Note: People have studied many triggering factors for the crypto flash crash on October 11.But whatever it is,In the final liquidation step, many users will find that their positions are suddenly automatically liquidated by the exchange before they reach the liquidation line.This involves the “Auto-Deleveraging” (ADL) mechanism of the perpetual contract.Here is a good article introducing ADL.From Doug Colkitt, founder of Ambient Finance, compiled by Bitcoin Vision.

1. Many people wake up and find that their positions have been liquidated, and they can’t help but wonder what “Auto-Deleveraging” (ADL) means.Here is a brief introduction.What is automatic deleveraging?How does it work?Why does it exist?

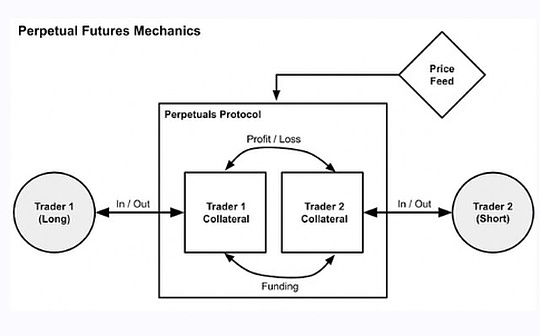

2. First, it’s helpful to look a little further and think about what the perpetual contract market is and what it does at a very abstract level.An interesting fact about perpetual contracts markets like BTC is that there is no real BTC in the system at all.Just a pile of idle cash.

3. What the perpetual contract market (or any derivatives market) does is allocate large amounts of funds among participants.It uses a carefully crafted set of rules to create a BTC-like synthetic instrument in a system where there is actually no BTC.

4. The most important rules:There are both long and short positions, and the long and short positions must be perfectly balanced.Otherwise it won’t work.Both parties invest money in the form of margin.Funding is then adjusted based on the rise and fall of BTC prices.

5. During this process, the price of BTC fluctuated excessively, and some participants lost all their funds.At this point, they are kicked out (“liquidated”).Remember, longs can only profit if shorts have money to lose (and vice versa).So, no money means you can no longer play.

6. Also, every short must be fully balanced by a solvent long.If the longs in the system have nothing to lose, then by definition that means the shorts on the other side have nothing to gain.(vice versa)

7. Therefore,If a long position is closed, one of two things is bound to happen.Either A) New long positions must enter the system, and inject new funds to replenish the position.EitherB) The other party’s short position must be closed, to restore the system to balance.

8. Ideally, this is all achieved through normal market forces.As long as we can find a willing buyer at a fair market price, we don’t have to force anyone to do anything.In a normal liquidation process, the liquidation process uses the same order book as normal perpetual contract market transactions.

9. In a healthy, liquid perpetual contract market, this should be fine.Liquidated longs are sold into the order book.The best bid price in the order book will be filled, and then the bid price will replace the original long position, become the new long position in the system, and generate new cash to replenish the long positions.In this way, both parties are happy.

10. But sometimes there really isn’t enough liquidity on the books.Or at least there is not enough liquidity to fill the trade and avoid losing more than the remaining funds on the original position.This would be a problem because it means there won’t be enough cash to distribute to others.

11.Often the next step in the waterfall is for an “insurance vault” or “insurance fund” to step in.Insurance vaults are special fund pools backed by exchanges.During unusual liquidity events, it is willing to step in and absorb the other side of the liquidation.

12. Typically, a vault tends to make considerable profits over time because it has the opportunity to buy at a deep discount and sell at a high point.For example,Hyperliquid Vault made approximately $40 million in one hour on October 11.

13. But the treasury is not omnipotent.It is just one more player in a wider system.It has to keep cash in vaults like everyone else, follows the same rules, and is limited in the risk and capital it can take.A waterfall operation must have a final step.

14.At this time, we will enter the automatic position building stage.This is a last resort and (hopefully) rarely happens as it forces people to leave rather than being paid.This happens so rarely that even experienced contract traders are often barely aware of it.

15. Think of it like an overbooked flight.First, use market power to solve the problem of excessive passenger flow.Airlines offer ever-increasing offers to any passenger willing to take a night flight.But eventually, if no one wants it, someone has to be kicked off the plane.

16.If the longs run out of money and no one wants to take over, the system has no choice but to send at least some of the shorts home and close their positions.The processes for selecting closing objects and closing prices vary greatly among exchanges.

17. Normally, the ADL system will select the profitable position to close based on the following factors: 1) Maximum profit; 2) Leverage; 3) Scale.That is to say,The largest and most profitable “whales” will be sent home first.

18. People will naturally be unhappy with the ADL because it feels unfair.You’re in the thick of your victory, only to be forced to quit.But this does need to exist to some extent.No matter how great a deal, there’s no guarantee you’ll always be the loser on the other side.

19. Imagine that you are in a situation where you are extremely lucky in a poker game.You come to a casino and beat everyone at the table.Then you go to the next table and beat everyone there again.Then the next table.Eventually, everyone else in the casino ran out of chips.This is ADL.

20.The beauty of perpetual contract markets (perps markets) is that they are zero-sum games, so the entire system can never go bankrupt.Not even real BTC will be lost.Just a bunch of boring cash.Just like thermodynamics,Throughout the system, value is never created or destroyed.

21. Auto-deleveraging is a bit like the ending of “The Truman Show.”The perpetual contract market constructs a very beautiful simulation of the underlying spot, but in the end it is all just imagination.Most of the time we don’t need to think… but sometimes we touch the edge of simulation.