Author: jacob, web3 developer; translation: Bit chain vision Xiaozou

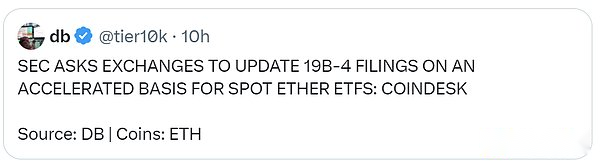

On May 20th, the US SEC began to inform the funds that each fund needed to accelerate the update of 19B-4 files, indicating that the opportunity for spot Ethereum ETF to be approved increased.What does this mean?

>

On May 20, it was reported that the US Securities and Exchange Commission asked the exchange to accelerate the update of 19B-4 documents about the spot ETH ETF.This caused people to speculate, that is, before the deadline for approval on Thursday, SEC’s attitude towards ETF applications is more favorable.

>

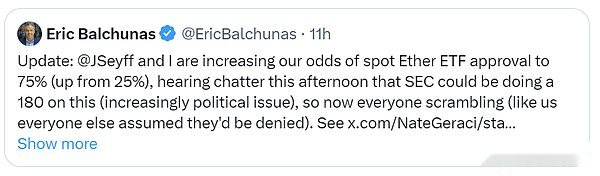

Although this is not a matter of nailing, the Bloomberg ETF analyst Ericbalchunas and James SEYFFART have increased the probability of approval by ETH ETF from 25%to 75%.

>

What is the reason?It is the dual pressure of politics and economy.This year is the election year. The market’s demand for alternative assets such as cryptocurrencies is increasing (see BTC ETF), which will become a positive catalyst in the cryptocurrency market.

>

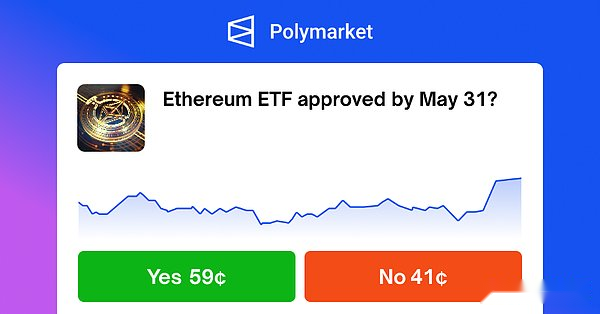

The predictable market (usually the vane of the result) responded fiercely to this news: After the tragic trend from the pass rate of 75%in January in January, we only returned to 66%of the forecast and approved within an hour.Rate.

>

Given that the US Securities and Exchange Commission has not expected this to be cryptocurrencies, especially ETH’s radical positions, especially ETH.Although the US Securities and Exchange Commission itself referred to ETH as a product, a few people like SEC Chairman Gary Gensler and others have always called it securities (considering concerns about pledge).

>

Not to mention the blunt position of cryptocurrency, Elizabeth Warren.Recently, Trump (of course the typical party style) tends to accept cryptocurrencies (although his former remarks are not the case), because his NFT series collections are good.

>

So, what does this mean?What should we do next?

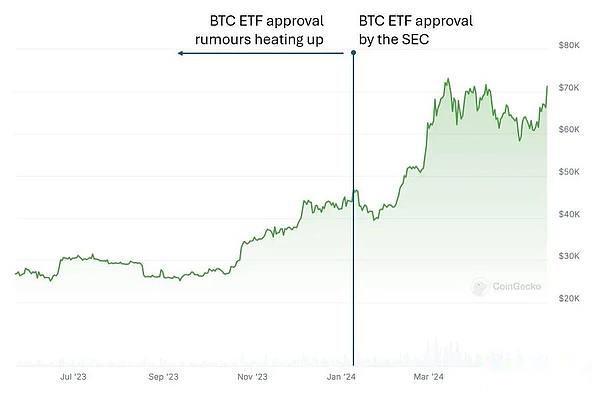

The last time we saw such a thing was approved when the Bitcoin ETF was approved in January 2024, which caused Bitcoin prices to steadily rise steadily from US $ 30,000 in November 23 to $ 46,000 in January.

>

This price trend usually marks that mainstream finance accepts BTC/ETH as the asset category that the market hopes to participate, so that the public can contact the bottom -level cryptocurrency.Bring a lot of verification needs to the industry.

>

If the demand for spot ETFs is strong, ETF must purchase the target currency to release the opening of the asset for a large number of investors, and these investors are not typical encrypted people, proficient funds, family wealth management rooms, or speculators.ETF is regulated, so it is “safer.”

This is a boring capital, which is a few larger than the encrypted capital we see now.These large pensions/donation funds have a large amount of funds (even if 0.5%to 1%of the flow flows to cryptocurrencies, it is also very important for the encryption industry).

>

Considering the price trend of the sideways last month and argument about ETH’s death, this is a good development.

>

Capitals entering ETF usually do not care about the consistency of ETH, re -pledge yield, decentralization, scale, and low -floating and high FDV.They do not conduct on -chain transactions, do not seek DEGEN income, nor do they trade MEME coins.But in general, they are definitely conducive to capital inflows and gain attention.