Author: Jack Inabinet, Bankless; Compilation: Five baht, Bit Chain Vision Realm

Ready to deny it?ETH’s relative value relative to BTC has been severely damaged in May.Why is Ethereum a poor market?Next week, what will affect your assets?

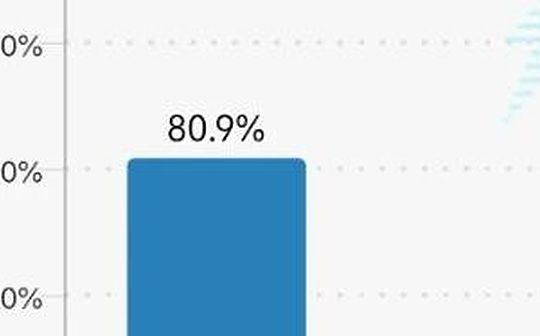

The US Securities and Exchange Commission (SEC) approved the possibility of spot Ethereum ETF by the end of May by the end of May, from 7% to 14%, but this possibility fell steadily throughout 2024, as early as the beginning of this year this year76%of the peaks are still at a low level.

It was reported last Friday that ARK Invest has deleted equity from its spot Ethereum ETF application, which seems to indicate that non -equity applications are about to be approved, which makes speculators in the forecast market even greater.However, participants in the spot market with stronger liquidity seem to believe that this statement is insignificant.

Although the probability of implicit approval in the forecast market increases slightly, the ratio of ETH/BTC has fallen by 2%this weekend, which has exacerbated the loss throughout May; it is currently under the key 0.05 level, and it is suppressed in the 2024 low.

According to the March report of Fortune magazine, shortly after the Ethereum network transitioned to equity certificates in September 2022, the US Securities and Exchange Commission (SEC) began to summon cryptocurrency companies to provide information on the Ethereum Foundation., Hope to classify the asset as securities.

Yesterday, Scott Johnson, the Van Buren Capital, emphasized that the documents issued by the US Securities and Exchange Commission (SEC) pointed out that the agency “notification for non -approval reasons is being considered.”

Although this file is included in the comments request of each spot Ethereum ETF, it is worth noting that all the spot Bitcoin ETF filing documents are not regulated.This shows that the SEC may refuse the spot Ethereum ETF, because they are not archived as a commodity -based trust stock, because they actually hold securities,The information received from the subpoena may prove this.

Although the SEC obviously strives to classify Ethereum as securities, it is worth noting that the regulatory agency approved ETF -based ETFs based on ETH commodity futures last October.

This decision was made after Ethereum transitions to POS, indicating that the SEC has given up its jurisdiction over the asset and consolidate its position as a commodity, because if the basic assets are securities, then these tools will be illegal illegal.(So trading cannot be performed).

Most of the market participants are expected to be the first final decision deadline for VANECK’s application on May 23, the deadline for VANECK will refuse the spot Ethereum ETF; however, given that the agency has approved the commodity futures ETF in advance, the new information is not provided at the subpoena, and the new information does not provide new information.It is difficult to see how the US Securities and Exchange Commission proves that these products are not listed.