Author: ABI, Swell CSO; Translation: 0xjs@作 作 作 作 作 作

Swell L2 currently has more than 1.2 billion pre -deposit.What is Swell’s construction?

Eigenlayer is a safe market.LRT is a safe liquidity to reintegrate tokens.When we build an LRT, we not only want to be a supplier.

Eigenlayer is a safe market.LRT is a safe liquidity to reintegrate tokens.When we build an LRT, we not only want to be a supplier.

Swell L2 is a L2 for re -mortgagingIt is the unlocked flywheel to ensure safe demand.

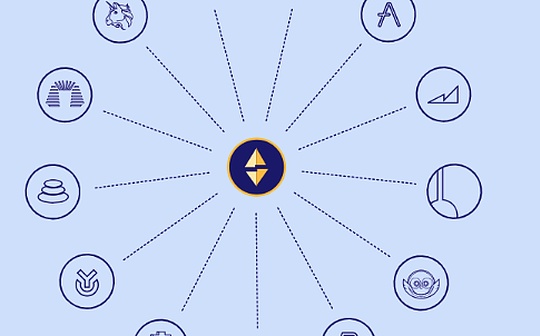

Swell L2 is a ZK-Validium built based on Polygon CDK.It uses the technologies created by three industry leaders Polygon, Altlayer, and EIGEN DA to create the next generation of DEFI centers.

Why choose Polygon CDK?Polygon CDK is used by OKX, Immutable, GNOSIS PAY, and the reasons for.

1. Do not charge any fees.Optimism Superchain charges 15%of the sorting costs.Polygon charge chain 0 based on Polygon CDK.What is Polygon’s motivation?

2. Polygon’s largest bet is the network effect of the polymerization layer.Through a unified proof of aggregation, all chains can achieve fast and secure native bridges.This creates a unified liquidity. For Swell, this means that we will become the center of the re -pledge of the entire aggregated ecosystem.

3. Swell has made a larger direction of the future development direction of ZK.ZK Rollups provides faster final certainty than the Optimistic chain. The fraud certificate of the Optimistic chain takes 7 days to achieve the final certainty, but it is often criticized due to higher TX costs due to the cost of submitting the certificate.This is where EIGEN DA needs.

By building the SWLL L2 as ZK-Validium, the cost difference between ZK and Optimistic Rollups (especially POST BLOB) can be greatly reduced.ZK-Validiums greatly reduces the GAS cost by using the non-DA main network.Before the emergence of DA solutions such as Celestia and Eigen DA, you need to start your own decentralized data availability committee.

But by combining RSWETH and EIGEN DA, Swell L2 can obtain DA security from its GAS token.We incorporate DA security into the chain “ETH”, so that we do not need to start a completely independent DAC, nor do we need to pay the rent from external DA solutions such as Celestia.

But by combining RSWETH and EIGEN DA, Swell L2 can obtain DA security from its GAS token.We incorporate DA security into the chain “ETH”, so that we do not need to start a completely independent DAC, nor do we need to pay the rent from external DA solutions such as Celestia.

We use Altlayer’s AVS stacks to achieve fast final determination, decentralized verification and decentralized sorting.RSWETH is now binding directly with Swell L2, and the decentralized chain infrastructure built by Altlayer is fed back to RSWETH.

We use Altlayer’s AVS stacks to achieve fast final determination, decentralized verification and decentralized sorting.RSWETH is now binding directly with Swell L2, and the decentralized chain infrastructure built by Altlayer is fed back to RSWETH.

The chain activity pushes the cost to the chain -based infrastructure AVS, thereby pushing the cost to $ RSWETH, which provides users with higher returns, and eventually brings more users to the chain.Welcome to re (3,3) and pledge the flywheel.

The chain activity pushes the cost to the chain -based infrastructure AVS, thereby pushing the cost to $ RSWETH, which provides users with higher returns, and eventually brings more users to the chain.Welcome to re (3,3) and pledge the flywheel.