Author:NoLimit, early Bitcoin investor; compiled by: Bitcoin Vision

Something terribly terrible is happening to the U.S. economy that almost no one is talking about publicly.

Something terribly terrible is happening to the U.S. economy that almost no one is talking about publicly.

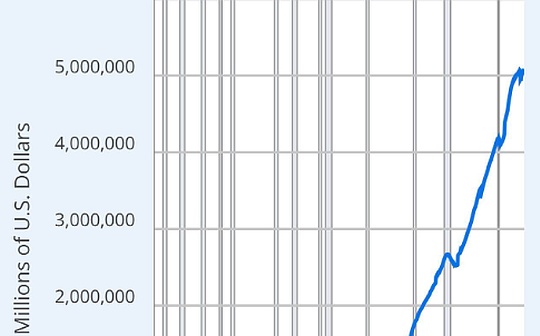

This picture isn’t the stock market, it’s not Treasury bonds, it’s not government spending, it’s consumer credit.

Ordinary people borrow money to survive.

It has been pulled vertically.

Consumer debt has been growing slowly, almost “naturally” for decades.

Entering the 2000s…the curve started to bend.

After 2008…the slope gets steeper.

After 2020… it becomes a straight line.

Now we’re sitting on over $5 trillion in consumer debt, the highest in U.S. history.

The most critical point that most people overlook is:

Americans are no longer borrowing money to buy luxury goods;

They are borrowing money to fight inflation and survive:

-

Supermarket shopping

-

rent

-

medical bill

-

repair car

-

credit card interest

-

Student loan restart

-

Wages can’t keep up with prices at all

People swipe their cards not because they want to buy,

But because there is no choice.

At the same time, CNBC is still repeating the phrase “Consumers are very strong” every day, like gospel.

But if consumers are really that strong…

Why is the U.S. household savings rate near an all-time low?

Why are credit card delinquencies rising the fastest since the Great Financial Crisis?

Why is “buy now, pay later” exploding in daily expenses?

The truth is simple:

Consumers are not strong at all, consumers are just highly leveraged.

Even more dangerous is:

When consumer credit goes through this kind of parabolic surge, it never ends well.

People will keep borrowing until they can no longer borrow.

Then this will appear:

-

demand collapse

-

massive layoffs

-

recession

-

wave of defaults

-

credit crunch

-

The Federal Reserve launches another “emergency bailout”

This graph doesn’t show growth at all;

What it shows is pressure building up.

Stress will not go away on its own;

It just releases.

What we are seeing now is not rising prosperity;

It’s the desperation that’s building up.

The U.S. economy has never been driven by innovation;

Nor is it driven by productivity,

It is driven by consumption – 70% of GDP.

So here comes the question:

When a consumer completely maxes out their card,

When they can no longer borrow money,

When this consumer engine that has supported the United States for 30 years suddenly stalls,

What happens?

This picture may be the most important early warning signal in 2025.

Most people don’t notice until it’s too late.

You have to see it now.