Tina, the founder of Flashbots, said on Twitter that the word MEV has been abused, and 99% of the discussion about MEV uses this term at will, either to describe problems that products can solve or to criticize Ethereum that they don’t like.The phenomenon ignores its formal definition.So should the definition of MEV cover potential extractable value or actual extracted value?Is all extraction behavior counted, or is it considered MEV only if harmful extractions are considered?

Views from all parties: The dispute over the definition of MEV

Time goes back to last week, Fastlane CEO Thognad posted his opinion on the definition of MEV on Twitter.He believesThe MEV problem cannot be solved at all, because as the research deepens, there will always be new ways of value extraction to be discovered and incorporated into the definition of MEV, which makes this definition continue to expand..This view sparked discussions in the community.

In this regard, Nathan Worsley, a consultant at Flashbots, said that the definition of MEV should be defined.Only before the block finally becomes a consensus part,The value that block proposers can observe and exploit.If the definition is too broad, it will lead to management complexity.However, Thognad felt that this limitation focused only on the role of block proposers in MEVs, ignoring other possible ways of value extraction.

Then, Ethereum researcher mteam joined the discussion, and he believed that MEV was any value that could be extracted from privileged locations within the system.Thognad further refined this definition: Any player who has a privileged position within the system and actively exploits system vulnerabilities or design flaws to obtain additional value that exceeds the passive player’s ability to obtain is considered a MEV.And a “zero MEV” baseline idea is proposed, that if a block builder only selects transactions from the public transaction pool in transaction fees and chronological order to build the block without performing any other operations, this should be viewedMake zero MEV.mteam responded that since blockchain is distributed, there are differences in network speed and connection quality, and the transaction order and content that different nodes may see are different, it is difficult to set a unified standard.He believes thatThe only useful definition is “harmful MEV”.

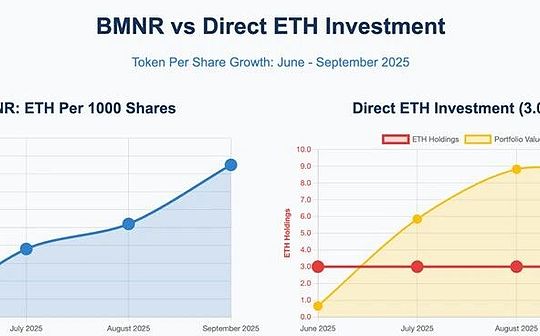

Tina forwarded the question mentioned by mteam in the discussion: whether MEV should be regarded as a value that can be theoretically extracted from a blockchain system, while REV (Realized Extractable Value) serves as a practical extracted value that is distinguished from the theoretical value.Tina notes that discussions about MEV on Twitter often ignore the formal definition of MEV and use the term more casually based on personal opinions and convenience, resulting in the market’s definition and understanding of MEVs becoming confusing.

Tina further mentioned that a GitHub issue discussion on MEV classification (closed in December 2021) may provide a systematic solution to clarify the definition and classification of MEVs.and consider whether this discussion should be reopened in order to better clarify the definition and classification of MEVs, thereby promoting a deeper understanding of MEVs.

Discussion on MEV classification

Although the above GitHub discussion failed to reach a final unified conclusion, it proposed multiple directions to improve the definition and classification of MEVs.It can be divided into the following key points:

-

How to clearly distinguish potential extractable value from actual extracted value:

-

Extractable Value: refers to all possible value opportunities that can be identified by analyzing transactions in the previous block under the current state of the blockchain.This includes transaction reordering, inserting, etc.In theoryThe greatest value that can be extracted.

-

Extracted Value: refers to a specific blockactualThe value extracted is the value obtained by the miner or other participants through actual operations (such as transaction reordering).This is an actual, quantifiable value.

-

How to distinguish between good and bad MEV:

-

For example, arbitrage operations may be considered “good MEV” by helping the market reach balance, while manipulating the order of transactions causes market slippage or unfair trading is considered “bad MEV”.This type of distinction helps identify the social impact of MEVs and proposes corresponding countermeasures for different types of MEVs.

-

Redefine the terminology:

-

Some participants proposed the introduction of new terms, such as the realized extracted value (REV), to clearly distinguish between the value that has been actually extracted from the theoretically extractable value.Dark MEV (Dark MEV) to describe those difficult-to-detect manipulations, such as those carried out through hidden market interventions.