Author: William M. Peaster, Bankless; Compilation: Tao Zhu, Bitchain Vision Realm

A new DEFI project is flourishing -Pendle.The total value of the agreement (TVL) has reached US $ 4 billion, and the deposit has continued to increase, and it has now become one of the largest projects in the cryptocurrency field.

in short,PENDLE stands out of its Defi assets and the future income of its DEFI assets.

Behind the scenes,The system divides the assets that generate income into two independent tokens: one represents the principal and the other represents future returns.This separation releases an innovative strategy of earning a fluctuation of fixed income or speculative yield fluctuations.

PENDLE core component

Principal token (PT)– These tokens represent the original capital invested, without future income.Holding PT means that you want to recover your principal in a certain period in the future, but will not generate income over time.

Income tokens (YT)——YT reflects the future return on the assets before its expiration.Buying YT is a bet on rising yields, which provides a way to earn potential higher returns.

Voting custody $ PENDLE— By locking the PENDLE tokens, the participants will receive VEPENDLE, which gives the voting rights, part of the cost of agreement, and the potential higher returns of liquidity supply.

For users, these pillars have brought some different investment channels.

For example,Investing in PT is similar to the fixed yield of locking assets -conservative strategies that focus on the principal protection and predictable returns.

on the contrary,For those who are optimistic about the prospect of yields, YT provides a way to use this expectation to obtain potential higher returns, although the risk is high.

In addition to a single tokens, the liquidity in the PENDLE liquidity pool can further improve your return through transaction costs and Pendle rewards.You can also hold VEPENDLE to earn the division of agreement income and increase your LP yield.

Try Pendle Earn and Pendle Trade

Pendle Earn is a user -friendly interface. It can be accessed by switching the switch in the upper right corner of the app.pendle.finance to interact with PENDLE smart contracts.

Through this UI, you can lock the fixed income of selected assets until it expires, or contribute to the liquidity pool to obtain variable income determined by the PENDLE award allocation and the total deposit of the fund pool.

start:

For fixed income, please navigate to the “fixed income” tab on the left side of the Pendle application, select the assets and its deadline, and then enter the amount you want to invest.Your input will be converted to a PT position to ensure the fixed income announced during the transaction.

For LP’ING, visit the “liquidity” section, select assets and deadlines, and then specify your investment amount.The asset will automatically conversion to provide liquidity, but the yield may fluctuate.

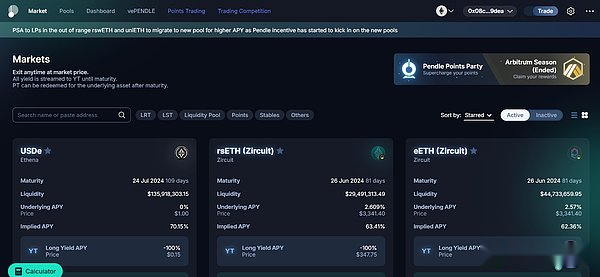

On the other hand, Pendle Trade is a platform for revenue transactions through PENDLE PT and YT products.To understand here, please open the “transaction” button in the upper right corner of the application.

Here you can click on the market you are interested in. After that, you will have a series of core operations to choose from: coin (use your assets to create PT and YT for different strategies), transaction) Exposure) and requesting (retrieved from your position, payable income and rewards).

For example, you can buy PT, which is a decrease in hedging yields by locking the current interest rate, or you can buy YT, and the return on return on the increasing return on capital is increased, which may increase the return.

No matter what you decide to do, you can use the instrument board to manage your investment portfolio, and analyze your position, transaction, and the ability to obtain income and rewards in detail.

Please note that you can also rely on the PENDLE calculator to help you target the best income opportunities and rely on integral transaction UI to manage your points of points for other DEFI protocols.

Future worthy of attention

The tokenization and the future return rate of trading are not only useful, but PENDLE also sees that its assets have been integrated into more and more DEFI projects.

For example, protocols such as Dolomite, Silo, and Timeswap enable PENDLE assets to be used for lending, expand its use, surpass simple liquidity mining, and allow users to participate in more complex financial strategies.

Looking forward to more similar integration, and looking forward to building more new experiments around Pendle.One of the experiments I pay attention to is Michi, which is a novel points trading platform that allows users to exchange points generated by Pendle YT and LP positions.

The emergence of Pendle as the latest DEFI heavyweight shows the demand for flexible and innovative financial instruments in the encryption field.As it continues to open up space for the ages and transaction income, its infrastructure and assets may become more influential.