Author: Thomas Carreras, DLNEWS Translation: Shan Ouba, Bitchain Vision Realm

summary

-

It is expected that Bitcoin will be halved on April 20, and the circulation of Bitcoin will be reduced by half.

-

Half of the price may be pushed up, but it may also bring challenges to Bitcoin miners.

In the field of cryptocurrencies, few events are highly expected like Bitcoin halves.

This process is about half of this process, playing a basic role in the reasons of the existence of top -level cryptocurrencies -it realizes the plan to gradually reduce the supply of new coins.

This is why market participants like to halve: Because Bitcoin miners no longer earn so many bitcoin, they cannot sell the same number of Bitcoin as before.As the Bitcoin decreases, the demand will remain unchanged, then the price of Bitcoin will naturally rise.

The impact of the supplier may be huge.Bitcoin rose by about 2,330%within 5 months after the first halved in November 2012, and 2,876%in 5 months after the decrease in July 2016.The third decrease in May 2020 was less impact, but Bitcoin still soared 611%within 11 months.

The fourth halving may occur on April 20, which is expected to have an important impact on Bitcoin miners and cryptocurrencies it depends on.

Halving mechanism

Every time the network participants add a new block to the blockchain, new Bitcoin will be generated for about every 10 minutes.

This is the so -called mining, which is not a simple process.Miners consume a lot of computing capabilities and electrical power to produce the next block of Bitcoin before competitors, thereby obtaining Bitcoin rewards and transaction costs.

But for philosophy and economic reasons, Nakamoto hopes that Bitcoin will have a fixed supply.Therefore, the number of Bitcoin’s existence sets a hard limit -21 million.

Half is a mechanism to ensure that the amount of Bitcoin’s circulation is reduced over time until it reaches Satoshi Nakamoto’s goal.For the first time, the Bitcoin block reward was reduced from 50 Bitcoin to 25, and the second time was halved to 12.5, and the third time was half to 6.25.The fourth reduction will reduce the reward of miners to 3.125 Bitcoin, which is calculated at the current price and is worth about $ 178,000.

This process should be circulated like this. Until 2140, the miners will only receive rewards for online transaction costs.

Impact on Bitcoin

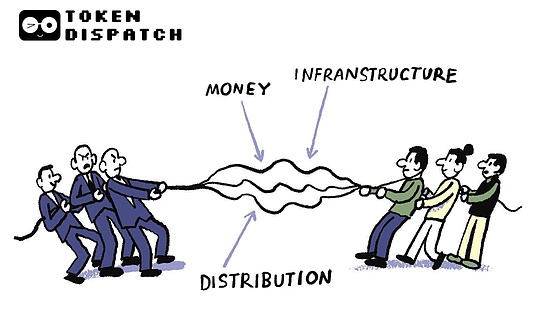

In most cases, Bitcoin Minerals sells Bitcoin they earn to pay for operating costs.Therefore, in the history of Bitcoin, miners have always been the source of Bitcoin selling pressure.

Due to the reduction in the number of Bitcoin earned by miners, the number of Bitcoin they can sell is limited.The characteristics of halving in the past three times are that Bitcoin sales have decreased significantly, which in turn has pushed the price of Bitcoin to a record high.

However, it is worth noting that the impact of the price of Bitcoin is smaller than before.At present, there are 18.6 million Bitcoin circulation, and in 2012 and 2016, when the first two were halved, the circulation supply of Bitcoin was about 10 million and 15.7 million Bitcoin, respectively.

This means that the proportion of Bitcoin sold by miners in the market has become smaller and smaller in the proportion of Bitcoin circulation supply.

Therefore, although the previous halving has pushed the price of Bitcoin to a new height, it is not guaranteed that the upcoming halving will be the same.

The challenges faced by miners

Because Bitcoin miners often rely on Bitcoin rewards as the main source of income, they are halved and often reduces their income by half.

The problem faced by miners is that their operating costs remain unchanged.If the mining operation is not high enough -for example, it signed an expensive power contract with energy suppliers -it may go bankrupt.

The challenges brought by half of this round are particularly severe.Competition in the mining industry is becoming increasingly fierce, even if it is normal, profit becomes more difficult.

Therefore, it is expected that the fourth time will be under tremendous pressure on medium and independent mining companies that cannot pass efficiently through the financial market.

Marathon Digital Holdings, the largest listed Bitcoin mining company, recently told DL News that the company is actively “looking for the acquisition place” as it is approaching.