Author: Ardizor, encrypted researcher; Translation: Bit Chain Vision Xiaozou

Why token economics is very important:

InGood token economics: Increased by 10,000%a year.

InBad token economics: Fall 90%a year.

In this article, I will openly analyze all the secrets of tokens.

>

Here I want to explore an important topic, which can save you hundreds or even thousands of dollars.That is to learn from others’ mistakes.When I did not understand the working principle of tokens economics, I made some bad investments. Now these investment still falls 80%compared to my first buy.

If you do not master the tokens, any investment purchase behavior is just a favorable price trend.This is why you avoid blind trading, otherwise you may suffer serious losses!

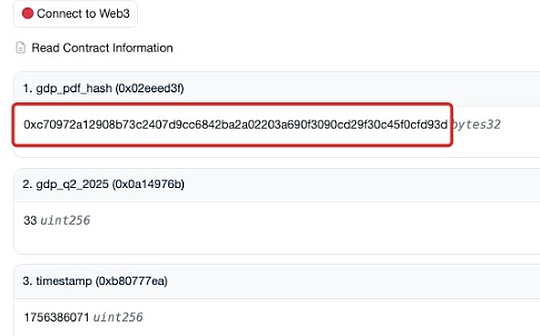

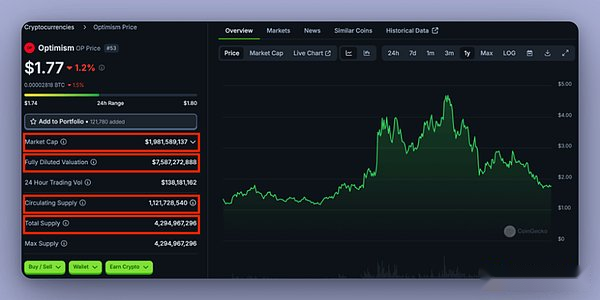

When evaluating potential investment, we can see on the tokens page:

· Market value (MC)

· Complete dilution valuation (FDV)

· Circulation supply

· Total supply

Each of them is a vital factors for wise decisions.The reason is as follows:

>

These are called basic supply indicators.

Mastering these indicators can help you evaluate the potential of tokens.

It is necessary to understand the functions of various indicators and its impact on the price of cryptocurrencies.

· MC: The value of circulation calculated in the US dollar

· FDV: The value of the total supply calculated in the US dollar

· Circulation supply volume: tokens of current circulation

· Total supply: all possible tokens

Next, we will discuss the three main factors of the issuance and success of any of the tokens today:

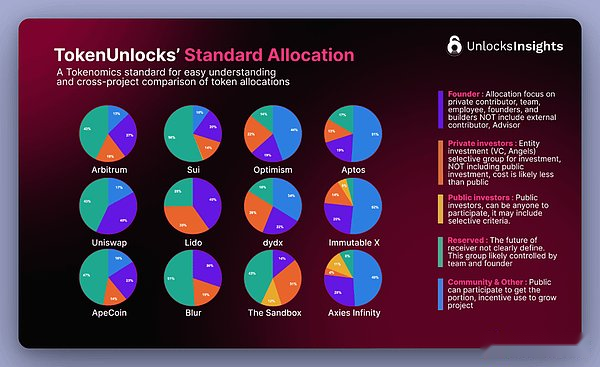

Factors 1: Tokens

There are two methods of allocation:

· Pre -mining -Sharing between early supporters, teams and consultants

· Fair release -Everyone has an equal opportunity to buy

In today’s market, most tokens allocate use pre -mining methods.

>

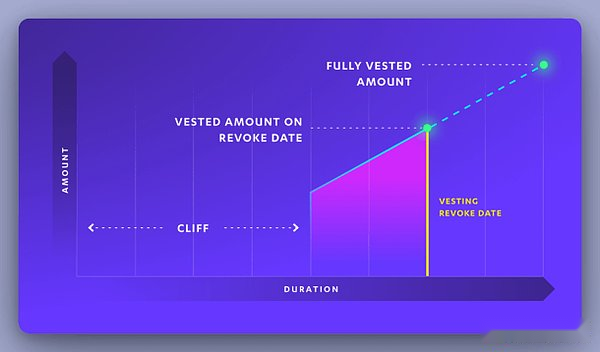

If 50%is assigned to investors and 100%will have TGE (tokens), investors may sell tokens.

Therefore, understanding the following points is very important:

· TGE allocation

· Cliff (CLIFF) stage

· VESTING Period

Token generation event (TGE) marks the time when the tokens are officially released.TGE allocation refers to the proportion of the distribution of the currency between individuals, usually between 10-20%.Cliff is the initial span after TGE, and it is the suspension date before the start of Vesting.VESTING said that a certain token percentage is gradually allocated every month.

>

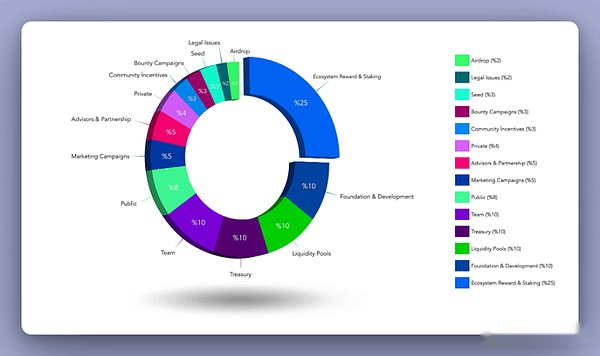

Factors 2: Distribution receiver

Common distribution receivers include:

· Airdrop

· marketing

· Public release (retail investor)

· Private equity (investor, KOL, etc.)

· Ecological system (pledge, reward, etc.)

etc……

>

Recently, many projects have been adopting such a strategy: moderate TGE (not more than 20%), the cliff period in the following months, and the period of belonging for more than a year.This method is more suitable for promoting long -term success of the project.It is important to verify these details before investing.

Factor 3: Demand

On the other hand, the prosperity of any token must rely on demand.This is why people buy.Taking the US dollar as an example, although it is facing obvious inflation problems, people continue to buy it because it is essential for daily life.Besides

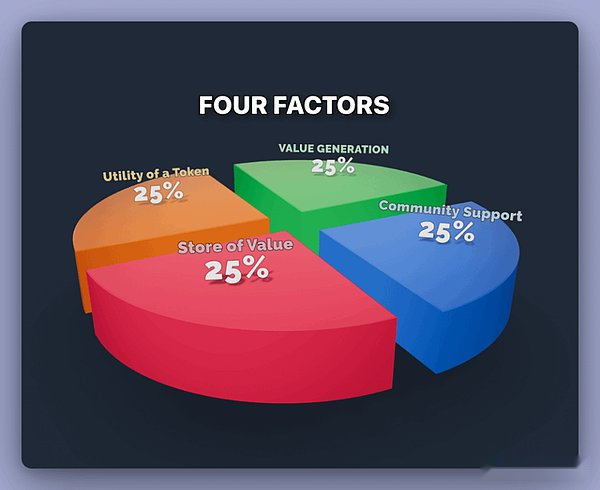

Generally speaking, there are four major factors to promote the needs of the tokens:

Factors 1: Community support

As seen in the recent cycle, a powerful community can significantly promote demand.For example, the value of MEME coins is soaring only because of the support of the community.

Factors 2: Value Storage

Many people buy cryptocurrencies to store wealth, just like investing in digital gold.Bitcoin is a typical example.

Factors 3: Tokens

Tokens that provide practical functions often attract buyers.A simple example is pledge, holding tokens can provide specific benefits.

Factors 4: Value Genesis

People seek tokens that can provide real value.Pledge allows users to lock their tokens and get regular rewards, which is also conducive to network development.In addition, holding tokens can obtain rewards, airdrops and other incentive measures from the project to benefit all relevant parties.

>

In addition, no matter how high demand is, it is important to understand who holds assets.Is it a powerful community or a short?This may be difficult to determine, because you need to contact the project community and analyze it carefully.But this is definitely worth it.

Please keep in mind this: Even if the tokens are bad, the price of tokens can still be very high, vice versa.

Remember this result in your heart!Welcome to the encryption world. Here, even the most ridiculous things can come true.

>

in conclusion:

In order to avoid blind investment allowing yourself to get unnecessary tokens, please keep in mind that the following elements must be considered:

· Total supply and circulation supply volume

· Distribution and distribution receiver

· Belonging period

· Distribution percentage

· need

After careful analysis, you will be able to determine whether a project is worth investing.