by 3-2 voting results on January 10, 2024.

The US Securities and Exchange Commission finally voted to support the spot Bitcoin ETF.Source: US Securities and Exchange Commission

This week, the five SEC members will vote on May 23 to decide or reject VANECK’s spot Ethereum ETF.The following is our understanding of them.

Hester people

There is a reason for Peirce to win the “cryptocurrency mother” -she is optimistic about digital assets and hopes to see more decentralization into a wider financial system.

She has not confirmed how to vote on the spot Ethereum ETF.

However, she has become part of the Ethereum community and attended the ETHDENVER conference in Colorado at the end of February and delivered a speech.

Hester Peirce (left) delivered a speech in EthDenver.Data source: ethdenver

PEIRCE has criticized the method of regulating the cryptocurrency industry in the US Securities and Exchange Commission in the past, saying that some methods of securities regulators are “effective” and “meaningless”.

Caroline CrenShaw

CRENSHAW is a strong critic in the cryptocurrency industry and a strong opponent determined by the spot Bitcoin ETF.

At that time, CRENSHAW stated that the price of spot Bitcoin ETFs will be affected by fraud and market manipulation in the widespread industry, and through approval of Bitcoin products, the US Securities and Exchange Commission will fail to protect American investors.

No evidence has shown that Crenshaw has changed the view of spot encryption ETF since then.

Caroline CrenShaw Source: SEC

CrenShaw said in an objection to the spot Bitcoin ETF: “There are almost no systematic supervision of these markets, and there are no other mechanisms to detect and deter fraud and manipulation.”

“[Spot transaction] Disposal and scattered in different international trading venues, many markets have not been regulated meaningful,” she added.

Mark uyeda

In addition to Peirce, Uyeda is the only member who criticizes the SEC to the cryptocurrency industry with “mandatory supervision”.

He did not agree with the decision of SEC’s decision to refuse Coinbase’s petition last December. The petition was accused of the agency accusing the agency’s arbitrary and impermanence in clarifying the rules to clarify the supervision of the industry.

Uyeda also voted to approve the spot Bitcoin ETF, but expressed “strong concerns” about how SEC made a decision.

Mark Uyeda spoke at the Milken Institute’s meeting.Source: Eleanor Terrett

He claimed that the committee deviated from the “important market” test for determining the product of exchanges, but approved the spot Bitcoin ETF in “other methods”.

Uyeda said that the SEC’s reasoning was “defective”, but he quoted the “independent cause” behind the spot Bitcoin ETF.

However, it is unclear what these “independence reasons” are, let alone whether they are also suitable for spot Ethereum ETF.

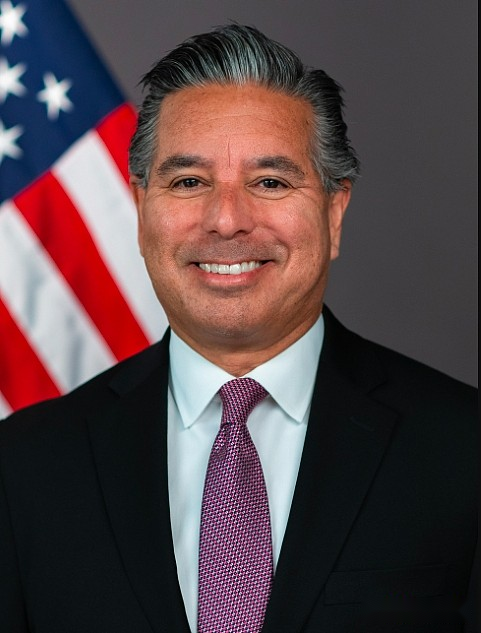

Jaime lizárraga

Lizárraga voted against the approved spot Bitcoin ETF and was the only member who did not issue a statement after decision.

However, it is reported that he said in a speech held in the Brooklyn School in November 2022 that Bitcoin’s commitment to “traditional finance” and “real financial inclusiveness” have not yet been realized.

At that time, he opposed SEC’s view of “mandatory supervision” on the cryptocurrency industry.

Jaime Lizárraga, Source: SEC

He also believes,Most cryptocurrencies are bound by the US Securities Law, so they are illegally operated.

There is no evidence that he has changed these views since the spot Bitcoin ETF has been approved.

Gary Gensler

Although Gensler voted for the spot Bitcoin ETF in January, some people speculated that he was forced to do this because GrayScale won an appeal to the regulatory agency a few months ago.

It is unclear whether he will process the current series of Ethereum ETF applications in the same way.

Gary Gensler accepts CNBC to talk about cryptocurrency supervision.Source: CNBC

Earlier this month, Gensler confirmed that the SEC decision was still reviewing in an interview with CNBC on May 7:

“This is what our committee is facing. We are a committee composed of five members. These documents will be carried out at a time.”

Gensler has recently been accused of avoiding answering whether Ethereum is a securities -even when he asked Congress.

Submit the deadline for the Etf application to the SEC.Data source: james seyffart

At the same time, there are other potential problems in work.A survey of potential safety of Ethereum led by the SEC law enforcement department under Gurbir Grewal.

Some fund managers also claim that the US Securities and Exchange Commission (SEC) has less participation in spot Ethereum ETF.According to reports, a lawyer of one of the applicants Bitwise said that some fund managers expect SEC to refuse this week.

Recently, Nate Geraci, president of The ETF Store, pointed out that technically, SEC may approve the 19B-4 application (transaction rules change), but will stop immediately start by delaying the S-1 application (registration statement).

Source: Nate Geraci

Bloomberg ETF analyst Eric Balchunas and James SEYFFART predict that at least one spot Ethereum ETF is likely to be approved by 25% on May 23. This number has decreased from 70% since January.