source:YQ, Altlayer;Compiled by: Bitchain Vision

The cryptocurrency market event that occurred on October 10 and 11 resulted in the liquidation of $19.3 billion, the largest single-day liquidation record in history.While initial reports attributed this to market panic following the tariff announcement, digging deeper into the data revealed some concerning patterns.Is this a coordinated attack on Binance and USDe holders?Let’s analyze the evidence.

Suspicious Pattern: Why These Assets?

The most puzzling aspects of the crash focus on three specific assets that experienced catastrophic price collapses — but only on Binance:

-

USDe: Dropped to $0.6567 on Binance while holding above $0.90 elsewhere

-

wBETH: Plunged to $430 on Binance alone (88.7% below ETH value)

-

BNSOL: Plunges to $34.9 on Binance, while other exchanges see little movement

This site-specific destruction triggered immediate alarm.Market panics don’t usually vary from exchange to exchange.

Timing issue

Things get particularly interesting.

On October 6, Binance announced that it would update the pricing mechanism for these three assets, scheduled to take place on October 14.

https://www.binance.com/en/support/announcement/detail/d6deec042d784b6ba5d8710a8c69d79d.

The crash occurred on October 10th and 11th—right within this vulnerability window.

Is it a coincidence that out of thousands of trading pairs, only those with announced updates experienced such extreme decoupling?The possibility seems slim.

Test attack hypothesis

If this was indeed a coordinated attack, the timeline suggests it was carefully planned:

5:00 am:Markets start to fall after tariff news – normal behavior;5:20 a.m.:Altcoin liquidations accelerate sharply – likely targeting market maker positions;5:43 am: USDe, wBETH and BNSOL crashed simultaneously on Binance;6:30 a.m.:Complete breakdown of market structure

5:00 AM (UTC+8): Initial market volatility begins

-

Bitcoin drops from $119,000

-

Trading volume is within normal range

-

Market makers maintain standard spreads

5:20 a.m.: First cascade liquidation

-

Altcoin liquidations accelerate dramatically

-

Volume surge: 10 times normal volume

-

Market maker exit patterns emerge

5:43 AM: Key decoupling event

-

USDe: $1.00 → $0.6567 (-34.33%)

-

wBETH: 3,813 USDT → begins a catastrophic decline

-

BNSOL: ~200 USDT → accelerated collapse

5:50 a.m.: Maximum decoupling

-

wBETH reached 430.65 USDT (parity -88.7%)

-

BNSOL touched as low as 34.9 USDT (-82.5%)

-

Buyer liquidity is completely lacking

6:30 AM: Market structural breakdown complete

-

Liquidations total more than $10 billion

-

Market makers withdraw completely

-

Binance-specific price anomaly is biggest

USDE/USDT crashed at 5:43am SGT.

WBETH/USDT crashed at 5:44am SGT.

The 23-minute gap between the general liquidation and the crash in specific assets suggests this was a continuous execution rather than a random panic.

BNSOL/USDT crashed at 5:44am SGT.

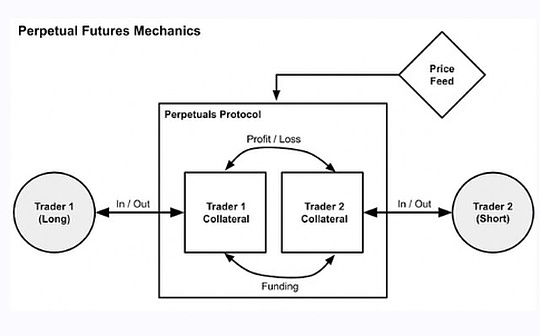

USDe factors

USDe is particularly vulnerable if someone seeks to exploit several factors:

1. Hidden leverage: Binance’s 12% return plan encourages circular borrowing, thereby creating positions with up to 10x leverage

2. Collateral concentration: It is reported that many traders use USDe as margin collateral

3. Order book: Although USDe is a “stablecoin”, its liquidity is surprisingly weak

When USDe fell to $0.6567, it not only caused direct losses but could also trigger a chain reaction throughout the ecosystem.

Market maker perspective

One theory circulating among traders is that the first altcoin liquidation at 5:20 a.m. specifically targeted market makers.If true, this would explain the subsequent liquidity vacuum.When market makers are forced out, they remove orders from all order books simultaneously, leaving the market defenseless.

What is the evidence?Binance’s altcoin prices are significantly lower than other exchanges — a pattern consistent with liquidations at major market makers.

profit assessment

If this was coordinated, someone would make a huge profit:

-

Potential short-term profit: $300 million to $400 million

-

Accumulating assets at low prices: $400 million to $600 million opportunity

-

Cross-exchange arbitrage: $100 million to $200 million

Total potential earnings: $800 million to $1.2 billion

These are not normal trading profits – these are robbery-level returns.

Other explanations

To be fair, there are several factors that could explain this uncoordinated event:

1. Chain effect: Once liquidation begins, it will naturally spiral upward

2. Concentration risk: too many traders using similar strategies

3. Infrastructure pressure: Systems collapse under unprecedented traffic

4. Panic Psychology: Fear creates self-fulfilling prophecies

However, the precision of which assets crashed and where boggles the mind.

what makes this doubtful

Several factors distinguish this from a typical market crash:

-

Platform specificity: The price plunge is almost entirely limited to Binance

-

Asset Selection: Select only pre-announced severely impacted vulnerable assets

-

Temporal precision: occurs within the precise vulnerability window

-

Sequentiality: Market makers are eliminated before the main goal is achieved

-

Profit model: consistent with the default strategy

What would it mean if true

If this is indeed a coordinated attack, it represents a new development in cryptocurrency market manipulation.Instead of hacking systems or stealing keys, attackers weaponize the market structure itself.

This means:

-

Every exchange announcement can become a potential vulnerability

-

Transparency reduces security

-

Market structures need fundamental redesign

-

Current risk models are inadequate

disturbing possibility

While we cannot conclusively prove coordinated behavior, the evidence is enough to raise reasonable doubt.Its precision, timing, location specificity and monetization model fit perfectly with the typical characteristics of coordinated attacks.

Whether through brilliant opportunism or careful planning, someone turned Binance’s transparency into a weakness, squeezing nearly $1 billion in the process.

The crypto industry must now grapple with a troubling question: In our 24/7 connected market, has transparency itself become a weapon at the disposal of sophisticated players?

Until we find out for sure, traders should assume that similar vulnerabilities exist across all exchanges.There could be many reasons for the events of October 10 and 11, but one thing is for sure, it was no accident.

The analysis is based on existing market data, cross-platform price comparisons, and established patterns of market behavior.The opinions expressed in this article are my own and do not represent those of any entity.