Author: Brayden Lindrea, CoinTelegraph; Compiled by: Tao Zhu, Bitchain Vision

Wall Street investors are still largely unaware of the potential of Ethereum, just as Amazon in the early 1990s before becoming a $2 trillion tech giant, said a research analyst at crypto asset manager 21Shares.Same.

Spot Ethereum Exchange Trading Fund was launched in July, but has relatively little inflows compared to spot Bitcoin ETFs.

21Shares research analyst Leena ElDeeb notedOnly by understanding the potential of Ethereum will ETH ETFs experience a large amount of capital inflows.

Eldeeb said,Ethereum is “complex, similar to Amazon in the 1990s – with great potential but not that simple use cases”.

Federico Brokate, vice president and head of US business unit at 21Shares, added that while Amazon was originally an online bookstore, “few people can predict that it will transform into a global e-commerce and cloud computing giant, reshaping our shopping and using numbers.The way to serve”.

Similarly, Ethereum was originally a platform that supports basic smart contracts and has now supported decentralized financial applications worth more than $140 billion since its launch in 2015.

“Just like Amazon goes beyond the book world and redefines the industry as a whole, Ethereum may also surprise us with revolutionary use cases that we cannot fully imagine today.”

Although Ethereum’s $320 billion market capitalization only accounts for 6.25% of Amazon’s $2 trillion valuation, Brokate pointed out that one advantage over Amazon in the 1990s was its large number of talents and its commitment to making the network useful.

“By the late 1990s, Amazon hired about 7,600 people. By contrast, the Ethereum network now has more than 200,000 active developers — including software engineers, researchers and protocol designers — all of whom are forIts development has contributed,” Brokate said, adding:

“Amazon has over 1.5 million employees worldwide and we may see similar growth in the Ethereum ecosystem.”

Although Ethereum has been challenged by Solana and other Layer-1 competitors, it still dominates the markets of decentralized exchanges, lending, stablecoins and real-world asset.

BlackRock, the world’s largest asset manager, has tokenized money market funds worth more than $533 million on Ethereum.Recently, United Bank of Switzerland launched its own tokenized fund on November 1.

Source: Ryan Rasmussen

PayPal and Visa are also growing on Ethereum.

However, “only a few investors understand the potential of Ethereum”, and many choose to temporarily “look at” the spot Ethereum ETF, Brokate noted.

Short-term investors remain “cautious” and are less willing to invest in spot Ethereum ETFs until Ethereum’s potential and use cases are “clearer”, ElDeeb added.

“[However] we remain optimistic that as the market matures and the growth of Ethereum’s diversified applications, investor sentiment and adoption will follow a similar path to sustained growth.”

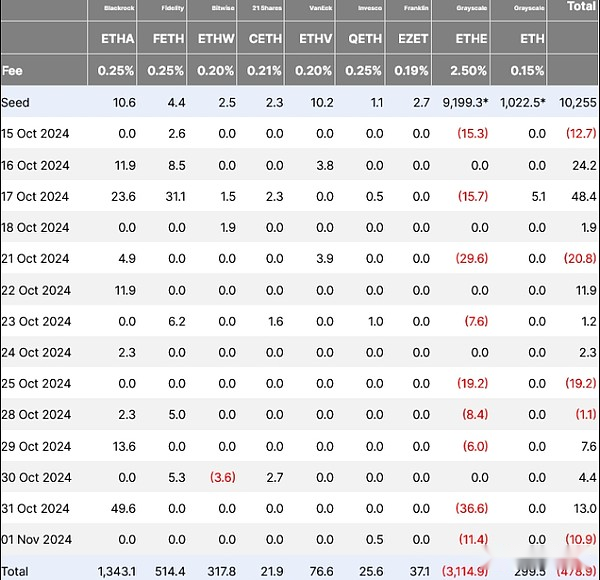

Katalin Tischhauser, research director at Sygnum Bank, noted that the inflow of spot Ethereum ETFs was only 9% of spot Bitcoin ETFs in the first 90 days, excluding Grayscale outflows.

Tischhauser noted that this was largely expected because of short marketing periods, investors are still “digesting” spot Bitcoin ETFs, and U.S. securities regulators do not allow pledges.

But Tischhauser said that in 12 months, investors will have more time to consider the bull market in Ethereum, which could be “significantly different”.

Therefore, she is not concerned about the number of spot Ethereum ETF issuers that have been continuously recording “0” traffic recently.

“It’s too early to talk about delisting now, and traditional investors need time.”

In the past few weeks, several spot Ethereum ETFs have recorded dozens of “0” traffic.Source: Farside Investors

21Shares is one of the eight spot Ethereum ETF issuers in the United States and has accumulated a net inflow of $21.9 million.

Tischhauser said,The lack of institutional funding flows may be attributed to Ethereum’s layer 2 expansion strategy, which is sucking revenue from the Ethereum mainnet.

CK Zheng, chief investment officer of crypto hedge fund ZX Squared Capital, noted thatThe decline in Ethereum revenue may have upset many Wall Street investors who prefer to implement cash flow analysis for valuation purposes.

But similar to Amazon’s losses in the 1990s for several consecutive quarters, Brokate is not worried about Ethereum’s recent revenue dilemma, as its Tier 2 scaling strategy is attracting millions of new customers at low cost.

Eventually, the fees at Tier 2 will become “large enough” to restore the Ethereum mainnet fee to the level before the introduction of the blob, Brokate said.