Author:Paul Krugman (Paul Krugman)

Original title:The Trump Trade is Unraveling

Introduction

Paul Krugman, winner of the 2008 Nobel Prize in Economics and columnist for the New York Times, has always been known for his distinct Keynesian stance and sharp public policy analysis.He is adept at translating complex economic mechanisms into clear social insights, and never shies away from controversial political assertions.

In his latest article on November 24, 2025, Paul Krugman made a sharp point:

Bitcoin has evolved into a “Trump trade,” and its fate is deeply tied to Trump’s political influence.Therefore, in his view, Bitcoin’s recent plunge is not an isolated market behavior, but a direct reflection of Trump’s decline in political power and influence in the financial market.

The following is the text:

What exactly is Bitcoin used for?It is not a currency—that is, it is not a medium of exchange that can be used for payment.

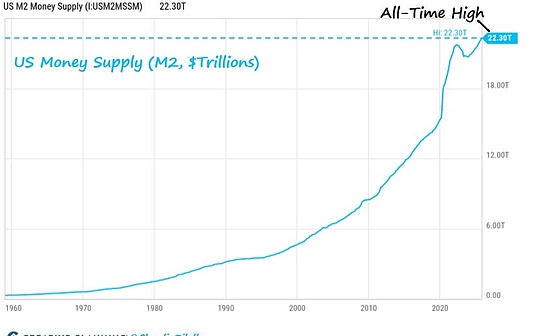

It is not a hedge against inflation.

Nor is it a hedge against financial risk—on the contrary, Bitcoin prices often move in the same direction, and more violently, than the AI stocks that have recently driven the stock market.

If there is a use case for Bitcoin, its core function is to conceal the flow of funds: encryption technology facilitates anonymous transactions that leave no paper trail.Not all of these transactions are illegal, but many of them are.

It is worth mentioning that anonymity not only facilitates criminal activities among crypto users, but also makes them easier targets.As long as you hold the Bitcoin key—the code that unlocks it—it’s yours, no matter who you are or how you obtained it.In this sense, getting a Bitcoin key is like getting a wallet full of hundred dollar bills.

This feature has triggered a wave of kidnappings targeting large cryptocurrency investors, with criminals demanding their victims hand over their keys.

In fact, such kidnappings have become so common that a major recent Bitcoin conference dedicatedA full-day “anti-kidnapping” workshop,Participants learn skills such as how to break straps with their teeth.

In addition to facilitating crime, Bitcoin is increasingly becoming a tool for financial plunder.Cryptocurrencies—and worse still, the stocks of companies that borrowed money to buy them—are heavily marketed to naïve investors who don’t yet realize the risks.They can still profit when Bitcoin rises, but most people may not understand how much they will lose when Bitcoin plummets.

Cryptocurrencies have indeed fallen significantly recently.Although Bitcoin has outperformed the more popular smaller currencies, it is still down about 25% since late October.

Bitcoin may rebound because it is not only an asset, but also a belief.

When I talked to Hassan Minhaj (a well-known American host and political commentator) about Bitcoin, he immediately responded to my criticism by saying: “I don’t want to be made into a meme. Bitcoin believers have targeted me.”

This quality of belief allows Bitcoin to always recover from setbacks and scandals that would destroy ordinary investments, because true believers will only double down on their investment in the face of price drops.Maybe this time too.

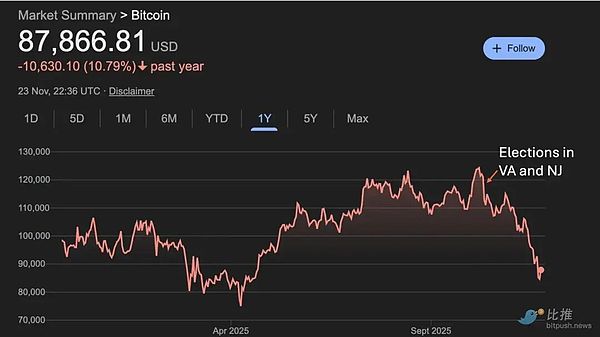

But it may be different – because today’s Bitcoin has essentially become a “Trump deal.”Bitcoin prices soared after Trump won the election last year, and the recent plunge coincides with a series of political setbacks for Trump.

Why is it called a Trump deal?

Part of the reason is that after his family essentially accepted huge bribes from the crypto industry, Trump is giving back to the industry with pro-crypto policies.

It is worth noting that he has signed an executive order allowing ordinary Americans to invest their 401(k) retirement funds in crypto assets – and these investors are often unaware of the risks.

More broadly, as I have argued, crypto is increasingly becoming a tool for financial predation, and the Trump administration has been extremely permissive of such predation.They are working to dismantle agencies established after the 2008 financial crisis to protect investors and market security, such as the Consumer Financial Protection Bureau.

Treasury Secretary Scott Bessant and other Trump administration officials and allies, including some at the Federal Reserve, are also working to weaken bank regulations that were put in place to limit the risky behavior that sparked the 2008 crisis.

All this is bad for retail investors, bad for financial stability, and good for financial speculators like Bitcoin promoters.

So how do we interpret Bitcoin’s recent plunge?Think of it as the collapse of the “Trump deal.”Although Trump continues to strive to give back to the industry that made his family rich and his insiders continue to work hard to create a breeding ground for all kinds of predatory behavior, Trump’s power is clearly declining.As a result, the price of Bitcoin, which has essentially become a bet on Trumpism, collapsed.

Why did Trump suddenly show weakness?Polls have consistently given it extremely low ratings since the spring, butIts net approval rating has fallen significantly over the past month.

Although he had just claimed to have the “highest approval rating of his political career” – no one knew which poll he was citing – Democratic victories in Virginia and New Jersey on November 4 have completely removed any doubts about his extremely unpopular poll results.

These election losses have shaken congressional Republicans’ willingness to follow Trump’s lead.At the same time, the ongoing relationship between Trump and Jeffrey Epstein is disrupting MAGA’s base.

What many political analysts may not have fully appreciated is the shock to the vast majority of his supporters who believed Trump was protecting the world from Democratic pedophiles when they came to realize that they may have confused heroes with villains.

Is it far-fetched to correlate Trump’s political woes with cryptocurrency prices?Not so.As Josh Marshall often emphasizes – there is unity in power.A weakened Trump would be less effective in advancing efforts on all fronts, including efforts to boost the crypto industry.

I will delve deeper into the connection between politics and crypto in a follow-up article.At this moment I just want to reiterate:

Bitcoin has become the Trump trade, and its price decline is an indicator of Trump’s fading control over the Republican Party.