Author: s4mmy.moca, researcher at Moca Network; compiled: 0xjs@bitchain Vision

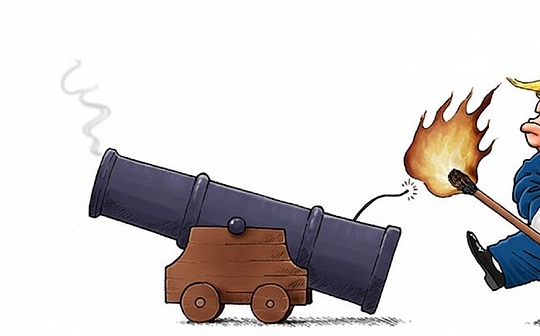

Ethervista is described as Pump.Fun of ETH.

Ethereum DeFi users are frustrated with the lack of innovation in the mainnet, and Ethervista’s novel LP and fee mechanisms are designed to address this problem by taking advantage of opportunity gaps in the market.

Ethervista released the white paper 2 days ago.It advocates fair issuance with a liquidity lock-in period of 5 days.Because analysis shows that most runaways occur within 2-4 days.The Ethervista token VISTA market value has exceeded US$15 million.

Why people pay attention to Ethervista

What are the key drivers?

1. Fair launch

100% of the supply is allocated to LP and locked for 5 days;

Each swap will be charged a fee in ETH, which is allocated to the liquidity provider, earned $25,000 in the first 5 hours;

By comparison, Pump.Fun costs $400,000 per day.

2. Economic model

VISTA tokens are deflated with a supply cap of 1 million;

It reduces the token supply by destruction – $200,000 was destroyed on September 2;

ETH revenue prevents the token value from a “death spiral”;

The largest holder currently has 5.8% of the VISTA token supply.

3. Upcoming features

3. Upcoming features

Futures, lending, futures and free flash loans containing the ETH-BTC-USDC pool;

User interface nostalgia, graphical hints about futures, lending and lightning loans;

There is no guarantee, but if done well, there is a possibility.

4. Market penetration

4. Market penetration

It targets market gaps in Ethereum’s current DeFi landscape, especially the lack of exciting new projects for retail investors;

This can be extended to lending/lightning loans to more mature retail investors;

Ethereum has a good developer and user base and is eager for some innovation.

How to participate in Ethervista

To participate in Ethervista, you need to purchase tokens from DEX on their website:

1. Connect to Ethereum wallet, 2. Change ETH to VISTA; 3. LP deployment (currently 0.006 ETH corresponds to 1 VISTA) – Lock for 5 days

Chat features are integrated, but beware of scam links.

Will Ethervista do a good job?

It’s still in its early days.ETH DeFi users are frustrated, so they are looking for something to use on the mainnet.

The initial LP will be unlocked on September 4, so be careful as the price may plummet by then.

The UI is nostalgic, but I will pay attention to the launch of other features.This is where the real execution and value lies, not just the DEX and white papers that address current market frustrations.