Author: Hart Lambur, UMA Lianchuang; Translation: Bit Chain Vision Xiaozou

Press: Recent,UMAAt1moon17Day announced that it will be launched on the online prediction machine to extract value toolsOVALAfter the announcement, its price is short5The rise in the sky exceeds more than2.5Times.1moontwenty threedayUMAFormally online in Ethereum main onlineOVAL,,UMALinkedHart lamburDetailed explanationOVALEssence

Key points:

· When the price update of the lending protocol triggers the liquidation, the Oracle extraction value (OEV) will be generated, which is a MEV.

· The lending agreement lost hundreds of millions of dollars on OEV.

· OVAL runs on the main network of Ethereum. The support agreement uses this OEV as a form of income and contributes to the sustainable development of DEFI.

· OVAL is realized by packaging the price update of ChainLink and using Flashbots to auction OEV.

· OVAL uses the long -tested Chainlink and Flashbots infrastructure to minimize integrated costs and trust assumptions.

· OVAL does not need code for integration, and 90%of Oracle MEV can be captured.

On January 23, 2024, UMA released OVAL — Oracle value aggregation layer on the main network of Ethereum.OVAL obtains a loan agreement income by obtaining a MEV called OEV (Oracle Extractable Value: Oracle Extract Value).

Ethereum’s leading DEFI agreement creates hundreds of millions of dollars per year.AAVE and Compound have created OEV far exceeding $ 100 million since launch.The value was lost to the MEV supply chain and did not bring any benefits to the agreement.

OVAL is not an Oracle prophet.OVAL is a mechanism that integrates with the lending agreement, and re -obtain the value generated by the chainLink price update.

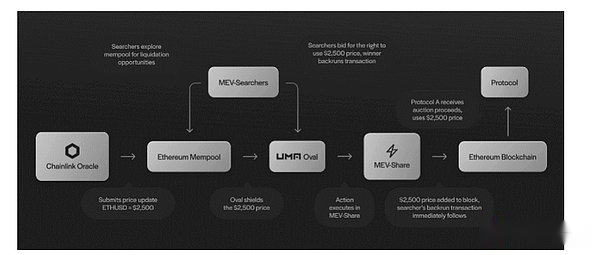

OVAL packaged existing Chainlink Data Feeds.In order to extract OEV, Searches (search) must conduct order stream auctions in the MEV-Share of Flashbots, and the auction income will flow into the agreement.

OVAL re -guide up to 90%of OEV back to its creation agreement.OVAL’s revenue can make the DEFI protocol and Oracle infrastructure more sustainable.

1What isOracleAvailable value (OEV)?

Oracle can withdraw value (OEV) is a MEV, which is created when the protocol receives the update from the price Oracle.

Taking a loan agreement like AAVE as an example: The AAVE market can create OEVs through the price of the Chainlink Data Feed, so that the excessive leverage positions face liquidation.In order to ensure the smooth operation of AAVE, the liquidator can obtain risk -free profits by quickly losing its position.

The borrowing agreement provides a large amount of liquidation bonus to ensure that the collateral can be sold quickly, allowing anyone (called “Search” in MEV) to repay the debt and apply for mortgage at a discount price.For example, liquidation on AAVE provides 5-10%liquidation discounts.These discounts must be large to ensure that assets can be sold quickly even with high volatility.

This liquidation discount is theoretical OEV, while OVAL can capture 90%of them.

Robert Leshner, CEO of SuperState, said: “MEV protection, especially MEV acquisition, is the forefront of Ethereum research. As far as I am concerned, I am glad to see UMA and Chainlink and Flashbots to seek capture hundreds of millions of outflows from the loan agreement.In the US dollar MEV, I am also glad that Oval is expected to bring a broader source of new income to the DEFI protocol. “

In order to obtain a liquidation fee, the MEV searchman competes with each other and provides a high “tip” to the block builders, in order to include their transactions into blocks.Then, in order to add the transaction to the blockchain, the block builders must pay a lot of value to the block proposal.All parties have obtained considerable profits from OEV, but they actually did not contribute to the agreement to create value.

2As well asOVALOperating mechanism

OVAL is updated by packaging ChainLink price and gathered searches to participate in the auction, so as to achieve OEV capture.The auction uses Mev-Share, an order stream auction agreement operated by Flashbots.

>

OVAL has attached the repayment instruction to the searchman’s data packet, requiring any excess value to be repaid to the agreement.Without OVAL, this part of the excess value is lost.We estimate that OVAL can recover hundreds of millions of dollars in value.

For the sake of insurance, if there is any delay related to OVAL or MEV-SHARE, the price of Chainlink will be released automatically.This ensures that fast liquidation can be performed.

3As well asMEVCutting -edge research

OVAL was closely established by its team and Flashbots team, using MEV-Share’s existing order stream auction infrastructure.

Flashbots estimates that since the merger of Ethereum in September 2022, the value of over 415,000 ETH has been extracted.In the MEV supply chain, this part of the value is extracted from protocols and unwilling users, and most of them have flowed into the pockets of Ethereum block builders and verifications.This is the status quo we strive to change.

As a MEV capture tool, OVAL destroys the MEV supply chain and transfers up to 90%of OEVs from the lending agreement as the income to the agreement.

Through this, OVAL allows the agreement to create a new revenue flow, and it may bring new mechanism design and business models to Defi.

“In Flashbots, we have always believed that DAPPS can greatly limit their exposure MEV quantity,” said HASU of Flashbots’ strategic supervisor.”The key opinion is that the agreement should not be blindly broadcasting the transaction to the public memory pool, but the right to implement the transaction should be auctioned to the competitive searcher market. OOVAL is based on this solution.And its users.

4, Safe first

OVAL design does not bring any additional risks to the underlying infrastructure of the Chainlink Data Feeds.To ensure this, OVAL has already passed the Open Zeppelin audit.

Because Oval uses Chainlink Data Feeds, the blue -chip protocol that integrates the solution can continue to obtain the price from the most Oracle providers using DEFI.

OVAL also has the same bounty plan, which plans to cover all UMA audited contracts, such as UMA Optimistic Oracle, OSNAP, and Across Bridge.

Tarun Chitra, CEO of Gauntletlet, said: “OVAL has a very attractive value proposition to major protocols such as AAVE -update the contract address and start earning a lotDEFI agreement cooperation, we look forward to how OVAL creates an additional source of income for their products. “

5How to integrate?

At the contract level, OVAL runs the same way as the CHAINLINK DATA FEED, and provides the protocol with the chainLink price, which has no effect on the end user experience.

There is an agreement that can easily integrate OVAL through simple governance.No need to change the code.