I have talked about APX Finance once, and the $ APX has nearly doubled from October 15th, 23rd to now.Today we change from an angle to talk about APOLLOX (now renamed APX Finance) ALP.

Today, $ alp’s Staking income has reached 55%.The yield of its competitive $ GLP is 13%. Some time ago, the $ VRTX pledge (not LP Token) of the Token was launched.

>

This type of LP Token pledged, or the income of native governance tokens, often comes from the fees income of the derivatives agreement, as well as the inflation rewards of the tokens.Alp is so.The direct reason that it can surpass the GLP and Vertex tokens is composed of FEE income (real income) and token inflation.However, it is worth mentioning that the real return that the agreement brings to Alp Stake is much higher than the inflation reward.

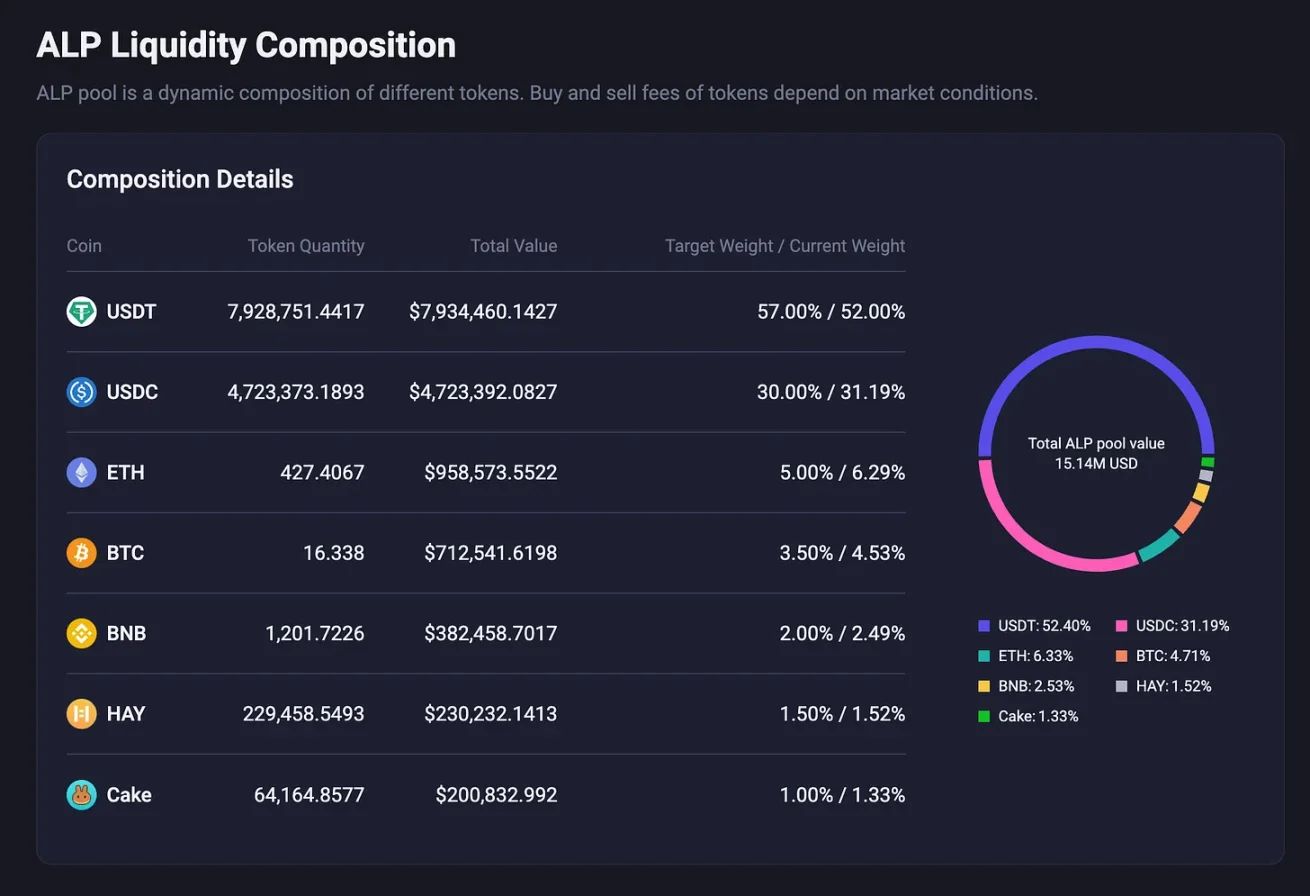

The composition of ALP is also more stable than that of GMX V1 GLP. The proportion of stable currencies has exceeded 80%, which is less affected by fluctuations in the Crypto market.

>

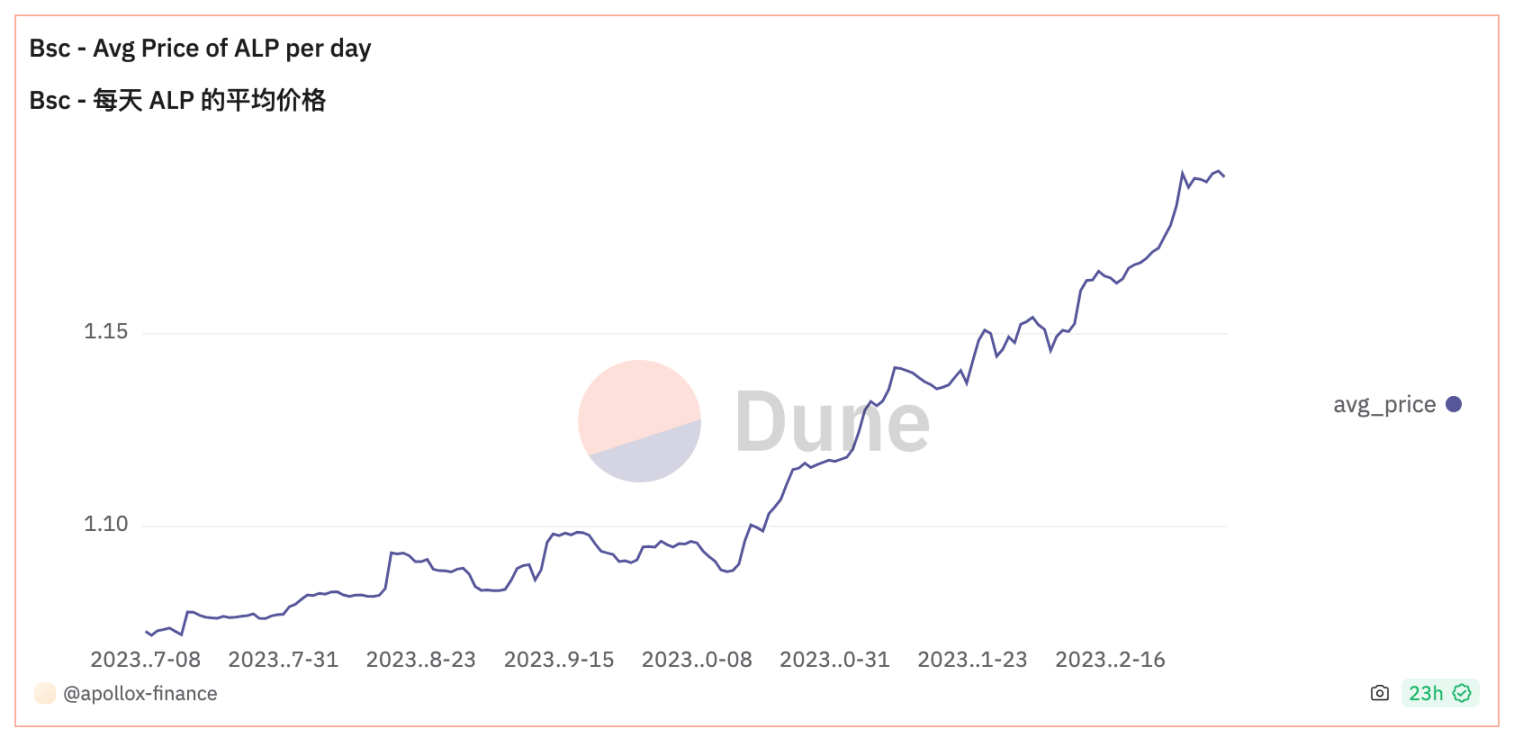

At the same time, the price of ALP has been steadily rising.Its rising power comes from the loss of Trader.According to Dune data, TRADER has now lost 1.48m USD, and this part will also be attributed to ALP’s income.

>

Trader’s losses may come from the following two aspects:

-

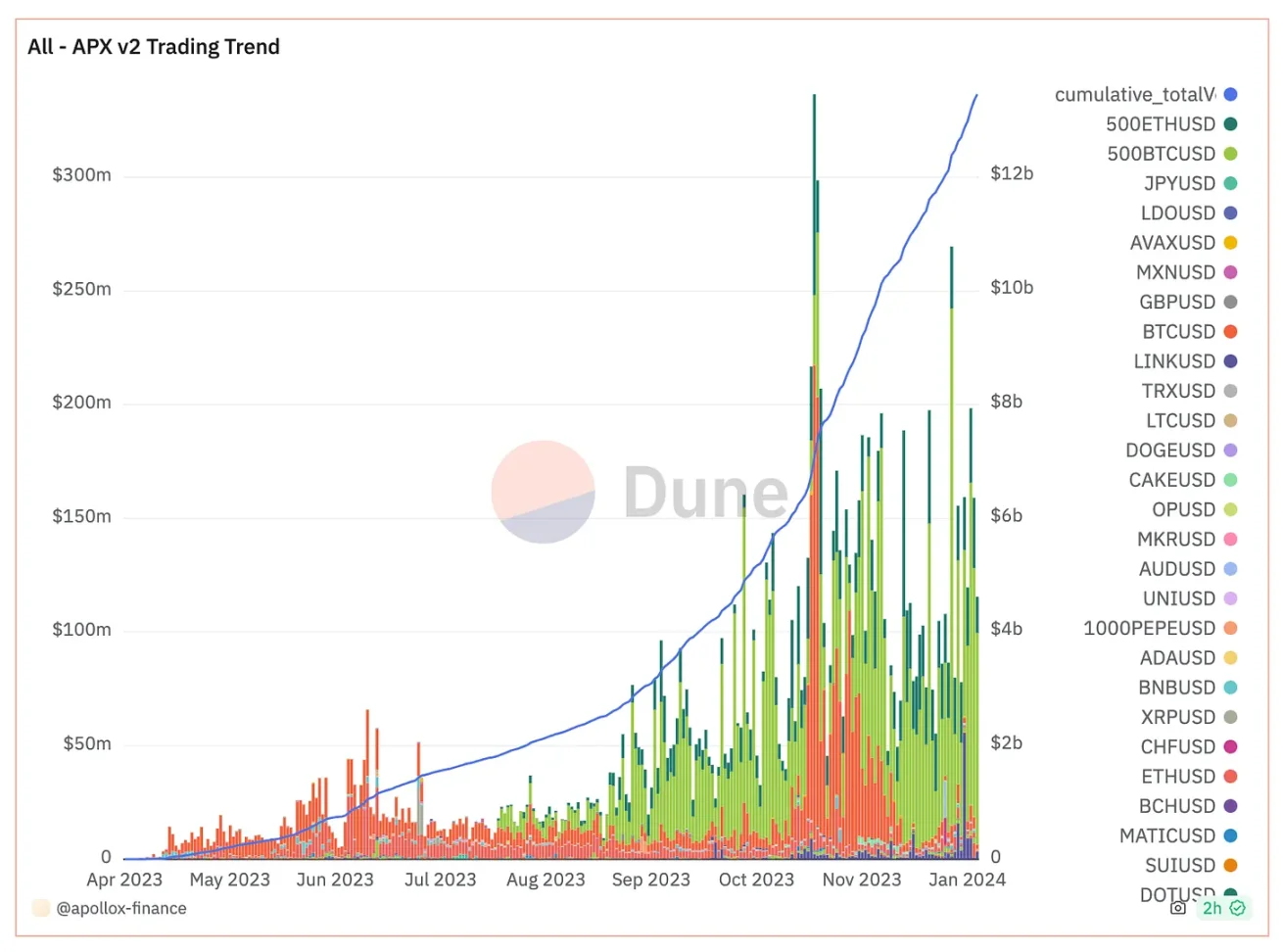

The market is turning to cattle, market risk preferences rise, and users & amp; transaction frequency growth.

-

APX Finance has launched the Degen mode, suitable for Trader with higher risk preferences.The high leverage of the Degen mode is more like gambling, not a transaction.We can see from the charts that 500ETHUSD and 500BTCUSD are in the proportion of overall Trend.

>

Secondly, APX Finance recently launched DUMB mode.The DUMB model allows users to predict the price changes of various types of assets at a limited time (60s, 5m, 10m). If the due price is greater than entering the price, 70%, 85% and 88% of the income can be obtained.However, if the due price is less than the entry price, users will lose a 100% principal.

The introduction of Degen and DUMB models is essentially providing users with a product that provides more fresh and higher risks and higher income, which has promoted the growth of transaction frequency and transaction volume in disguise.

Therefore, with the promotion of these two new products and basic disks (such as extending to Arbitrum, OPBNB, Base Chain), the agreement income increases, and the price growth of ALP price + cost income increases.ALP price increases, more people buy ALP, better depth, and better user transaction experience.

The agreement will repurchase the $ APX with the income, and part of the repurchase $ APX will be assigned to the $ APX Staker, and the other part will be destroyed directly.In this way, the price of $ APX will also rise.

On the whole, the price performance and cost income performance of $ APX and $ ALP are driven by APX Finance products and data. You can pay more attention to the DUNE data dashboard of Perp Dex and APX.