Author: Justin Baba, Messari Research Analyst; Compiled by: 0xjs@Bitchain Vision

The crypto industry has long been working hard to solve the problem of stablecoins, namely creating a decentralized, efficient capital and stable value stablecoin.

-

Centralized stablecoins such as USDT and USDC meet scalability requirements, but their dependence on centralized entities makes them vulnerable to government intervention.

-

On the other hand, decentralized stablecoins, especially collateralized debt positions (CDP) models like MakerDAO’s DAI, provide an alternative that is more resistant to censorship, but due to the excessive collateralization rate of these stablecoins (thisIt means that the collateral that supports stablecoins is valued higher than the value of the minted stablecoins), and therefore faces huge expansion challenges.This leads to inefficient capital use.

So with DYAD, a CDP stablecoin designed to solve capital efficiency issues while maintaining decentralization.

-

DYAD can mint stablecoins at a ratio of 1:1 to collateral.This is achieved through DYAD’s practical token KEROSENE.

-

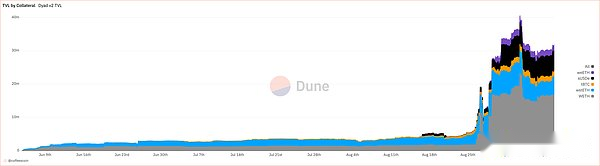

To cast DYAD, the user must first obtain a Note NFT.Note can be minted directly from the protocol or purchased on the secondary market, with gradually increasing costs.Once you obtain a Note, users can deposit various collateral types such as WETH, wstETH, tBTC, and sUSDe and mint DYAD based on that collateral.

-

Liquidation occurs when the collateral value is less than the required 150% collateral ratio (CR).In this case, other notes holders can liquidate their positions, receive collateral and a 20% bonus.

KEROSENE is a key element in unlocking the DYAD mechanism, enabling users to mint stablecoins at higher loan-value ratios.

-

KEROSENE tokenizes excess collateral deposited into the agreement, allowing users to take advantage of these previously unused collateral.But it should be noted that unlike Luna, KEROSENE will not add the protocol’s TVL.

-

Its value is deterministic and can be calculated by subtracting the value of the total supply of DYAD from the amount of exogenous collateral deposited and dividing that value by the total supply of the KEROSENE token.

-

Note holders can earn KEROSENE by providing liquidity to the DYAD-USDC liquidity pool.Additionally, users can increase their earnings through XP, which is earned by liquidity providers over time based on the amount of KEROSENE held in their notes.When the user removes KEROSENE from his Note, the Note’s XP balance will be reduced.

Source: @coffeexcoin’s Dune Dashboard

DYAD represents an attempt to redefine decentralized stablecoins by combining improved capital efficiency with flywheel token economics.If the protocol can continue to increase the DYAD supply and its TVL, then demand for KEROSENE will increase as users wish to acquire this additional capital.