Author: ian.btc | 0xWorkhorse, Compiler: Shaw Bitcoin Vision

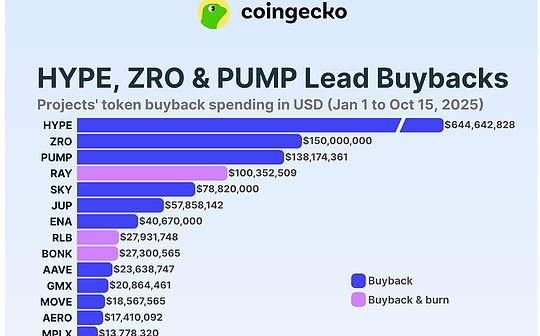

Amid the storm of liquidations that rocked the entire cryptocurrency market on Friday, one platform stood out: Hyperliquid.While other platforms struggled to stay solvent, the platform generated $41.5 million in fees over one weekend and generated a 10% yield for HLP depositors.

Products with this level of elasticity are not common – thenWhat is HLP, how does it work and how can we get involved?

Let’s start from the beginning.

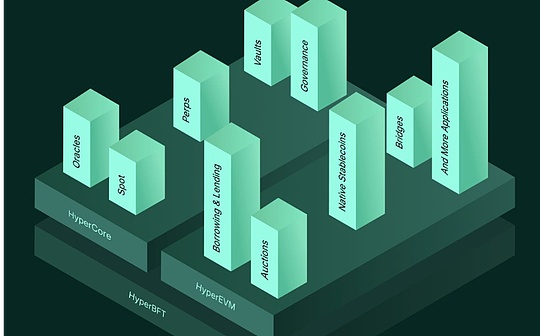

Hyperliquid is a decentralized perpetual futures contract exchange (Perp DEX) built on its own high-performance Layer-1 blockchain HyperEVM.The protocol was launched by Hyperliquid Labs in 2023 and quickly became the dominant player in the decentralized perpetual contracts market – with a market share of over 73% by mid-2025 and peak daily trading volume of over $59.5 billion.

At the heart of this success liesHyperliquid Protocol (HLP) Vault – a protocol-governed, community-owned liquidity pool.It allows ordinary users like you and me to deposit stablecoins such as USDC and earn income through intelligent automated trading strategies.Unlike traditional automated market makers (AMMs) that only rebalance token pairs, HLP takes a more hands-on approach: it actively trades in more than 130 perpetual contract markets, handles liquidation and arbitrage, and then returns all proceeds to depositors.

The key point worth highlighting here is: they return all HLP earnings to depositing users.

This means that HLP turns pooled deposits into powerful counterparties – capturing fees, funding rates and spreads in the process.To better understand, we can think of it as a professional market maker business diversification: individuals, decentralized self-organizations (DAOs), and even large institutions can participate without deep trading knowledge or huge initial capital.

As of the time of writing this article in October 2025, HLP’s total value locked (TVL) is approximately $300 million to $400 million, and its earnings are stable, often bucking the trend when the cryptocurrency market falls.

HLP operating mechanism

HLP runs within Hyperliquid’s HyperCore engine, which drives a fully on-chain centralized limit order book (CLOB).The engine delivers sub-second finality and processes over 100,000 orders per second, achieving centralized exchange-level speeds, all of which must keep up with the volume of transactions passing through the vault.

The vault itself fully benefits community users who provide liquidity for trading.Therefore, unlike user-created vaults, HLP is owned by the protocol itself and charges no fees.This means that 100% of profits will be distributed directly to depositors and distributed based on the user’s staked amount.

key aspects

1.) Liquidity supply

When a trade cannot find an immediate match, HLP steps in and acts as a counterparty.This closes the spread and ensures the trade runs smoothly – in other words, it makes the trade feel “as expected” and in line with the standards set by platforms like Robinhood.

For example, during Friday’s liquidation storm, HLP excelled in executing the liquidation process in the $10 billion platform liquidation, helping Hyperliquid maintain 100% uptime even as many competitors were in trouble.This means that HLP has access to stronger liquidity even during periods of market volatility, but also faces short-term risks if the market moves adversely.

2.) Price oracles and funding rates

The decentralized oracle pulls spot prices from major exchanges every three seconds.This anchors funding rates and liquidation points, helping to avoid manipulation and keep prices within 1% of the real-world reference price.For example, this oracle uses weighted medians from sources such as Binance (weight 3) and OKX (weight 2), which are calculated by validators to ensure robustness.

On this basis, the HIP-3 upgrade can integrate more assets without changing the core oracle settings, ensuring fair allocation of funds even in new and exotic asset pairs (such as commodities).

3.) Liquidation

If traders are overleveraged, HLP steps in to absorb and manage these positions.It collects fees and bonuses from it while maintaining the stability of the platform.To be clear, the funding comes from HLP’s own reserves of about $400 million, separate from the agreement’s $1.3 billion aid fund.

That means HLP acts as a “toxic liquidator,” profiting from chaos — such as making $41.5 million in one day during Friday’s crash — while avoiding bad debt.However, in extreme tail events it is combined with the automatic deleveraging (ADL) mechanism (see below) to spread losses.

4.) On-chain transparency

From trading to clearing, all operations are centralized within a block and can be audited by anyone.Deposits start with Arbitrum, using the native USDC bridge to HyperEVM, and fees are paid using ETH.Tools like Hyperliquid Browser allow users to verify everything in real time, thereby building trust.This transparency has been particularly prominent during recent market volatility, with on-chain data confirming zero downtime and fair mechanisms.

5.) Automatic position reduction (ADL) mechanism

When liquidations deplete counterparties in extreme markets, automatic deleveraging (ADL) is initiated as an emergency measure – ordering contract positions based on profit and loss and leverage to spread losses.For example, it might close highly leveraged profitable positions to balance the books and thereby protect the entire system.

This is closely related to HLP, which spreads risk across the vault, such as last Friday, when open interest fell from $15 billion to $6 billion, but no bad debts were incurred.This means increased stability for HLP depositors, but in rare cases it may “limit” the gains for individual winners.

6.) Income distribution

All transaction, funding and clearing fees will flow directly into HLP and be distributed to depositors proportionally, without any fees.For example, the community-owned model’s historical annualized return of about 17% surged to 165% to 200% after Friday’s frenzied trading — but that will eventually return to normal.Having said that, this means users will receive a steady flow of passive income, which, coupled with HIP-3’s permissionless marketplace, will likely increase overall transaction volume and fees, further boosting earnings.

Strategies used by HLP

HLP Vault uses proprietary algorithms carefully crafted by the Hyperliquid team, which has extensive experience as a traditional financial market maker and includes senior members from companies known for high-performance trading systems such as Jane Street.This expertise enables automation, 24/7 operation, and the ability to adjust based on on-chain data.

1.) High-frequency market making

HLP places and adjusts buy and sell orders around the “fair” price to capture the bid-ask spread.For example, it bets on a short-term price rebound to normal levels while avoiding larger directional risks.However, this exposes it to the risk of adverse selection – trading with informed counterparties – a risk the team circumvents through real-time oracle data and order book analysis.

2.) Funding rate arbitrage

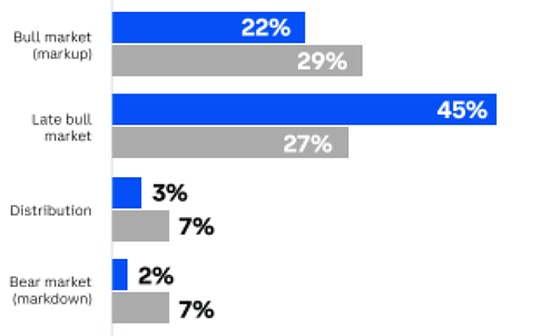

It exploits the gap between long and short funding rates, often with a slight bias toward net shorts.This strategy can bring stable returns to HLP when retail investors make large bullish bets.For example, in a bull market like early 2025, this net short preference generated positive returns from overleveraged longs, contributing to HLP’s 50% return in 2024.But it’s worth noting that in a deep bear market, without dynamic hedging, funding rate flips may put pressure on yields.

3.) Dynamic adjustment

As the size of the vault increases, the strategy will expand to more markets and adapt to market fluctuations.This could smooth earnings, but growth could slow slightly due to increased competition.On this basis, HIP-3’s permissionless token listing mechanism can more quickly expand asset classes into new areas, such as commodities or Meme coins, thereby enhancing scalability without manual intervention.

4.) Clearing and collection of fees

HLP actively participates in liquidating highly leveraged positions and earns bonuses and part of the trading fees.Essentially, this turns platform risk into gain – and we already know how well it performed on Friday.This means a stable revenue stream, albeit one tied to overall market activity.

In essence, this active strategy differentiates HLP from passive strategies such as GMX’s GLP, which bet on long-term asset growth.HLP remains basically neutral to market trends, which allows it to match centralized exchanges. Even for large transactions, slippage is very small (0%-0.01%).

Performance

If all of this goes as expected, HLP is likely to be the best tool to hedge against a sharp pullback, making it a perfect fit for a bear market strategy.

Since its launch in May 2023, HLP has delivered strong risk-adjusted returns through its automated strategies.As of this writing, HLP’s cumulative profit and loss (PnL) is approximately $121.8 million, a total return of approximately 450% given the recent spike in volatility.This translates into an annualized yield (APY) of about 65% to 70% over its roughly 2.4-year life, but the historical average yield has hovered around 17% during stable periods due to compounding and changes in TVL.

In short, the performance has been strong—spectacular and, to be honest, a little crazy.

Summarize

HLP has grown from a niche feature in 2023 to the preferred market maker in DeFi.Milestones such as permissionless listings, spot trading, and the debut of HyperEVM in February 2025 open the door to more integrations.HIP-3 also brings new improvements.

In a bear market, I think HLP will perform well – better than most DeFi returns – and can be viewed as a hedging tool, especially if the market is as volatile as it has been recently.The platform successfully built resilience and was able to profit from the disruptions that hurt directional bets.It may not “pop” during a slow winter, but due to its low-risk characteristics, it should be able to hold steady and earn positive (even if modest) returns.

Having said that, as I begin to prepare for a long hibernation in the coming bear market, HLP will be part of the strategy.