On October 11, 2025, the largest black swan in the history of the currency circle was born.From today on, there is an additional anniversary in the currency circle:10·11.This is the largest serial liquidation case in the history of the currency circle!Not one.The number of liquidators exceeded 1.64 million, and the amount liquidated exceeded US$19.2 billion.

“9·4 incident”, FTX bankruptcy, luna incident, 3.12 incident, 8·05 tragedy, 5·19, etc.,These are no longer ranked.

After the pin insertion correction in mainstream currencies:

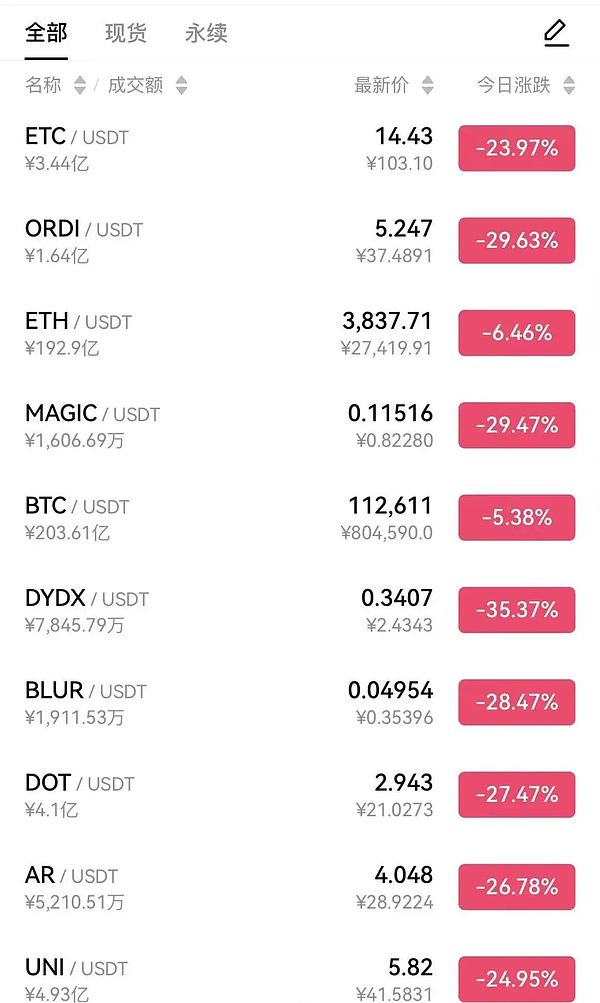

Only BTC and ETH had single-digit declines, but the largest declines exceeded 15% in 24 hours.

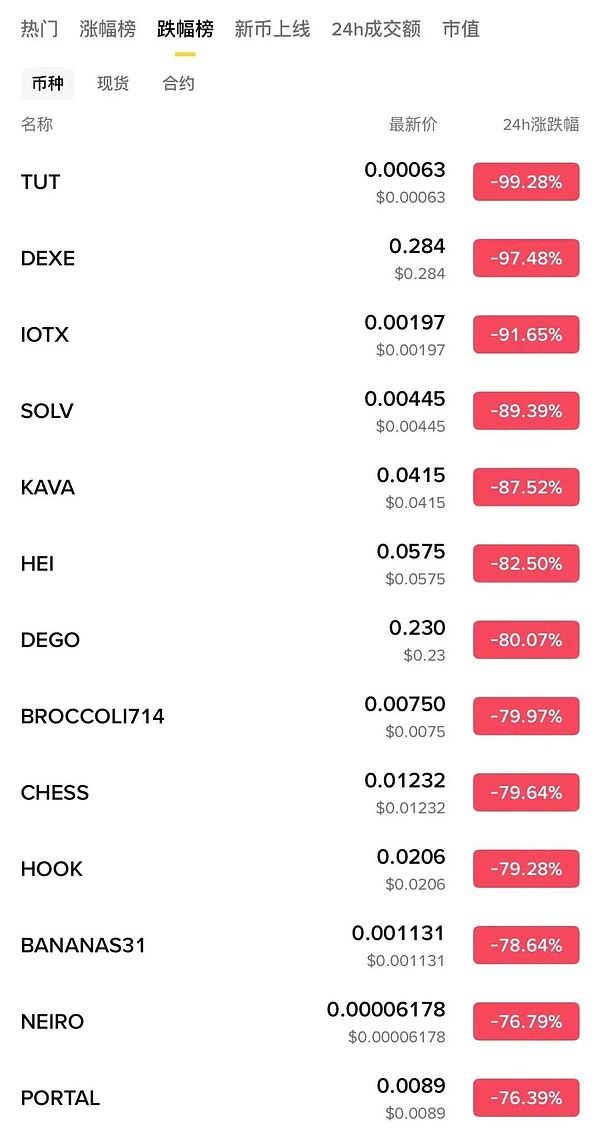

BTC price from122,000 US dollars, reaching the lowest price of 102,000 US dollars, the maximum drop was more than 16%;ETH price starts from4,340 US dollars, reaching the lowest level of 3,400 US dollars, with a maximum drop of more than 22%;Mainstream currencies such as Solana (SOL) and XRP fell almost 30%.It is normal for altcoins to fall by more than 90%.

As long as leverage and contract trading are enabled, 98% of the positions will be liquidated.

In the fastest hour, the total liquidation volume on global exchanges soared to US$9 billion.

The trigger for this epic disaster turned out to be: Trump’s “tariff nuclear bomb.”

It all started on the afternoon of October 10, Eastern Time, when Trump made a sudden announcement at the White House: imposing 100% tariffs on all Chinese imported goods and attaching new export control measures, aiming to “completely reshape the global supply chain.”

This is not empty talk – in his first week in office, Trump has fulfilled his campaign promise and escalated the trade war into a “comprehensive confrontation.”

The market collapsed instantly: U.S. stock Nasdaq futures fell 3.5%, and global supply chain stocks plummeted; cryptography, as a “risk asset”, bore the brunt.

Why is encryption so fragile?The proliferation of leveraged trading is the culprit.

In the bull market of 2025, the leverage ratios of platforms such as Binance and Bybit soared to 125x, and retail investors and institutions flocked to long positions, ignoring macro risks.

As soon as Trump’s tweet came out, algorithmic trading machines sold off at a high frequency, triggering a domino effect: price flash crash → stop loss triggered → forced liquidation → liquidity depletion.

Some people said: “I have suffered heavy losses. This is the last thing I want to see.”

Some people said in despair: “The BNB bulls have been wiped out and their life savings are gone. I want to end everything.”

In just 15 minutes, the market evaporated by US$20 billion; this was not an “accident”, but the textbook definition of a black swan: low probability, high impact, and “inevitable” only after the fact.

This is not only a decline in the currency circle, but also a general decline in U.S. stocks.

A months-long calm on Wall Street was shattered, with U.S. stocks tumbling after President Donald Trump threatened to sharply increase tariffs on China.

The S&P 500 fell 2.7%, its worst day since April.The Dow Jones Industrial Average fell 878 points, or 1.9%, and the Nasdaq Composite fell 3.6%.The FTSE A50 futures index closed down 4.26% in consecutive overnight trading.

According to media reports, Trump on Friday threatened to significantly increase tariffs to counter other countries’ implementation of stricter export controls on rare earth minerals, and said that he would significantly increase tariffs, making investors worried that trade relations between major countries will continue to deteriorate.

Trump said on his social media platform Truth Social: “As President of the United States, I will be forced to take financial measures to counter their actions.

One of the policy options we are evaluating is to significantly increase tariffs on products entering the United States.There are many countermeasures that are also under serious consideration.”

Why is this the largest liquidation in the history of the currency circle, bar none?

First, today is the largest net outflow of BTC contracts in the past five years.Liquidation is also the largest.

Second, among the liquidation data in the past five years, today is the largest and has the largest number of people.

Clearing data on October 11, 2025

Leading events: Trump’s tariff incident;The number of liquidators exceeded 1.64 million; the amount liquidated exceeded US$19.2 billion.

February 3, 2025, clearing data

Leading event: Trump’s tariff threats.

Tonight, brothers in the currency circle, please drag Trump out and whip his corpse!

After the black swan, there must be a phoenix reborn?

“The biggest liquidation in history, all exchanges collapsed!”Yes, but remember: the currency never sleeps.The black swan flies by, leaving behind a stronger on-chain ecology.

Perhaps this hindsight was right this time:The currency circle is not about who can run faster, but about who can live longer!

When encountering the current market situation, you should believe it and foresee it!

Although black swans are cruel, they breed opportunities.

Historical pattern: From 1 to 3 months after the incident, the market rebounded by more than 30%.BTC has rebounded from 110K to 112K, and institutions such as BlackRock are quietly buying ETFs.

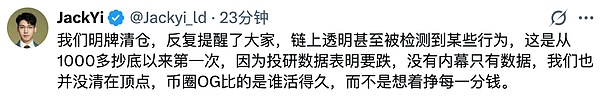

The author’s operations and opinions are:

Although this decline is not the largest, the leverage liquidation is the largest in history!Don’t buy the bottom for the time being and wait patiently for the situation to become clearer. This drop is far greater than expected.