Author: Wen Shijun

Who is the richest Chinese in the world?Currently, Nvidia CEO Huang Renxun.Huang Renxun, 62, was born in Taiwan, China. Under the wave of AI, his net worth has soared to US$151.4 billion, ranking 9th in the world.

Who is the richest Chinese born in mainland China?It is 48-year-old Zhao Changpeng. His net worth is US$75.3 billion, ranking 22nd in the world, and 1.7 billion more than Zhong Shanshan, who ranked 24th.

Among the world’s top rich people who started from scratch, Zhao Changpeng, born in the 1975, is considered a younger one, and he also has the rare life experience of other rich people – the richest prisoner in human history.Just at the end of April last year, Zhao Changpeng was sentenced to four months in prison by the United States, and even lived in the same cell with a double murderer.

Recently, Zhao Changpeng returned to China.In late August, he appeared in Hong Kong twice publicly: on the 27th, he appeared at the University of Hong Kong and had a Chinese conversation with Vice President Lin Chen at the “Crypto Finance Forum 2025”. On the 29th, he attended the “Asian Bitcoin Conference” in Hong Kong and had an English conversation with Taylor Evans, the organizer of the conference and one of the founders of Bitcoin Magazine.

In the official introduction materials, the number one guest of the “Asian Bitcoin Conference” is Eric Trump.Yes, he is the second son of the current US president and is also considered to be the person in the Trump family who understands cryptocurrencies the best.The second guest of the conference was Zhao Changpeng.In front of many cryptocurrency practitioners and enthusiasts, he talks in English with the ease and freedom brought by absolute wealth freedom.

Of course, the current global shift in cryptocurrency regulation has also made him much easier – in this sense, Zhao Changpeng’s high-profile return to China has symbolic significance.

From prisoner to guest

“The last US government should not be particularly smart.” In this Chinese dialogue between Hong Kong University on the 27th, Zhao Changpeng’s words came out, and the audience burst into laughter.”I have the right to say this,” Zhao Changpeng continued, and the response from the audience was applause and laughter.

Just this time a year ago, Zhao Changpeng was still in prison in the United States.After the Trump administration came to power, the US government’s attitude towards cryptocurrencies turned 180 degrees, and the policies of major economies around the world began to be ambiguous and even loosened. Now Zhao Changpeng has become a hot guest of honor in the world.

Zhao Changpeng continued: “But this government is very smart. They have a business background. It is clear that Tether has helped the United States consolidate the important position of the US dollar in the world and also helped the US dollar and the US expand its influence in the global currency field.”

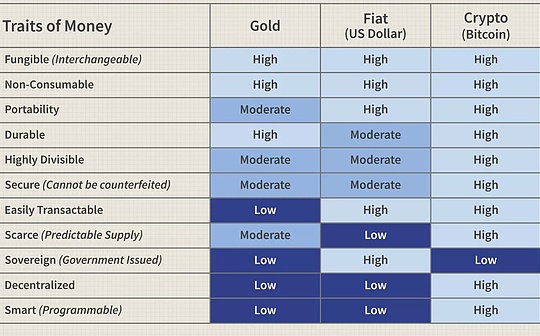

Tether is currently the largest issuing company for the stablecoin USDT.Stable coins are cryptocurrencies that maintain relatively stable value by anchoring specific assets such as fiat currency and gold.The USDT issued by Tether is locked at 1:1 with the US dollar, taking into account the stability of the currency value and the high liquidity of cryptocurrencies.

Why does stablecoins support the US dollar?Zhao Changpeng mentioned a set of data on the spot: “Now there should be more than 100 billion US dollars of USDT funds used to purchase US Treasury bonds.” This is a very high proportion. As of September 2, the total scale of USDT, the world’s third largest cryptocurrency, was about US$168 billion.

After all, he was once the richest Chinese, and Zhao Changpeng naturally introduced the topic to the internationalization of the RMB: “China has an important goal, which is to enhance the influence of the RMB internationally, and (stable currency) is exactly in line with this goal.”

Within China, Hong Kong is currently a “test field” of cryptocurrencies.On May 21, 2025, the Hong Kong Legislative Council passed the draft “Stablecoin Ordinance”, which officially came into effect on August 1.

The Ordinance clearly states that fiat stablecoins are issued in Hong Kong, or stablecoins that claim to be anchored to the Hong Kong dollar are issued inside and outside Hong Kong, and they all need to apply for a license from Hong Kong.This is actually giving stablecoins legal status while incorporating them into regulation.

Although, the Hong Kong Monetary Authority said that by the first phase of early 2026, only a few stablecoin licenses will be granted.However, from the opening of the application in early August to the 31st, 77 institutions have “expressed their intention to apply for a stablecoin license.”

There are many big names among them – including Hong Kong dollar issuing banks such as Bank of China (Hong Kong) and Standard Chartered Bank (Hong Kong), as well as technology giants such as Ant, JD.com and Xiaomi.

The track is hot and the competition is fierce. It is also against this background that Zhao Changpeng appears in Hong Kong again.

The biggest winner of cryptocurrency

Zhao Changpeng was born in Lianyungang, Jiangsu in 1977. Later, he immigrated to Canada with his family. Before graduating from university, he joined the Tokyo Stock Exchange as a software engineer.He recalled that when he got his degree and then looked for a job, he might miss such a job opportunity.

In 2005, he returned to China to start a business in Shanghai, and initially he worked on a high-frequency trading system.In 2013, Zhao Changpeng first came into contact with Bitcoin; the following year, he made a decision that seemed a bit reckless at the time: sell the real estate in Shanghai and invest all his funds in Bitcoin.

Whether it is work or investment, if you see it correctly, you are willing to bet, which may be a part of his personality.

Zhao Changpeng’s wealth reached its peak in 2021: his net worth of US$94.1 billion, ranking first among the richest Chinese in the world – it was only four years since he founded the cryptocurrency exchange Binance in Shanghai.

Cryptocurrency exchange is a platform for buying and selling cryptocurrencies such as Bitcoin.In fact, it is precisely because of this type of platform that cryptocurrencies can go from a theory-based “digital asset” to a wealth that ordinary people can trade and circulate.

Of course, it also made him, the “boss” of the exchange, make a lot of money.According to Zhao Changpeng at the University of Hong Kong on August 27, “There are probably two more profitable businesses in this (cryptocurrency) industry, namely stablecoins and exchanges.”

How do you make money in these two businesses?

Stablecoin issuers earn money income: when users exchange stablecoins, they deposit reserves into the issuer’s account. These funds entering the issuer’s account can be profitable through investments (such as purchasing US Treasury bonds).

As for the exchange, profits mainly include transaction fees, currency listing fees for the project to be listed on the platform, etc.The larger the cryptocurrency industry, the greater the profit margin as an exchange for the industry’s “infrastructure”.

Binance, founded by Zhao Changpeng, is not only the world’s largest exchange, but also issued the exclusive cryptocurrency BNB (Binance Coin).In addition, Zhao Changpeng once revealed that 99% of his personal wealth is cryptocurrency assets, and his wealth has also achieved a geometric surge in the appreciation of cryptocurrencies – even becoming the richest Chinese in the world.

With the blessing of the halo of wealth, he became a symbol of the entire industry.

The hardest thing in the United States

However, the cryptocurrency industry uses blockchain and decentralization as its underlying logic – there is a significant conflict with the traditional centralized monetary system and financial system controlled by governments and central banks.Worrying about losing control and being undermined by fiat currency, suspected of being a “Ponzi scheme”, was once a common attitude of many governments towards cryptocurrencies.

If you want to wear a crown, you must bear the weight.After founding Binance, Zhao Changpeng’s life also had to start “wandering” around the world with that round of global cryptocurrency regulation.

In early 2018, Binance announced that it would stop providing services to mainland Chinese users.At first, Zhao Changpeng wanted to move Binance to Japan – he used to work there, but soon received an order from the Japanese Financial Department.Later I tried many places, including Hong Kong, Taiwan, Malta, Bermuda, Jersey, Singapore…

In the end, Binance itself also “decentralized” – no longer announced its official headquarters; while Zhao Changpeng himself chose to settle in the UAE, contrary to the character of “not buying a house”, and purchased a 1,077.68 square meters and six-bedroom mansion in Dubai for US$13.5 million in 2021.

Many Arab countries are quite rich because of the “black gold” of oil, but due to religious traditions, their financial systems clearly prohibit interest – and the current financial systems are mostly based on interest, which also makes the local area more inclusive of various “financial innovations”.

But the United States is the most difficult one.

The United States is the world’s largest cryptocurrency market.But for a long time, Binance chose to “build the plank road openly and go through Chen Cang secretly”:

On the surface, Binance launched an independent “Binance America” to isolate it from the Coin Security Ball Platform, fully complying with the regulatory requirements of the United States at that time.But Binance once also allowed American users to bypass geographical restrictions or provide evidence of being “not in the United States” and directly use the coin security ball platform for transactions.

The U.S. prosecutors collected evidence and asked Binance and Zhao Changpeng to cooperate with the investigation.In November 2023, Zhao Changpeng “voluntarily” traveled to the United States from the UAE – signed a plea agreement and resigned as Binance CEO, but was still banned from leaving the country, awaiting trial.In April 2024, he was sentenced in Seattle; fined him and Binance for more than $4 billion, setting a record since the founding of the United States.

At the end of September 2024, Zhao Changpeng was released from prison and returned to his home in the UAE in a low-key manner.In early November of the same year, when Trump won the election, Zhao Changpeng began to become active online and offline again.

“The less restrictions, the better the global economy will be”

Trump’s reversal of attitude towards cryptocurrencies is also very dramatic.He once said: “Bitcoin looks like a scam. I don’t like it.” But in July 2024, during his second presidential election campaign, Trump personally visited the Bitcoin 2024 conference and announced with a high profile: “Ensure that the United States becomes the cryptocurrency capital and Bitcoin superpower on the planet.”

Trump did not break his promise.On March 6, 2025, Trump announced the establishment of a strategic Bitcoin reserve in the United States.The next day, Trump hosted the “first White House Crypto Summit”, at which Treasury Secretary Scott Becent said: “We will maintain the United States as the world’s major reserve currency, and we will use stablecoins to do this.”

Under Trump’s urging, the “Guiding and Establishing a US Stablecoin Country Innovation Act” came into effect on July 18 before China (Hong Kong’s Stablecoin Ordinance came into effect on August 1).

In the English conversation at the Asian Bitcoin Conference on the 29th, Zhao Changpeng said: “To be honest, I am actually quite surprised that the United States can advance these measures so quickly. I want to give Trump’s governance a thumbs up!”

Zhao Changpeng naturally understood that this was a global trend: “I know the UAE is planning to further advance to make policies more friendly and innovative to the crypto field; Hong Kong, China, is also gradually opening up; I also learned when I was in Tokyo three days ago that Japan is embracing cryptocurrencies vigorously.”

He is also very clear about the logic behind it: “The United States is now driving regulators and leaders from all over the world to focus on cryptocurrencies and blockchains, which is great for the industry!”

The regulatory rules that left Zhao Changpeng imprisoned back then were also subverted.Zhao Changpeng said in English: “Just yesterday or this morning, the U.S. Commodity Futures Trading Commission also announced that it may allow U.S. citizens to trade (cryptocurrency) on international platforms.”

“Ideally, anyone should be able to trade with others, and anyone should be able to invest or raise funds globally.” This biggest beneficiary of blockchain decentralization is inevitably a fan of the free economy.

“The fewer restrictions, the better the global economy will be,” said Zhao Changpeng.