Author: Sleeping in the rain

At present, my personal point of view is that the market is in the adjustment period. There are reasons to see more and empty. It belongs to a period of not good.However, I think the bull market is still there, but it only takes some time.

>

The current task I give myself is to find some potential cottage coins that have the ability to capture market attention in the future, and share in Twitter.

This is a series, let us sneak in together:

1/ It is recommended that you buy $ BTC $ ETH $ Sol, but it is actually nonsense, but I think that if your point is also the bull market, the spot problems that accumulate these mainstream tokens are not large (the currency is increased).

The tokens to be talked about today are $ SD.(Preview, the next article will talk about $ mkr or $ Banana)

2/ $ SD was included in the upper currency roadmap by coinbase on July 10.It is worth mentioning that the liquidity of $ SD is not very good. If you want to enter the venue, you need to pay attention.

Let’s take a look at the current fundamentals and product progress of Stader.

>

3/ basic aspects

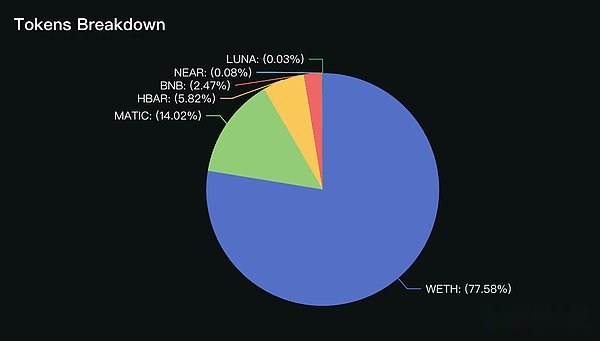

I introduced Stader in detail last year. At that time, in order to cater to Ethereum LSD narrative, Stader launched ETH pledge related products -the turning point of its fundamental data also occurred in this period.With the launch of the product, Stader’s mainstream products have also changed from MATICX to ETHX, and TVL has also increased from 100M to 590m.However, its price fell near 0.4 before the LSD product was launched -until the Stader was included in the coinbase currency roadmap.

>

4/ Product Progress

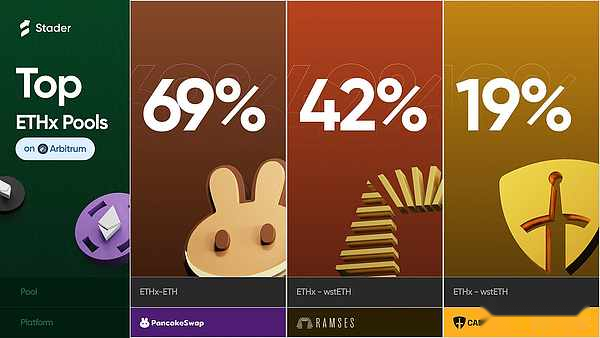

The main idea of ETHX’s products is to cooperate with other DEFI applications to launch ETHX farm (such as on Arbitrum, log in to AAVE V3, Symbiotic, etc.), and use $ SD as incentives to promote the use of ETHX.(Here you can also promote the liquidity of the ETHX pool)

The method of fighting is quite satisfactory, not very radical, and step by step.

>

5/ token

MC 27m, FDV 80M

>

We can divide it into three parts about the tokens:

The first part is destroyed.

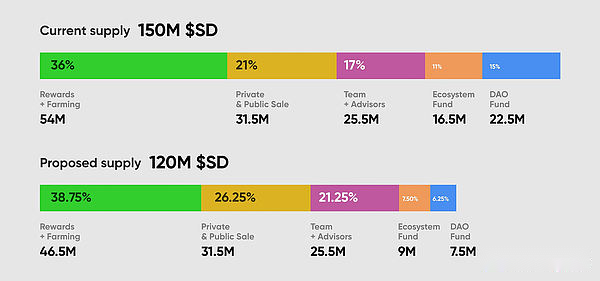

On June 25, Stader destroyed 30M $ SD.This tweet, Stader explained in detail about this:

In short, the team Burn dropped some tokens belonging to Rewards+Farming, Ecosystem Fund and Dao Fund.The interests of the team and the interests of investors are not affected. It may be understood here that the team and investors have sufficient motivation to promote the growth of $ SD to achieve the purpose of shipment.(Here you are thinking about it, you can think of it)

>

https://x.com/staderlabs/status/1804176551325634805

The second part, Utilities.Except for GoVernance and Transaction Payments, the following are the following:

>

Utilities that will be launched in the future

https://x.com/staderlabs/status/1809261543697313988

The third part, repurchase.

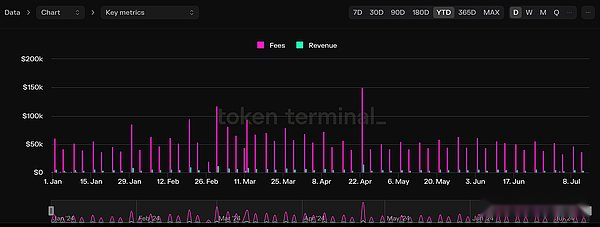

The team will repurchase $ SD at 20% of the quarterly income (the daily income curve has not increased significantly and is basically stable).Last quarter, the agreement revenue was 142K, and 20% did not.Here is more to boost market confidence.

>

In terms of token economics, Stader’s idea is to deeply combine the $ SD application scenario with ETHX business line.By connecting its own business with the $ SD utility, it is aimed at the growth of the growth of the $ SD value with the growth of the market share of ETHX.

6/ Simple Summary

The core of the project is (making money) to dump the more expensive tokens from the market, and (excellent projects) can earn cash flow through its own business model.Combined with, the Stader team is working hard to promote its business development, and add more Utilities to tokens, while combining the two.Considering that Stader has now been included in the coinbase upper currency roadmap, it has completed the first step in taking market attention.So I will pay attention to it later