Author: SAM Reynolds, Coindesk; Compilation: Five Bah, Bit Chain Vision Realm

-

The proposed key files of the Ethereum Exchange Trading Fund (ETF) suddenly were approved unexpectedly.

-

FIT21’s unexpected approval in the House of Representatives and by indicating that cryptocurrencies have become election issues.

-

ARK will not make money from its Bitcoin ETF.

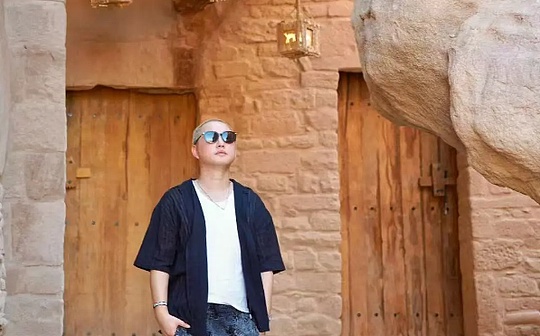

ARK Invest CEO Cathie Wood saidCryptocurrencies have now become issues of the United States election. This is why the key documents of the proposed Ethereum Exchange Trading Fund (ETF) suddenly approved the approval.

“People think it will not be approved. It will never be approved,” Wood said in an interview with the What Bitcoin Did Podie Host on the Consensus 2024 stage.”If it is approved in a conventional manner, we will receive inquiries from the US Securities and Exchange Commission. No one has received inquiries from the US Securities and Exchange Commission before.”

Wood is also the company’s chief investment officer. He said that the House of Representatives’s emotions on the 21st Century Financial Innovation and Technical Act (FIT21) are changing.The bill was passed with the support of the two parties last week, which clearly stated that this may be a problem of the year of the election.

“Another thing that happened was that former President Trump’s attitude towards Bitcoin and cryptocurrencies became more harmonious. That week, he said that he would accept campaign donations in the form of cryptocurrencies.”Follow, Wood said.

Wood also said,Although Solana ETF may be approved, it is unlikely to be established on the exchange trading fund focusing on Meme coins, because large institutions such as large brokerage companies and investment consulting companies will not accept funds in non -“dominant” categories.

Bitcoin as a public product

Wood also said that ARK’s position is that Bitcoin (BTC) is a public product.The ARK 21SHARES Bitcoin ETF, which was approved and charged in January, will not make money.

“We should allow as many people as possible to use [ETF], so keep the cost at a very low level.”

She also announced,ARK will allocate a certain percentage of private equity funds to support Bitcoin developers to ensure that regardless of ETF’s profitability, they can receive continuous support.

Bitcoin and Etherwood

Wood is known for its optimistic Bitcoin. She predicts that in 2030, the price of Bitcoin may reach 1.5 million US dollars, and it is called the “financial highway”.

Despite the progress of Ethereum ETF approval, Ethereum (ETH) is ushered in her own golden moment, when asked if she is more willing to hold Bitcoin or Ethereum, Wood did not hide her position than Bitcoin.

“There is no doubt that Bitcoin is the first choice. It is a global currency system. It is a technology and a new asset category. These three concepts are two. There is nothing else in the encrypted world that can be with it.compete.”