Author: CryptoCompound, Compiler: Shaw Bitcoin Vision

The revolution no one mentions

While most eyes in the cryptocurrency space are focused on price charts and exchange-traded fund (ETF) inflows, the real story of late 2025 is unfolding in the shadows.The market is being rebuilt from the inside out—not by hype, but by infrastructure.

After years of uncertainty, a combination of regulatory clarity and institutional access has quietly changed the script.Cryptocurrencies are no longer an outlier asset trying to prove their legitimacy.It is becoming part of the global financial system – every formulation of compliance provisions, every approval of an ETF, and every change in policy are promoting this process.

This change did not happen in a vacuum, but was achieved through documents, frameworks and capital allocation committees.And that’s what makes it powerful.

Access changes everything

Institutional investors have favored Bitcoin and Ethereum for years, butUnable to bear its operational risks: custody, compliance, tax treatment, counterparty risk.However,The launch of the spot Bitcoin ETF in January 2024 and the advent of the Ethereum ETF in July have broken this barrier..

This is not just another product launch, this is a new bridge that provides pension funds, family offices and hedge funds with a new way to allocate capital within a regulated ecosystem.

The data speaks for itself.In early October 2025, cryptocurrency ETPs (exchange-traded products) saw record single-week inflows of $5.9 billion, bringing total assets under management to a record high.BlackRock’s IBIT ETF currently hovers around $100 billion in AUM, the fastest-growing ETF in history.

These are not retail flows chasing volatility.They are portfolio flows, subject to investment committees and compliance frameworks, and are capital intended to be held for the long term, not speculative funds.

Institutional influence is everywhere

The spot market only reflects part of the picture.The real impact of institutional adoption is felt in derivatives markets.

Cryptocurrency futures and options trading volume hit an all-time high on the Chicago Mercantile Exchange (CME).Institutional traders use these tools not for gambling but to express directional views, manage risk exposure and arbitrage efficiency.

Ethereum futures’ daily trading volume and open interest have hit new highs for several months, while CME’s Bitcoin options open interest has just exceeded $9 billion.

This growth in liquidity and depth is critical.It can narrow spreads, improve hedging, and create the mechanical stability institutions need.

in short:We are witnessing the professionalization of cryptocurrency market structures.

Regulation is not the enemy, but a catalyst

Cryptocurrency industry veterans often cringe at the word “regulation.”But in fact, it is regulation that makes this phase possible.It is regulation that converts potential energy (interest) into momentum (capital allocation).

In the United States,U.S. Securities and Exchange Commission (SEC) Approval of ETFs— albeit cautiously and with many strings attached — gives Bitcoin and Ethereum legitimacy as investable commodities.The SEC does not need to protect cryptocurrencies conceptually; it only needs to ensure that cryptocurrencies are accessible within existing frameworks.

at the same time,Europe’s MiCA regulations will come into full effect at the end of 2024, creating the world’s first comprehensive digital asset rulebook.The regulation covers stablecoins, exchanges and custodians, and more importantly, it enables access across 27 EU countries.This enables compliance projects to scale operations across Europe for the first time without having to start from scratch.

in Asia,Hong Kong approves spot Bitcoin and Ethereum ETFs in 2024, while expanding exchange and custodian licenses, making it a regional gateway for institutional and retail funds.

While each jurisdiction’s approach differs, the trends are clear:Cryptocurrencies are gradually gaining legal recognition.And when assets gain legal recognition, they attract large amounts of money.

The data speaks: Who is buying and why

A closer look at recent money flows reveals a pattern:

-

Market breadth is expanding.While Bitcoin remains dominant, ETF inflows for Ethereum, Solana, and XRP are steadily growing.Asset allocators no longer view “cryptocurrency” as a single concept – they are building diversified investments across settlement layers and execution chains.

-

Market resilience is increasing.Even after heightened volatility or liquidations, ETF redemptions remain low.This is not a weak-hand market, but a long-term market.

-

Hedging transactions are very complex.CME’s futures and options trading activity is closely tied to ETF capital flows.Institutional investors do not trade spot for excitement; they implement complex and risk-controlled strategies within regulated boundaries.

These signals suggest that the market is moving from a narrative-driven cycle to a structure-driven cycle.The market tone is more stable, but the foundation is more solid.

Macro Background: Liquidity, Risk and Rotation

Every major cryptocurrency cycle reflects global liquidity fluctuations.The difference this time is how liquidity comes in.It no longer flows through speculative leverage but through regulated packaged products.

As global yields stabilize and central banks gradually ease monetary policy, liquidity is finding new homes — and now Bitcoin is one of them.Portfolio strategists increasingly consider itViewed as a highly liquid anti-inflation instrument with non-correlated potential.

Meanwhile, Ethereum is positioning itself asThe income settlement layer of digital finance.As staking, re-staking, and rollup activities continue to expand, Ethereum has transformed from a technology asset into a revenue-generating protocol.

This is not the Meme era of 2021.It’s a slow tectonic shift—from curiosity to configuration.

Opportunities and layouts worthy of attention

Bitcoin – Institutional Beta

ETF inflows remain the most reliable signal of underlying demand.As long as IBIT and other products maintain solid weekly gains, dips are buying opportunities.The long-term layout is still conducive to the formation of a higher bottom structure, and institutional buying will form support.

Ethereum – Practical Income Investing

Ethereum benefits from regulatory access and network activity.Its staking income and destruction mechanism give it properties similar to “technological dividends”.Once the Ethereum ETF gains deeper liquidity in Asia and Europe, keep an eye on the rotation of funds.

Asia – Gateway to Hong Kong

Hong Kong’s ETF structure, especially its physical subscription/redemption model, is expected to unlock real capital liquidity between relevant markets.Tracking primary market subscription data can provide an early understanding of Asian capital inflows.

Europe – MiCA’s advantage

As MiCA stabilizes, compliant issuers and service providers are expected to come to the fore.Tokens related to transparent governance, auditing and on-chain reporting are likely to gain institutional traction as their issuance becomes increasingly widespread across the EU.

How to layout at this stage

Cryptocurrency investment at this stage is not about chasing hot spots, but about understanding the flow of legality.

For traders: Pay attention to ETF capital inflows, CME open interest and cross-exchange basis spreads.These indicators can show institutional liquidity before prices fully react.

For investors: Think from a framework perspective rather than looking at the code.

-

Core positions: Enable liquidity and exposure to Bitcoin and Ethereum through regulated instruments.

-

investment location: Choose layer-1 protocols and infrastructure tokens with clear regulatory paths.

-

tactical trading: Relative value and volatility strategies using options and futures.

For developers: Aligned with compliance.The winners from 2026 to 2028 won’t be the brightest – but those developers who integrate with regulated rails.

Risks to keep in mind

No structural trend is foolproof.Three major risks remain:

-

regulatory policy reversal: Enforcement actions or changes in political winds could slow adoption or cause short-term volatility.

-

liquidity shock: If global financing costs suddenly rise, ETF inflows may level off, putting pressure on market sentiment.

-

Operational accident: Failure in escrow or delivery will test confidence in the new “institutionalization” narrative.

But even these risks indicate one thing: cryptocurrencies no longer exist in a vacuum.It’s deeply connected to the broader financial ecosystem—for better or worse.

The bigger picture

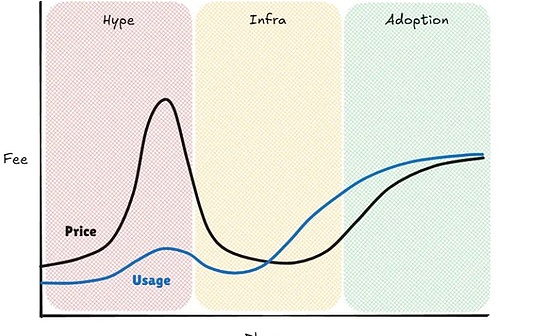

Every asset class goes through three stages:Speculation, Regulation and Consolidation.

Cryptocurrencies have already gone through the first two phases.Now comes the third stage.

This isn’t the noisy, frenetic bull market of 2021—it’sA low-key accumulation phase built on legality, compliance and infrastructure building.

Ironically, by the time most investors realize this, it’s already too late.Institutional investors are already on board – asset allocation models have been set, compliance has been approved, and investment exposures have been determined.

The next phase of cryptocurrency growth will no longer be driven by excitement, but by market access.