source:Buidlpad official, Compiled by: Shaw Bitcoin Vision

Community sales platform Buidlpad officially announced that the community sale of MMT tokens in partnership with Momentum Finance has been launched on Buidlpad.

Momentum is the leading centralized liquidity market maker (CLMM) DEX on Sui, providing liquidity providers (LPs) with high annualized returns (APR) and aiming to become the core liquidity engine of the Sui ecosystem.Momentum has a cumulative transaction volume of over US$18 billion and a total value locked (TVL) of US$550 million, making it one of the most adopted and advanced DeFi protocols in the Sui ecosystem.

The community issuance marks a new milestone in Momentum’s development history, allowing users to obtain its native token MMT before the Token Generation Event (TGE).All tokens purchased through Buidlpad issuance will be 100% unlocked at TGE.

In this article, users will learn all about Momentum, including details on its product ecosystem, HODL activities, and community issuance of MMT tokens.

About Momentum

Momentum is the leading CLMM DEX on Sui, providing liquidity providers with high capital efficiency and top annualized returns.Momentum adopts the ve(3,3) model at TGE and supports core products such as xSUI liquidity staking, MSafe fund pool infrastructure, and vaults for high-performance DeFi strategies.Momentum is also the preferred liquidity platform for most major token issuances on Sui.

The protocol benefits from Sui’s unique architecture, including Programmable Transaction Blocks (PTB), allowing users to bundle multi-step DeFi operations into a single transaction.This provides a seamless and low-cost experience for retail and institutional users.

Key Highlights

Momentum is considered the “Robinhood of cryptocurrency.”It is a next-generation DEX and modular DeFi platform based on the Sui blockchain and built using the Move language.It integrates multiple core products to create an integrated financial ecosystem.These products include:

-

Momentum DEX, a centralized liquidity AMM similar to Uniswap v3 but optimized for Sui

-

MSafe, a multi-signature treasury tool with attribution and dApp integration; xSUI, a liquid staking token for Sui

-

Token Generation Lab (TGL), a launch platform for high-quality projects; Vaults, providing automated revenue strategies

-

Momentum X, a compliance-focused real world asset (RWA) tokenization platform

Together, these components form an operating system for global finance in which cryptoassets and real-world assets can coexist in composable and compliant markets.

Innovation and Technology

Momentum DEX benefits from Sui’s Programmable Transaction Block (PTB), which makes complex DEX operations atomic and less expensive, without relying on cumbersome routing contracts.Traders can bundle multiple steps into one atomic operation.For example, exchange → increase liquidity → stake liquidity provider (LP) tokens → claim rewards, all operations can be completed with one click and one signature.Either the whole thing succeeds, or it all fails.

Since the batch processing functionality is built into the chain itself, users do not need to make additional approvals and calls.This can bring the following benefits:

-

Lower transaction fees

-

Token quotas bring less risk

-

Smoother and clearer user experience

Sui is object-centric and adopts a parallel execution mechanism to ensure that independent liquidity pools are updated at the same time, thereby preventing the activity of one pool from slowing down the speed of another pool.This architecture has the following advantages:

-

Higher system throughput

-

Faster transaction closing

-

Narrower MEV/sandwich attack window

This architecture allows Momentum to deliver capital efficiency, user-friendly design, and institutional-grade infrastructure, positioning itself as the liquidity engine driving the future of tokenized markets.

Momentum’s growth and ecosystem traction

Since launching in beta in March 2025, Momentum has:

-

Attracts over 2.1 million unique active users

-

TVL over $550 million

-

Cumulative transaction volume exceeds $18 billion

Momentum’s Bricks points program combined with a liquidity multiplier drove rapid inflow and user engagement of TVL ahead of TGE.It has become the main liquidity engine for Sui’s native applications, helping its sustainable application.Momentum integrates with Wormhole for cross-chain assets and partners with Sui wallets and data providers to quickly become the default hub for liquidity and distribution.

MMT Token Community Issuance Overview

The official will hold a Momentum community release event on Buidlpad, and eligible users can participate by completing the required steps within the specified period.All contributions are in units of 1 USD, and tokens will be fully unlocked at TGE.

Offer details

-

Total financing: $4,500,000

-

Accepted assets: BNB (BNB Chain), SUI (Sui Network)

-

Token Unlocked: TGE 100%

-

Subscription range: USD 50 – USD 2000 (up to USD 20,000 depending on level and qualifications)

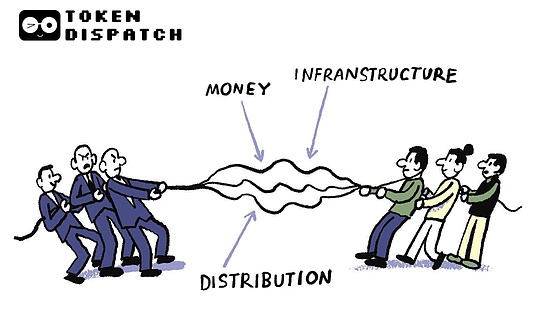

In order to simplify the process and ensure fairness, the offering adopts a two-tier valuation model.Which tier a user is in depends on betting on growth through HODL or participating in Momentum’s Wagmi1 and Wagmi2 activities.

Level 1 and Level 2 Pricing Models

Level 1 (FDV of $250 million):

Users qualify for Tier 1 if the following conditions are met:

-

Hold a position of at least $3,000 in Momentum LP via Buidlpad HODL

-

Participated in Momentum’s Wagmi 1 and Wagmi 2 campaigns.

-

Snapshot at 2:00 AM (UTC) on October 25, 2025.

Please bind the wallet used for staking to qualify.The contribution limit will increase with the size of the LP position.

If a user already holds $3,000 or more of active pledged assets on Momentum LP and wants to enjoy the benefits of this community product, he or she needs to unstake on Momentum first and then go to Buidlpad HODL to stake again.Please make sure to bind the wallet used on Momentum to your Buidlpad account before your subscription ends.

Users with a position of at least $3,000 in Momentum LP are not guaranteed to qualify, they must still pass the anti-Sibyl test.

Tier 2 (FDV of $350 million):

Open to all other eligible Buidlpad users who complete KYC and subscribe, but do not hold eligible liquidity pool positions.

Detailed explanation of MMT token sales process

The MMT token community sale will be launched in four phases, each designed to ensure security, fairness and broad participation.

Phase 1: KYC registration and subscription

From 10:00 am (UTC) on October 22, 2025 to 2:00 am (UTC) on October 25, 2025.All users must complete KYC verification and subscribe within this period to participate.No assets are required to be invested at this stage.Subscription only represents the willingness to participate.

If the user has previously completed KYC verification for Buidlpad sales, there is no need to repeat it.Just make sure to subscribe before the deadline.

Additionally, if users plan to qualify for Tier 1 valuations or use Buidlpad HODL to increase their contribution cap, please ensure that the qualifying wallet is bound to the Buidlpad account before the subscription ends.

The second stage: review period

Deadline is October 27, 2025 at 10:00 AM (UTC).Following the conclusion of the subscription period, Buidlpad will disqualify ineligible entrants, including those from restricted jurisdictions and those suspected of engaging in Sybil attacks, bot attacks or brushing activities.

The third stage: subscription period

October 27, 2025 10:00 AM (UTC) to October 28, 2025 10:00 AM (UTC).If the subscription is successful and KYC is verified, the user will see the eligibility status on the Momentum project page,

During these 24 hours you can:

-

Use BNB (BNB Chain) and SUI (Sui Network) to invest

-

Subscription for any amount between the minimum and maximum limits

Contributions must be in the form of the assets listed above and must be within the qualifying range of $50 to $2,000 for regular users, up to a maximum of $20,000 for Momentum stakers and Wagmi1 and Wagmi2 participants.

Capital contributions do not guarantee distribution.Eligibility still needs to be reviewed.Over-investment will be refunded after settlement.

Stage 4: Settlement and Refund

Completed at 10:00 AM (UTC) on October 31, 2025.

at this time:

-

The final allocated MMT will be displayed on the Momentum project page

-

If you oversubscribe or are disqualified, you will receive a refund in the same tokens used to subscribe

-

If the distribution is successful, the tokens will be fully claimable at TGE

After the settlement is completed, the official will notify through community channels and platforms.

Additional privileges for Wagmi1 and Wagmi2 participants

As a thank you for your ongoing support, Momentum will offer tier one pricing and higher contribution limits to participants of the Wagmi1 and Wagmi2 campaigns.These users do not need to stake to qualify, but must bind their Wagmi wallet to their Buidlpad account before the end of their subscription.Higher subscription limits range from $3,000 to $10,000 depending on the Wagmi level of the user.Eligibility is not guaranteed and all users need to pass review.

Earn rewards with Buidlpad HODL

This community offering is supported by the ongoing HODL campaign, a pre-TGE staking program run by Momentum in partnership with Buidlpad.The campaign has attracted over $280 million in incremental TVL through Buidlpad users alone.

Participants can stake supported Momentum LP trading pairs on Sui and stake via Buidlpad to earn high annualized returns as well as a 2x Bricks Points multiplier, valid until October 25th.

Supported fund pools include:

-

SUI-USDC

-

xSUI-SUI, suiUSDT-USDC, LBTC-wBTC, xBTC-wBTC

Rewards and APR are dependent on pool liquidity and trading activity.

Not only that, Buidlpad HODL staking users on Momentum will also receive Tier 1 FDV and higher subscription caps based on their Momentum LP positions.

Only stakings made via Buidlpad HODL during the event dates will be considered.

Please note:

If eligible, we will only allocate the highest available subscription cap.The subscription limit cannot be accumulated.

For example:

If there are two wallets staking on Momentum

-

Wallet A meets the $13,000 limit

-

Wallet B meets the $4,000 limit

Consider only Wallet A’s upper limit ($13,000).The two caps do not add together.

Up to 30% priority allocation reserved for Momentum community supporters and content creators

Officials have reserved up to 30% of the community issuance share of MMT tokens to provide distribution to loyal community contributors and original content creators to help spread Momentum’s mission and ecosystem.

To qualify for priority distribution, participate in team-based UGC activities:

-

Your content must focus on Momentum’s mission, growth, and its role in trading, staking, and yield optimization within the Sui ecosystem.Please tag @MMTFinance

-

Must tag @buidlpad as the official MMT community distribution platform

-

Post it as X topic, tweet, article or video

-

Show support by adding ” Ⓜ️Ⓜ️T ” to your X profile name

-

Content must be original and can be in the form of X posts, topics, videos or articles

-

We will detail additional rules and guidelines in a separate tweet shortly after this announcement

More rules and guidelines will be detailed in another tweet shortly after this announcement

Plagiarized, AI-generated or copied content will be disqualified.Momentum and Buidlpad reserve the right to determine eligibility in their sole discretion.

Submission method:

-

Upload content to buidlpad.com/projects/momentum starting at 10am UTC on October 15, 2025

-

Submit by 9:59 AM (UTC) on October 22, 2025

-

Use the same email and wallet address tied to your Buidlpad account

-

Link your X to your Buidlpad account (mandatory)

All entries will be reviewed.If your work is selected, you will receive priority allocation of $150 or more, which will not be diluted even if sales exceed your quota.

If a subscriber wishes to subscribe in excess of this guaranteed amount, any subscription in excess of its preferred allocation amount will be subject to standard dilution and distribution rules.All participants must still complete the KYC, subscription and subscription steps using the same verified account to claim their allocations.

Subscription fee structure

Final distribution amounts over $50 will be subject to a 3.5% subscription fee.This fee is used to support KYC, compliance and anti-Sybil measures.If your participation is unsuccessful, there is no fee to pay.