Author:Anthony Pompliano, Founder and CEO of Professional Capital Management

I’ve written before about the concept of a “big idea.”The basic idea is that every great investor will have a great idea during his or her lifetime.Their job is to exploit as much of this idea as possible.

Buffett buys undervalued assets at low prices.Icahn put pressure on the company to improve.Simons uses mathematics to find imbalances in markets.The list goes on and on.

I think the core philosophy of our generation is:The government will never stop printing money.There are many ways to take advantage of this, but your (and my) task isProfiting from the incompetence of politicians and central bankers.

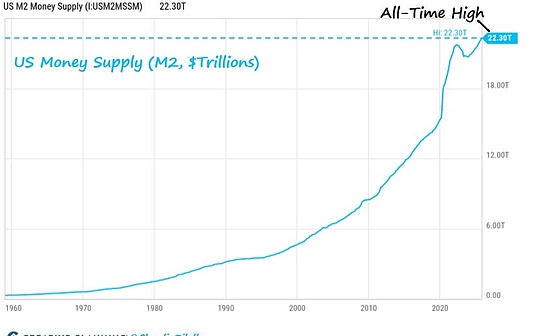

Charlie Bilello of Creative Planning noted,The U.S. broad money supply (M2) just hit an all-time high of $22.3 trillion.

As he accurately summed it up: “Death, taxes and money printing…”

Charlie explained that this record high was because “The U.S. money supply grew by 4.6% over the past year, which is the largest year-on-year increase since July 2022.”

This is obviously a positive for investors.If you hold an asset denominated in U.S. dollars, and the U.S. dollar continues to depreciate, your asset price will soar..The higher the price, the richer the investor.

But for those with insufficient assets, a national crisis is unfolding.Balaji Srinivasan noted, “The cost of living crisis is really a sovereign debt crisis.Printing money and borrowing can only last for a while and will cause problems in the long run.And the long-term problem has arrived.”

It seems to me that just as one generation of investors gets a great investment idea, every generation of society has to deal with a bad policy idea.In our generation,The trend of printing money has given rise to both great investment ideas and bad policy ideas.

This is why there is so much controversy, debate and confusion.What is good for the richest 50% of Americans is disastrous for the poorest 50%.The more money is printed, the richer those who own assets become and the poorer those who do not..

The first principle to fundamentally solve social problems is to stop printing money, but the problem is that no one, especially politicians, has the incentive to do so.It would be suicidal for any elected official to deprive voters of the various benefits that come from printing money.

We have to make tough decisions today.Just don’t expect our leaders to have the guts to do it.