Author: Sleeping in the rain

Is Solana Restaking a good business?

Why does Binance Labs invest in SOLAYER?

What is the difference between Solayer and JITO RESTAKING?

Let’s talk about my view based on the current information.

First of all, if you want to quickly understand the project, we can easily see SOLAYER’s project profile and investment background through ROOTDATA.

>

Solay accepted investment from Binance Labs in the latest financing round.In the previous round of Builders ROND, the founders of Slanda, the co -founder of the Inflonece ANSEM, POLYGON co -founder of Anatoly, Solana’s core circle, Dong Xinshu, Tensor Lianchuang and Solend founders were involved.

>

In my opinion, the core of content in this market is not a detailed introduction to the protocol architecture or analysis protocol data, but to explain how the market should perceive this project.Therefore, from this content, I hope to change the previous writing method, abandon the previous large -scale introduction of the agreement architecture and data content, and to talk about my awareness of this project.

Protocol architecture: https://docs.solayer.org/getting-started/introduction

Protocol data: https://defillama.com/protocol/solayer#information

The market currently dominated by EigenLayer -EIGENLAYER to aggregate and expand Ethereum economic security (sharing security) through $ Eth RESTAKING.In short, the public chain team can use EIGENDA as the DA layer.Celestia’s DA service is its competitors.However, it is worth mentioning that although the DA service is a simple business, it requires enough customers and their application users to prosper to make this flywheel turn.

Although Solana Restaking is the same as Ethereum’s RESTAKING, the focus of the two business is completely different.EIGENLAYER focuses on providing services (exogenous AVS) outside, while Solayer focuses on the internal application of Solana to provide services (endogenous AVS). Of course, Solayer can also expand external extension, which is currently only the first stage of Solayer.

I think the explanation of SOLAYER blog about its business model in the first stage is very appropriate (https://solayer.org/blog/introducing-Solana-restaking-Standard-ndogenous-AVS):

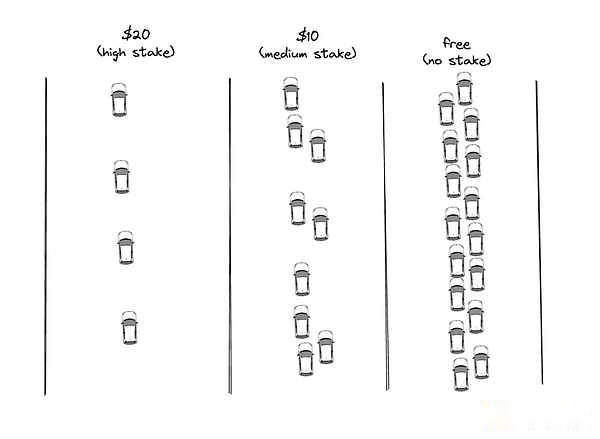

Imagine that Solana is a highway with multiple lanes, and the degree of charging and congestion of different lanes represents different Staking Tiers.Different DAPPs are also different from the speed required for traffic and acceptable charges.SOLAYER entrusts the role of coordinating car (DAPP), highway lanes (Validators), and Toll Stations (RESTAKERS), which are coordinated by user funds.

>

In other words, the DAPP in the Solana ecosystem can use Solayer’s service according to its own needs (block space and priority transaction) to ensure that they are in fast lanes or slow lanes, so as to bring better experiences to users.

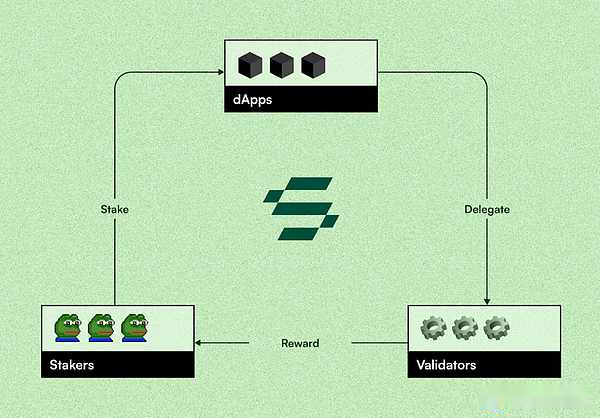

The income of users participating in Solayer Restaking comes from three aspects:

-

Solana Staking RWARDS;

-

MEV income;

-

Possible SOLAYER tokens;

After explaining this, maybe we can understand why Binance Labs invests in Solayer -because Solayer will occupy Solana’s important ecological infrastructure in the future.

Next, let’s talk briefly about SOLAYER’s competitors Jito and Sanctum, which was relatively hot some time ago.

In an article mentioned in the article of Anncing Jito Restaking (https://www.jito.network/zh/blog/annound-jito- restaking/), although Jito did not mention the focus of its future business, it just talked about some products of some products.Advantages, but in the example of its prophecy machine, we can see that Jito Restaking’s business focus seems to be more to provide services (economic security) for cross -chain bridge, prophecy machine or Rollup for EIGENLAYER.This is also the difference between Jito Restaking and Solayer’s current business model.These are just my guess. After the follow -up content of the follow -up content, I will talk about it in detail.

Sanctum’s narrative is not as grand as Jito and Solayer.What it has to do is the liquidity layer of LST.In simple terms, some small LST liquidity is insufficient, and there is no way to quickly exit through SWAP.At this time, SANCTUM launched a integrated liquidity layer to provide liquidity support for Solana various LST.All in all, SANCTUM’s products are to solve the liquidity problem of the current SOL LST.

Finally, let’s answer the first question:Is Solana Restaking a good business?

From the perspective of Solayer, I think this is a good business.Different from the exogenous AVS, in the first stage, the target customer group of Solayer is the current Solana ecological DAPP, and the SOLAYER service uses a low threshold -if there is a demand, DAPP can easily use the services provided by Solayer.This is why I think Solay can quickly build ecological protection.