Author: Balaji Srinivasan, author of CTO, The Network State before Coinbase; Translation: 0xxz@作 作 作 作 作 作 作 作

History is reversing.

Ninety years ago, Roosevelt and his government embarked on the road of centralization in the 20th century.At that time, the bottlenecks of Volkswagen media and large -scale production of new technologies enabled them to control the population, recruit top talents for their “think tanks”, and captured gold after a series of epic legal struggles.

These golden administrative orders have now been forgotten, but at the time, they were reported as much as the 9/11 or Apollo Lunar Moon.They are the most important issues in the United States, and they have been reported more than contemporary Supreme Court judgments (such as the “Roy Valley Case”).Why?

Source: David Glick article of Princeton University

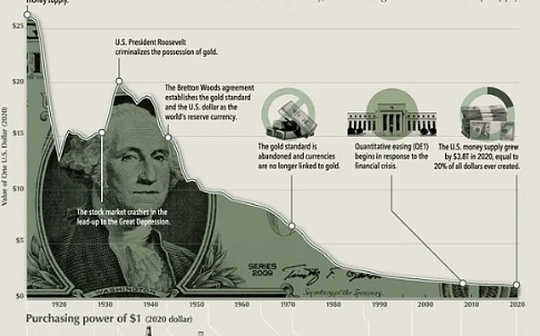

The reason is,The transformation from the gold support system to the legal support system is equivalent to a soft communist revolutionBecause the “tangible” gold section laid the foundation for the “invisible” wealth seal of the money printing.

The judge who was trained at the time completely understood this.At that time, Judge Mcreynolds, the famous disagree, condemned the ruling with the most stringent wording, stating that “the Constitution has disappeared” and “USD … Tomorrow may be 30 points, 10 points the next day, 1 point the day after tomorrow, 1 point the day after tomorrow, 1 point the day after tomorrow, 1 point the day after tomorrow, 1 point the day after tomorrow, 1 point the day after tomorrow, 1 point the day after tomorrow, 1 point the day after day”” “.

Biography from Mcreynolds

Biography from Mcreynolds

Mcreynolds is right.Although Roosevelt threatened to fill in the court (Note: The judicial procedure reform bill in 1937, usually becoming the “court filling plan”, is a legislative initiative proposed by U.S. President Roosevelt, aiming to add more judges to the Supreme Court of the United States to obtain the new policy against the New DealThe court was forced to make an institutional surrender, but the 6102 gold administrative order affected every economic decision maker in the United States because it was equivalent to the US government to confiscate the citizens’ gold assets to clarify its bond defaults, and it was it and it was it.A century of currency depreciation lays the foundation.

Now it’s all relaxed.Roosevelt’s team can conform to the wave of centralized technology and establish giant countries around the world.

But today, today’s technology is conducive to “decentralization” -personal computers, end -to -end encryption, mobile phones, and of course cryptocurrencies.

Therefore, top talents will not be included in the government think tank.The talents of US agencies are being “lost.”Therefore, in general, epic legal struggles are developing in our direction.

This is not just a decision by the Washington Tour Court.The ideological conflict between decentralization and centralization is reflected in the approval itself of the Bitcoin ETF with a 3-2 voting results.Reading SEC members Peirce’s outstanding outstanding approval statements, severe denial of Crenshaw, and the reluctance of SEC Chairman Gensler.

You will see the echo of the gold administrative command, but the opposite voice.This time, the central centralized state was forced to surrender in the system.As Crenshaw’s opposition shows, this is a surrender:

“… The Bitcoin spot market has no major regulatory agencies. The spot Bitcoin ETP will participate in markets that are not subject to supervision, decentralization, continuous transactions, and global melee. Even if there are major regulators in this market, most of them may exceedThe scope of the US supervision … “

Let it sink into it!This is what American power is really worried: not Bitcoin as “fraud”, but Bitcoin as freedom.Not only do they want to rule you, they also want to rule the world, so they are afraid of the prospects of “global melee … beyond the scope of the US regulation”.They know that as Nakamoto’s intention, any spot ETF will raise the price of self -custody Bitcoin they cannot control.

so:Since Roosevelt has won gold, our lives have surrounded the centralized countries instead of decentralized markets.The country has been controlled for too long, and we have forgotten what freedom looks like.But now gold is slipping from them and returning to your hands.

History is reversing.