Author: Tom Mitchelhill, Cointelegraph; Compilation: Deng Tong, Bit Chain Vision Realm

The total lock value (TVL) based on Ethereum’s liquidity re -pledge agreement Eigenlayer (TVL) soared an amazing $ 1 billion in just eight hours after the agreement temporarily canceled its pledge limit.

On February 5th, Eigenlayer announced that it would temporarily raise the upper limit of the bet of 200,000 Ethereum each of Ethereum before February 9.The agreement states that this temporary cancellation “pave the way for the future”, and in the future, all pledge limits will be permanently canceled.

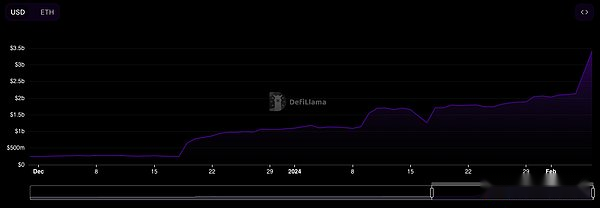

According to DEFILLAMA data,Within 8 hours after the announcement, as investors injected the liquidity ETH token held by themselves, the TVL of the agreement soared from about 2.5 billion US dollars to 3.58 billion US dollars.This huge growth marks an increase of $ 1.6 billion last week, which is shocking.

As of February 5, TVL on Eigenlayer increased from US $ 448 million in December to $ 3.58 billion.Source: DEFILLAMA

The EIGENLAYER protocol allows investors to protect other networks by pledged ETH to obtain additional benefits.As of the release, Eigenlayer supports liquidity pledge tokens, such as ETH (STETH) and Swell Stated Ether (SWETH) pledged by Lido Dao pledged.

At present, ETH pledged by Lido is the most popular pledged token on Eigenlayer, which accounts for more than $ 1.2 billion of Eigenlayer’s total TVL value.ETH pledged by Swell is the second largest token in the agreement, with a total TVL of $ 392 million.

The way to pledge is to provide interest for investors to lock their existing mobile pledged token, and then use these token to assist in verification, borrowing, and providing liquidity on other blockchain networks.

Although EIGENLAYER is widely believed that it provides a novel cases for ETH pledged token, market commentators and developers have worried about the mechanism of the agreement, saying that high pledges are similar to leverage.

In May last year, Vitalik Buterin, the co -founder of Ethereum, warned that the significant increase in pledge and the excessive use of data or price Oracle may bring major “systemic risks” to the Ethereum ecosystem.

EIGENLAYER’s test network was launched on April 7, 2023. The main network of the agreement was launched on June 14 two months later.Since then, the TVL of the agreement has increased its amazing 21,623%, reflecting the wider passion of the cryptocurrency market for re -pledge.