In the first bull market, you were Bitcoin Maxi, and you made millions of dollars from it.In the second bull market, you’re still Bitcoin Maxi, you’re making millions of dollars.You made millions of dollars in the third bull market because you were Bitcoin and Ethereum Maxi.In the last bull market, you made millions of dollars because you were BNB, Solana and Avalanche Maxi.In this bull market, to make millions of dollars, you have to be $Solana and $TON Maxi, otherwise you will be empty-handed.

History of the Bull Market of Cryptocurrency

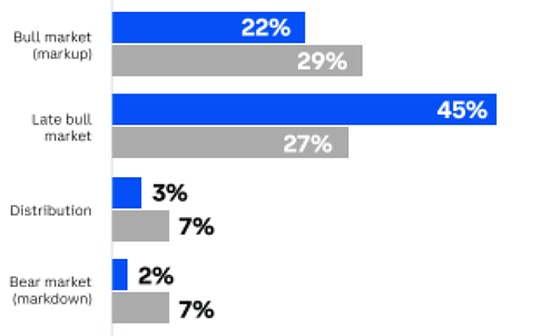

There have been many bull markets in the history of cryptocurrencies, and each bull market has different catalysts and market dynamics.

2011–2013——Geopolitics

The uncertainty, political and financial crises of 2011-2013 made Bitcoin a safe haven.Although this is not the first time this has happened, the bull market has proved the possibility of using Bitcoin as a hedge trading tool.

2015–2017 – BTC becomes mainstream

From 2015 to 2017, Bitcoin’s price has risen as mainstream media coverage and increased usage rates in people.It is worth noting that the price of Bitcoin rose from $200 to $670, marking a revolutionary step in seeking social recognition.

2020–2021 — Digital

During the COVID-19 pandemic, cryptocurrencies have seen unprecedented growth; demand for virtual transactions and DeFi payment systems has surged.

2024 – Now

At the beginning of 2024, Bitcoin rose sharply, breaking through the $60,000 level.The latter is due to expectations of an upcoming fork event and the SEC’s approval of Bitcoin ETFs listed on the U.S. market.It is at this point that finance and digital currencies meet as a new initiative provides a regulated channel for institutional investors who want to invest in Bitcoin.Overall, both regulatory approvals and excitement for the next halving period provide ample fuel for this craze.

in conclusion

In this bull market, to make millions of dollars, you have to be $Solana and $TON Maxi, otherwise, you will be empty-handed, that’s a more relaxed way, and that’s my point of view, not a little bitFinancial advice.