Author: danny; Source: X, @agintender

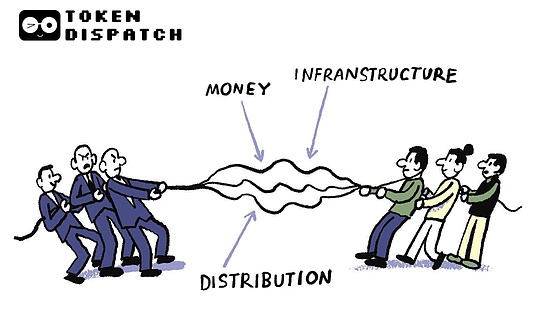

The core of Chaoshan Bank is to “do not let one’s own money go out” and achieve absolute internal circulation of funds and value precipitation. BNB Chain’s development path and training system also seem to be moving in this direction.

“From asset issuance to trading to leverage, everything is precipitated in the ecosystem” is the cornerstone of this model.Binance attracts retail users and funds from around the world, especially Asia, through its status as a universal CEX.Then, through a series of designs, we ensure that these funds and user activities remain within the BNB Chain ecosystem controlled by them to the greatest extent, forming a strong value closed loop:

-

Entrance (deposit attraction): Users deposit funds through BinanceCEX, purchase BNB and participate in Launchpad/Holder airdrop/trading/deposits and withdrawals.

-

Asset issuance (value transfer): Platforms such as Four.Meme play the role of “asset factories”, continuously creating new Meme coins and providing speculative targets for funds within the ecosystem.

-

Transaction (exchange/circulation): PancakeSwap, as the “central market” within the ecosystem, undertakes almost all transaction needs, and transaction fees and other values are captured on the chain.

-

Leverage (credit expansion): “Direct line” projects such as Aster and Lista DAO provide lending services and pledge transaction services, allowing the existing funds in the ecosystem to be amplified, further boosting transaction activities and accelerating capital circulation.

This process is like a bank. After absorbing deposits, it does not invest them in the external market, but lends, invests, and trades internally. All profits and value generated remain within the system, ultimately pushing up the value of the entire ecosystem (and $BNB).

1. Three-layer funnel structure with absolute internal circulation and value precipitation

The first layer: traffic entrance and asset issuance (Four.Meme)

The core role of Four.Meme is to serve as a traffic portal and a “factory” for asset issuance.

-

Industrialized asset issuance platform: Pump.fun created Meme’s launch platform model, while BNB Chain “industrialized” it through platforms such as Four.Meme.This means that BNB Chain has established an efficient and large-scale “production line” that can continuously create new Meme currency assets.This continuous “new” ability is the key to attracting speculative and high-return-seeking retail users, bringing a steady stream of traffic and attention to the entire ecosystem.

-

Engine to capture retail users: BNB Chain’s core user profile is the huge global retail users, especially in the Asian market.Meme’s low threshold, high volatility and community-driven characteristics perfectly fit the preferences of this user group.Therefore, supporting a platform like Four.Meme is tantamount to mastering the core engine that attracts and converts these users.

Second layer: price fairness and value anchoring (Aspecta.ai)

Aspecta.ai, as a price oracle (one of Aspecta’s functions), is the “weights and measures” of the entire DeFi system.All leverage and lending activities (such as those conducted on Lista) rely on fair prices provided by oracles to calculate collateralization and trigger liquidations.If the lever is the “throttle”, then the price oracle is the “dashboard” and “brake”.By supporting its own oracles, Binance ensures the reliability and consistency of the most important basic data sources in the ecosystem, avoiding the risks of data manipulation or single points of failure that may arise from relying on external oracles.This is equivalent to the “bank” having its own exclusive and absolutely trusted asset appraiser, ensuring the accuracy of all collateral valuations, which is the cornerstone of the stability of the entire credit system.

The third layer: core leverage and financial infrastructure (Aster, PancakeSwap, Lista)

If Four.Meme is the “front door” to attract users, then Aster, PancakeSwap and Lista are the “core palaces” that host these users and funds for in-depth economic activities.

-

PancakeSwap: Liquidity and Trading Core As the absolutely dominant DEX on BNB Chain, PancakeSwap is the liquidity center of the entire ecosystem.All assets issued through Four.Meme will eventually need to be traded and provide liquidity on PancakeSwap.It is not only a trading place, but also a key indicator of ecological activity.Controlling PancakeSwap means controlling the lifeblood of asset pricing and liquidity within the ecosystem.

-

Aster Dex & Lista DAO: direct provider of leverage

-

Aster Dex is a rapidly growing decentralized contract trading platform.Its total lock-up value (TVL) soared 570% in a short period of time, reaching $2.34 billion. This, coupled with recent incentivized trading activities, directly promoted the growth of the number of active addresses on BNB Chain.

-

Lista DAO “Lending” is the most direct and core leverage tool in DeFi.Lista provides financial support to the ecosystem by providing the stablecoin lisUSD.Stablecoins are the basic module of DeFi Legao and are the prerequisite for realizing all complex financial activities such as lending, leveraged transactions and derivatives.

2. Wealth amplification cycle: the complete path from $1 to $n

This cycle clearly shows how the various products work together to amplify the initial capital.(Take revolving loan as an example)

Step 1: Commit

-

With $1, you are attracted to Four.Meme’s new project.

-

Use this $1 to buy your favorite Meme asset on PancakeSwap.

Step 2: Mortgage

-

Deposit your Meme assets (or other assets such as BNB) into Lista DAO or Aster as collateral.

Step 3: Valuation

-

Aspecta.ai (price oracle) instantly fairly values the collateral and tells Lista/Aster how much your assets are worth and how much you can lend.

Step 4: Borrow

-

Based on Aspecta.ai’s valuation, a certain amount of stablecoin lisUSD (for example, worth $0.6) was successfully loaned from Lista DAO.

Step 5: Reinvest/Amplify

-

Put the borrowed lisUSD stable currency into PancakeSwap/Aster again to buy more of the same Meme asset or open a contract, or other promising new assets.

-

Result: Starting with only $1 of capital, now holding $1.6 worth of assets.This completes your first leverage increase.(Aster can magnify more times)

Loop ➔$n

-

As long as the price of the mortgaged asset rises, the amount that can be borrowed will increase.Participants can repeat steps 2 to 5, continuously enlarging the position, eventually theoretically enlarging the initial $1 to $n (while also amplifying the risk).

This three-layer structure forms a powerful flywheel effect:

Four.Meme (entry) ➔ PancakeSwap/Aster (trading) ➔ Aster/Lista (leverage) ➔ PancakeSwap (reinvest)

Aspecta.ai is the “cornerstone of value” that runs throughout and ensures that the entire leverage system will not collapse.Through this sophisticated collaborative design, BNB Chain creates an efficient capital amplification machine for retail users.

3. Strategic intention: Why must we keep the leverage in our own hands?

The fundamental reason why Binance cultivates these projects as “direct descendants” is that the core financial control of the ecosystem – especially leverage – must be in its own hands.

-

Risk control and system stability: “It’s easy to get into trouble when a position is liquidated” is the key.Leverage is a double-edged sword. It can accelerate prosperity, but it can also trigger a chain of liquidations when the market goes down, leading to systemic collapse.By supporting “direct” lending, stablecoin and contract trading projects with leverage attributes such as Aster and Lista, Binance can have a deeper understanding of the leverage level and risk exposure of the ecosystem, and has the ability to intervene and coordinate in extreme situations to avoid the collapse of third-party protocols that would cause a devastating blow to the entire BNB Chain.

-

Accelerating the flywheel effect: Leverage is the “amplifier” of ecological growth.Users can mortgage their assets on Lista, lend stablecoins, and then purchase new Meme coins or other assets on PancakeSwap.Or go to Aster to open a position with n times leverage.This process greatly improves capital efficiency and creates more purchasing power out of thin air, thereby driving up transaction volume, TVL, and network activity.This allows the “Binance flywheel” to rotate at a faster speed, making the ecological prosperity more significant.

-

Value closed loop: By ensuring that core links such as asset issuance, trading, and lending are completed by “direct” projects within the ecosystem, Binance can ensure that most of the value (such as transaction fees, loan interest) is deposited within the BNB Chain, ultimately feeding back the value of $BNB, forming a closed business loop.

Binance’s strategy is to build a vertically integrated financial ecosystem:

Use Four.Meme as the engine for asset issuance to continuously create “fuel” that attracts retail users; then through core infrastructure such as PancakeSwap, Aster, and Lista, we provide a place for these users and funds to trade, precipitate, and leverage, thereby maximizing the economic vitality and system stability of the ecosystem.

4. Centralized trust and the role of “parent”

Underground banks do not rely on external laws, but on the credibility of core individuals.The operation of BNB Chain is also highly dependent on the implicit endorsement and strong intervention of Binance, the “grandparent”.

The degree of decentralization of BNB Chain has been criticized. Its number of validator nodes is small and it is considered to be closely related to Binance.However, this “centralization” has become its advantage in attracting retail investors to some extent:

-

Reputation is guarantee: The project party chooses to develop on BNB Chain, and users choose to trade on it, largely due to their trust in the “Binance” brand.Investment in Binance Lab or selection into the MVB program is like a bank owner’s “seal certification” of a project, which greatly reduces users’ trust costs.

-

Strong intervention to ensure safety: The most typical example is that in 2022, BNB Chain chose to “suspend the entire chain” due to a cross-chain bridge attack.From a decentralized fundamentalist perspective, this is unacceptable.But judging from the logic of the “bank”, it is the “big family” who takes thunderous measures to protect the “family” assets and prevent runs and collapse when a crisis occurs.This approach sacrifices the principle of decentralization but caters to the simple needs of its retail investors for financial security.

5. High efficiency, low threshold and specific community services

Underground banks exist because they are faster, more flexible, and better aware of the needs of “their own people” than traditional banks.The success of BNB Chain is also because it accurately serves a specific group – cost-sensitive global retail traders.

-

Ultimate cost and speed advantages: In the DeFi summer of 2020, compared to Ethereum’s high gas fees, BNB Chain provides extremely low transaction costs and fast confirmation times.This is crucial for Meme/DeFi operations, which require high frequency, small amounts, and fast entry and exit speculative activities.It is like a bank bypassing the cumbersome processes of banks and providing the most direct and efficient services.

-

Serving specific cultural communities: The rise of BNB Chain is closely related to the participation of Asia, especially the Chinese community.It has successfully provided a “perfect petri dish” for the explosion of Chinese Meme. From cultural resonance (such as the “Binance Life” meme) to trading habits, it has accurately catered to the needs of this huge community.This is just like the Chaoshan bank serving the Chaoshan business gang and having a natural foundation of culture and trust.

summary

Comparing the BNB Chain model to “Chaoshan underground banks” is not derogatory, but an insight into the nature of its business model.It reveals the fact that the prosperity of BNB Chain is not a purely decentralized, bottom-up organic ecosystem, but an extremely efficient on-chain economy that is carefully planned and highly controlled by Binance and realizes the internal circulation of capital and value.

Although this model deviates from the decentralized form of the encryption world, it is undoubtedly extremely successful commercially.In the most pragmatic way, it meets the core needs of the vast majority of retail users: low cost, high efficiency, and trust and reliance on “big parents” in a chaotic market.

Under human nature, above mechanism – that is life.