Author: Long Yue, Wall Street News

Amid recent wild swings in Bitcoin prices, two key leading indicators from the options market and miner on-chain activity are sending increasingly strong warning signals.

The latest market developments suggest traders are bracing for potentially more downside risks.Cointelegraph reported today that “delta skew,” a key indicator in the Bitcoin options market, has climbed above 10%, indicating that professional traders are buying put options at a premium.This is often seen as a classic sign of bearish sentiment in the market.

At the same time, the movements of miners have also aroused market vigilance.According to data from CryptoQuant, miner addresses have deposited approximately 51,000 Bitcoins to the Binance exchange since October 9.The largest inflows into exchanges since July have historically tended to precede price weakness.

The simultaneous deterioration of these two indicators directly led to a rise in market risk aversion and posed a severe test to Bitcoin’s price support.Bitcoin prices fell to $107,600 on Thursday.

Options market lights up red as bearish bets surge

Data from the derivatives market clearly reflected growing concerns among traders.

Data from laevitas.ch shows that the Bitcoin 30-day options delta skew indicator, which measures the sentiment of professional traders, has exceeded 10%, significantly higher than the neutral range of -6% to +6%.This suggests that market participants are willing to pay a higher cost to purchase put options to hedge against the risk of falling prices.

Additionally, the need for downside protection strategies is evidenced by trading volumes.On Thursday, put options reportedly outperformed call options by 50% on the Deribit exchange, with the metric climbing to its highest level in more than 30 days.

This is a sign that market pressure is building, as under normal circumstances, cryptocurrency trader sentiment is on the optimistic side, with normal readings for the put/call ratio being lower.

Miners transfer massive amounts, history predicts selling pressure

In addition to signals from the derivatives market, the movements of miners, one of the most critical players in the Bitcoin ecosystem, have also added uncertainty to the market.

Data from CryptoQuant shows that in the seven days since October 9, miner addresses transferred 51,000 Bitcoins to the Binance exchange, worth more than $5.7 billion.Among them, on October 11 alone, miners deposited more than 14,000 Bitcoins to Binance, which occurred on the second day of the recent “big explosion in the currency circle”.This scale is also the largest since July last year.

CryptoQuant noted in a Thursday report that,Miners move Bitcoin from wallets used for storage or mining to exchanges, usually meaning they may be preparing to sell or hedge.

The report emphasizes that while these transfers may also be for other reasons such as staking, financing or operations, historical experience shows that when miners start selling, the market usually does not end well.

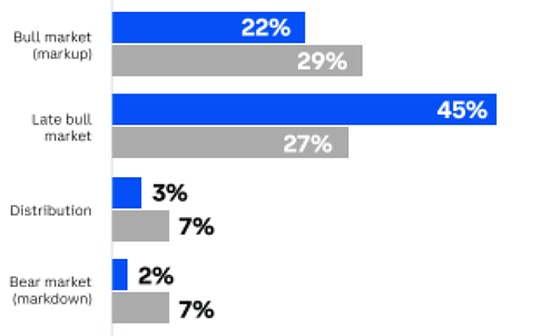

This sentiment shift from “hold” to “sell” has historically weighed on Bitcoin prices and is often the precursor to significant price corrections.

Bitcoin miners have switched from holders to sellers, which historically has heralded a dramatic shift in Bitcoin price and market sentiment.