Author: Martin

At the end of June 2025, a listed company called BitMine Immersion Technologies launched the Ethereum treasury plan.Over 135,000 Ethereum shares have been increased in the past 10 hours, and the total holding volume has exceeded 1.3 million. Thomas Lee, chairman of the company, publicly declared: “Our goal is to hold 5% of the world’s Ethereum.”

This is not an isolated case. From traditional game company SharpLink to investment institution BTCS, listed companies are hoarding Ethereum at an unprecedented rate. Strategic ETH reserve data shows that as of August this year, the total ETH held by institutions has reached 8.3% of the total supply, doubling from 3% in early April.

$1385 soared to $4788Daily trading volume climbed to the range of $4.5-4.9 billion, and Wall Street analysts began to putETH is called “digital oil” – it is not only the energy to drive the blockchain economy, but also an indispensable strategic reserve in institutional asset allocation.

1. Institutional hoarding craze: Ethereum becomes the “new gold” of corporate vault

In 2025, Wall Street’s capital torrent is pouring into Ethereum at an unprecedented rate.The latest data shows that the proportion of ETH held by corporate vaults and ETFs has exceeded 8.3% of the total supply, doubling from 3% at the beginning of the year, equivalent to about 10 million ETHs being locked in institutional vaults..The three giants are particularly eye-catching:

• Bitmine Immersion Tech (formerly Bitcoin mining company) Ethereum micro strategy BitMine pressed the acceleration button and increased its holdings by more than 135,000 Ethereum in the past 10 hours, and its total holdings have exceeded 1.3 million. It is the world’s largest enterprise-level Ethereum holder.Since the launch of the Ethereum reserve strategy on June 30, it only took 7 weeks to reach 0 to 1.3 million pieces, with an average increase of more than 27,000 pieces per day. What’s more, the weekly increase of 247,000 pieces from August 10 to 16, worth more than 1 billion US dollars!Previously, the company plans to control about 5% of the global Ethereum supply, and has completed 21.7%, which fully demonstrates that it has completed 21.7%.BitMine’s Ethereum reserves have entered an exponential growth stage, and its radical strategies may lead a new pattern of enterprise-level Ethereum configuration.

• The latest data shows that Ethereum treasury companies have reached 70, with a total holding of more than 3.7 million pieces. SharpLink, which ranks second, has held more than 728,000 pieces.

• The Ether Machine has also exceeded 340,000 mark.

It is expected that the total holdings of enterprise-level Ethereum may exceed the 8 million mark by the end of the year.

What’s even more amazing is the flow of ETF funds. BlackRock’s ETHA spot ETF has purchased more than 3.6 million Ethereum, totaling more than 12 billion US dollars. Grayscale’s Ethereum ETF has purchased nearly 2 million, totaling about 7.3 billion US dollars. The net inflow of Ethereum ETF in the past week was US$2.85 billion, of which the net inflow on August 11 exceeded US$1 billion!

2. Theory of technological evolution: From merger to upgrade of Pectra to revolution of digital oil

Ethereum’s market performance in 2025 is impressive. Ethereum’s underlying transformation is disrupting the performance ceiling. The Pectra, which was implemented in Q1 2025, has been upgraded to reshape the network bones through 12 key EIP proposals:

• EIP-7702 allows ordinary wallets to obtain “smart contract-level functions”, and users can realize Gas payment and social recovery like WeChat payment, completely bid farewell to the fear of mnemonics;

• EIP-7251 raises the verifier pledge limit from 32ETH to 2048ETH, and the node communication efficiency has increased by 3 times, clearing obstacles for institutional pledge;

As network activity increases, ETH destruction accelerates, forming a self-reinforcement cycle of reduced supply and price support.

3. Ecological explosion: value reconstruction from DeFi to RWA to stablecoins

Ethereum is tearing off the label of “Bitcoin Follower” and evolved into a global settlement layer with trillions of real assets on the chain.

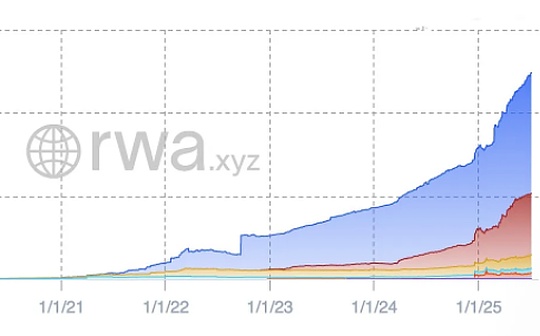

RWA (Real World Asset) has become one of the strongest narratives in 2025, covering traditional assets such as U.S. Treasury bonds, real estate equity and carbon credit. BlackRock’s BUIDL fund scale exceeded US$2.4 billion, and more than 90% of the assets are deposited in Ethereum.

The integration of DeFi and AI has opened up a new dimension. AI agents can independently implement dynamic interest rate lending strategies and optimize the MEV distribution mechanism, attracting more than 100,000 traditional developers to flock to the ecosystem. DeFi locked positions soared to US$85.9 billion in July, a three-year high, of which Ethereum accounts for 60% of the share.

Stablecoins consolidate Ethereum’s “on-chain dollar” status. 54% of the stablecoins (about US$137.7 billion) on the entire network are circulating in Ethereum. Each transfer burns ETH, strengthening its “digital crude oil” attribute.

4. Wall Street trend: Why does capital choose Ethereum?

The most eye-catching trend in 2025 is that listed companies will include Ethereum in their financial reserves on a large scale.Unlike the early days of Bitcoin that was regarded by enterprises as a pure means of storage of value,Institutions regard ETH as a “productive asset” – they can not only obtain profits through pledge, but also participate in the DeFi ecosystem to obtain additional returns.

Behind the large-scale influx of institutional capital into Ethereum is its irreplaceable practical value in the crypto ecosystem.Unlike Bitcoin, which is mainly used as a means of storage of value, Ethereum has become the basis for the operation of the blockchain economy.

The core platform for real-world assets (RWA) tokenization, as of the end of 2024, Ethereum accounted for 81% of the RWA market, locked in about US$14.9 billion in assets, and served more than 80,000 asset holders. Analysts believe that this will become a key factor driving Ethereum’s strong growth in 2025.

The cornerstone of the stablecoin infrastructure, Ethereum accounts for 54% of the stablecoin market, supporting the most successful application scenario in this cryptocurrency field. The supply of stablecoin circulation reaches US$200 billion in 2024, and is expected to exceed US$400 billion in 2025.

Compared with Bitcoin’s “digital gold” narrative, the core of Ethereum’s winning institutional favor lies in its triple advantages:

1.Productive asset attributes: Pledge ETH can obtain an annualized return of 3-5%, which is more attractive than US bonds during the Fed’s interest rate cut cycle;

2.First-mover advantage of compliance: EU MiCA regulations list ETH as a “compliance benchmark”, and Trump nominates pro-cryptocurrency SEC president to clear the shadow of policy;

3.Ecological network effect: 5,000 active DApps and 500,000 developers build moats, which is five times the scale of Solana and other competitors.

Fundstrat founder Thomas Lee asserted: “The fair value of Ethereum should be in the range of $10,000 to $15,000.” Bitwise CIO’s prediction is relatively conservative: ETH will exceed $7,000 in 2025.

5. Challenges and the Future: Ethereum’s “Digital Oil” Path

When Bitcoin ETFs drive the first wave of institutions, Ethereum is opening a more imaginative value narrative with a combination of technology soaring + ecological explosion + compliance breakthrough.

It is not only a better “digital gold” – it is also a productive asset connecting the traditional finance and crypto world, it is the settlement layer of the RWA trillion market, and the infrastructure of the AI agent economy. Every additional ETH in the enterprise vault is voting for this value reconstruction.

As Bitmine said during its transformation: “We are not betting on the token price, but the operating system of the entire digital economy.”When Ethereum tear off its old tags, a golden age belonging to the smart contract ecosystem has just dawned.

BlackRock hosts US$2.4 billion in Treasury bonds on Ethereum, and Sony builds the meta-universe in Layer2 – the entry of the traditional world, indicating that Ethereum’s “institutional narrative” has opened the title page.

The far-reaching impact lies in the reconstruction of financial infrastructure. With the acceleration of the on-chain trend of RWA (real-world assets) and a market opportunity worth $16 trillion is opening up. As the underlying platform, Ethereum is expected to become the core infrastructure of the next generation of financial system.

When Ethereum accounts for 81% of the RWA market and 54% of the stablecoin market, one question is worthy of deep consideration for investors:What we are witnessing is the reenactment of another Bitcoin story or the beginning of a more profound “digital oil” revolution?