Author: Austin Weiler, Messari research analyst; compiled by: 0xjs@Bitchain Vision

Polymarket is one of the darlings in cryptocurrency in 2024.It initially attracted attention with its unique value proposition, providing users with the ability to profit from various market forecasts – a product previously related to sports betting.This differentiator enables users to access and profit from forecasts in various markets such as entertainment, business and science.

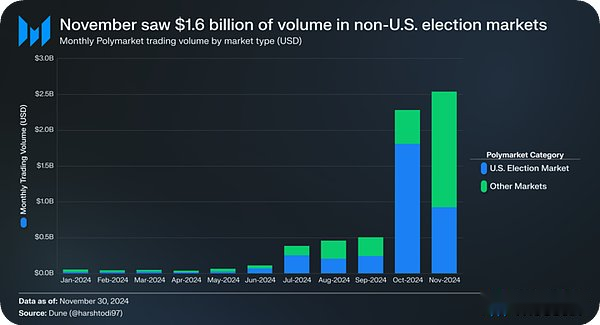

However, the U.S. election is a major event that everyone wants to predict and profit from.This is not limited to the results, but also the extent of victory in a particular state, whether Biden will be replaced, what Trump will say at the next rally, etc.The hype around the election helped Polymarket’s monthly trading volume soared 42 times between January and October 2024.

While this unprecedented growth is impressive, many believe that Polymarket’s success is election-driven and predicts that its usefulness will eventually decline after the election.Now, nearly a month later, market volume and unique user metrics on Polymarket show that it can and will remain practical for the long term.

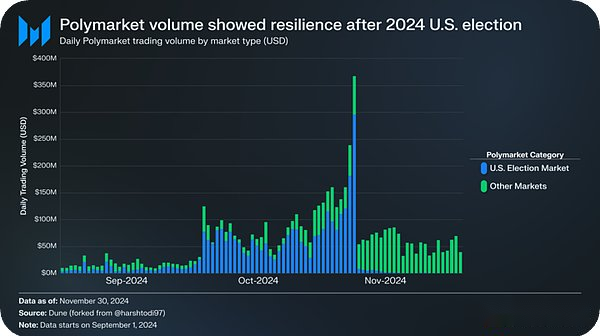

As expected, Polymarket gained significant momentum in the month before the election.During these 30 days (October 6-November 5), Polymarket’s daily trading volume hit an all-time high, with an average daily trading volume of $103 million.

As expected, Polymarket gained significant momentum in the month before the election.During these 30 days (October 6-November 5), Polymarket’s daily trading volume hit an all-time high, with an average daily trading volume of $103 million.

After the election, it is generally believed that trading volume will fall because retail investors focus mainly on markets related to the U.S. election.It is true, with the average daily trading volume from November 6 to November 30 falling to $58 million, down 44% from the peak of the 30-day rolling average.

Although this decline is huge, if we narrow the scope further, the result is not as big as it seems.The total trading volume in markets related to non-U.S. elections in November totaled $1.6 billion.

Although this decline is huge, if we narrow the scope further, the result is not as big as it seems.The total trading volume in markets related to non-U.S. elections in November totaled $1.6 billion.

This is higher than the volume in any single month from January to September 2024.While this short-term outlook does not guarantee survival, it is a positive preliminary indicator that Polymarket has sufficient product market fit to sustain future growth.

To maintain this momentum, Polymarket must continue to improve its products, especially without major predicted events like the U.S. election.In addition, the forecast market sector may attract more competition, including new entrants and existing players.To ensure sustainable growth, Polymarket should focus on:

-

Provide users with more features, including joint betting and cross-market joint betting (for example, combining political event prediction with sports events).

-

Emphasize unique features that distinguish them from competitors (Web2 and Web3), such as financialization of forecasts.

-

Explore other blockchain products outside of Polygon.

-

Continue to improve their user experience to reach a wider audience.

Polymarket’s journey is far from over, and despite the challenges ahead, there are signs that it is resilient and adaptable.