Author:Martin

As traditional currencies continue to change in the torrent of time, there are two assets that are showing vitality that transcends the times.

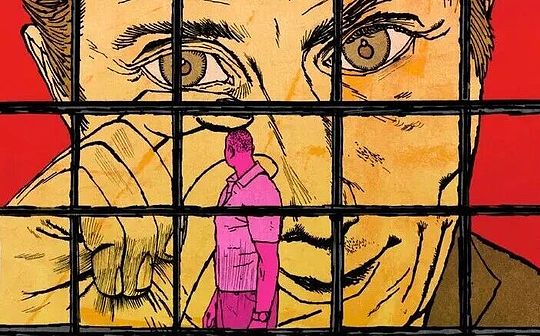

“Bitcoin and gold will ‘live’ longer than any other currency“.On October 12, Tether CEO Paolo Ardoino’s statement on the X platform triggered widespread repercussions in the cryptocurrency and traditional financial circles. This is not onlyAffirmation of the value of two assets,It is also an important judgment on the evolution of the current monetary system.

As the issuer of the world’s largest stablecoin USDT, Tether itself has made large-scale allocations to Bitcoin and gold. According to public data,Tether holds more than 100,000 Bitcoins (worth over $10 billion) and nearly 80 tons of gold (worth about $8 billion), making it one of the largest holders of gold outside of banks and countries.

The choice of giants

Tether, which dominates the stablecoin field, has in recent yearsThatProfits are heavily invested in “safe assets” such as Bitcoin and gold,This allocation is not accidental but is based on a deep understanding of the long-term value of these two assets.

Paolo Ardoino said bluntly:“I believe gold should be safer than any national currency.So I think if people start to worry about the potential increase in U.S. debt, they might look at alternatives.” This view represents the concerns of a growing number of institutional investors.

Gold is undoubtedly rapidly consolidating its “ultimate safe-haven status” in 2025, with prices hitting record highs recently.Meanwhile, Bitcoin has also performed well,After hitting a record high of $126,000 in October, it is still trading above $110,000.

Digital gold vs. physical gold

Bitcoin is often referred to as “digital gold,” an analogy that goes far beyond their combined role as a store of value.Both feature independence from central banks, limited supply, and universal recognition.

Ardoino has a brilliant discussion on this: “Many Bitcoin believers are reluctant to talk about gold, as if gold will diminish the shine of Bitcoin, but the fact is,Bitcoin is perfect. Although gold is not perfect, it is not the opponent of Bitcoin. Its opponent is legal currency..”

In essence, what Bitcoin and gold fight against is the risk of depreciation of legal currencies. In the context of the current surge in global debt – since 1970,CompleteThe ratio of global debt to GDP has soared from 110% to 360%. This anti-depreciation attribute is particularly valuable..

Tether not only holds a large amount of gold itself, but alsoLaunched gold-backed token XAUT, each backed by one ounce of gold, this combination of traditional assets and blockchain technology is showing the future integration trend of finance.

Entry of institutions and central banks

The recognition of Bitcoin and gold comes not only from crypto companies like Tether, but traditional financial institutions are also actively reassessing the value of these two assets.

Deutsche Bank predicted in a recent report,By 2030,Bitcoin and gold will coexist in the global central bank reserve system,Marion Laboure, an analyst at the bank, said: “Although gold has long been the most standard alternative asset, the Trump administration’s landmark decision to establish a U.S. Bitcoin strategic reserve in March this year has once again triggered intense discussions about central banks holding Bitcoin as a reserve asset.”

This endorsement is based on profound macro analysis: “As the dollar weakens, central banks face a key question:Can Bitcoin exist alongside—or even replace—gold as a credible reserve asset?” Deutsche Bank believes that “strategic allocation of Bitcoin could become a modern cornerstone of financial security, echoing the role of gold in the 20th century.”

Wall Street giants are also taking active actions. Since 2025,Institutional investors bought a total of 417,000 Bitcoins (accounting for about 2% of the circulating supply), while retail investors sold 150,000 Bitcoins during the same period, this phenomenon of “institutional buying and retail selling” is kicking off a redistribution of wealth.

Intrinsic value cornerstone

Why have Bitcoin and gold stood the test of time?The key is that they all haveIntrinsic value support.

Gold’s value comes from its physical properties and scarcity,The time required to produce the same amount of gold is relatively stable, and the impact of technological improvement is limited. This makes the time for unit gold output relatively constant, which becomes the fundamental basis for the long-term stability of gold’s intrinsic value.

Bitcoin’s value comes from its algorithmic scarcity and time condensation, the output of Bitcoin is determined by time. As the block reward is halved, it takes longer and longer to produce one Bitcoin. This intrinsic value is growing and irreversible, making Bitcoin an ideal choice for long-term value storage.

In contrast, the output cost of legal currency is almost zero, and the unit currency value has almost no time to solidify. This is why since the disintegration of the Bretton Woods system,Gold has appreciated a hundred times against the US dollar, and Bitcoin has been soaring since its birth, dwarfing any traditional assets..

The rise in the price of gold has proven its safe-haven status. Many Wall Street financial institutions have listed a gold price of $4,000 in 2026 as a baseline scenario, while the rise of Bitcoin has demonstrated the revolutionary impact of technology on the financial system.

No matter how traditional markets fluctuate,Both Bitcoin and gold have shown viability beyond that of any single sovereign currency.As Paolo Ardoino said, these two assets will most likely exist longer than any other currency.