First of all, let me state that I don’t understand contracts, only loans.This short article was written because I saw a causal chain written by a friend in the circle of friends. It was very well written, and I wrote it in response.I hope you will correct any mistakes or omissions.

usde will be launched on binance in September, and apy12% marketing activity will be launched from September 22nd to October 22nd. There are three ways to participate in this activity:

1. VIP loan, which can be revolving loan up to 3.5 times;

2. Easy deposits and loans, you can achieve 3.5 times the revolving loan;

3. For leverage trading, large investors can achieve 5 times leverage.

Let’s talk about this anchoring incident first, and the conclusion of the final impact of the three products:

1. VIP loan users, no disaster areas.The financial side is not affected.However, on the morning of the 11th, since Binance took over the mortgage assets, this part was valued at 0, but the liabilities were displayed, so the assets displayed by the app at that time = liabilities – spot, most of which were negative.According to feedback from group friends, some people panicked at this time and quickly closed their positions in various ways, resulting in some losses.

2. Easy deposits and loans, small disaster areas.Before Binance is compensated, the principal loss is within 10%, which varies according to different revolving loan multiples. The loss = USDE liquidation negative premium + liquidation fee.Note: The liquidation of Deposit and Loan is not a camel that aggravates the decline of usde, but occurs between 0.92-0.97 after usde rebounds (which can be directly calculated. Cross-verification evidence: If your deposit and loan have eth, btc, etc., you canThe liquidation price can be calculated between the forced liquidation list and the bounty compensation. Mine happens to be, eth liquidation price = 3933, and the liquidation time is in the range of 5:45-6:00, avoiding the 5:30-5:45 exhaustion period, and it is not the amount of energy to smash the market.

3. Leveraged trading, the hardest hit area.Margin trading is liquidated in real time, so the liquidation price ranges from 0.99 to 0.66, which is also the main battlefield for this unanchoring.Before Binance compensates, the losses are huge. If the cycle is more than 2.5 times, the entire principal will be lost. The simple liquidation fee for users with 5 times is 8% of the principal.

Fuse and startup (this part is pure speculation)

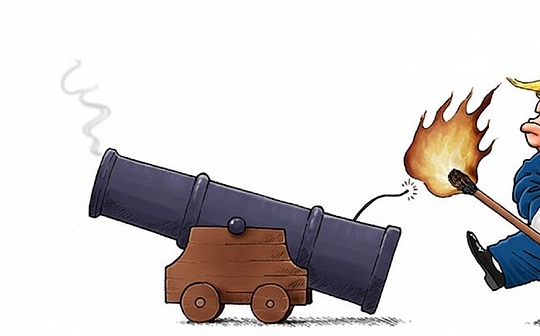

Trump made negative remarks on China’s tariffs and other negative remarks, and billions of dollars were sold on Hype, causing BTC and eth to plummet…

Note, here comes the ignited lead to the leveraged trading product.Let me talk about a premise first. I suspect that some whale users put a lot of BTC and ETH into leveraged trading products, borrowing USDT, and then the leverage cycle of USDE-USDT, or the unified account sharing margin, the liquidation of the contract, triggering the liquidation of massive USDE-USDT in margin trading.

No matter what, the fact is that at this time, the plummeting of Bitcoin and Eth triggered the liquidation of his (it may be multiple people or one person) positions. The liquidation engine continued to throw out his USDE to pay off the USDT liability, and the downward spiralThe vortex started and hit the 0.91 mark, and then the 0.82-0.8 mark. The 0.82 mark is the liquidation price of the five-fold cycle. A large number of giant whales accumulated here. In an instant, the mark exploded, burst the embankment, and the torrent poured down to 0.66.

Responsibility and identification (some are guesswork)

usde has a real-time mint-redeem mechanism. The price of usde on the chain is relatively normal. The redeem cost of the arbitrage bot is 0.1%. Any price difference greater than 0.1% will automatically trigger the start of arbitrage operations.Bybit’s selling pressure to 0.92 was due to the fact that after Binance’s eth withdrawals were blocked, smart arbitrageurs turned usde to bybit through the bsc chain to sell. However, there was a mint-redeem mechanism in the bybit site, which triggered the arbitrage of this part of the bot, thereby inhibiting the price from falling from 0.92.

[Afterwards, a certain team had already written this part of the arbitrage path and bot. At that time, they planned an alternative to USDE relocation after Binance’s eth withdrawal may be blocked. It is completely possible to use the BSC chain to use Bybit’s in-site mint-redeem mechanism for relocation arbitrage, thereby suppressing the decline of Binance’s USDE. Unfortunately, their team was sleeping at that time, and it was all their lives.]

Why is Binance’s eth withdrawal blocked? If you have any impression, Binance once paid a handling fee of 500 eth to organize the wallet. At that time, it was ridiculed by the entire network.I guess after that incident, Binance’s hot wallet withdrawal mechanism set a limit, that is, when the gas of the eth chain exceeds a certain amount, withdrawals will be stopped. This is reasonable from the perspective of the exchange, because if there is no limit, each transaction will cost several hundred U. To be honest, hundreds of millions of dollars in gas may be lost in a day.But this time…This mechanism inadvertently locked up the lifeline of usde. That is, after 5:36 minutes, usde in binance could not be mentioned on the chain for mint and redeem. Even if these arbitrage bots switched to bybit for arbitrage for a short time, they were locked by the upper limit of bybit’s withdrawal amount, so the audience could only watch usde fall to 0.66.

Because of this, in Binance’s reward announcement, the time is determined: those affected by decoupling between 05:36 and 06:16 on October 11, 2025 (East Eighth District time) will be compensated for the difference and liquidation fees.That is to say, Binance believes that before 5:36 and after 6:16, Binance’s withdrawals were normal and everything was market behavior.

Follow-up and improvements

The oracle parameters of usde set the minimum price. Currently, Binance has not announced it. My suggestion is to set a dual track. First, the starting point is 0.85, that is, the high wall of the five-time revolving loan cannot be easily broken (note that I have never recommended leverage trading for revolving loans, and there are pictures below to prove it); second, it can be evaluated based on the specific situation of Ethena’s assets-positions-liabilities, and updated at any time;

Binance has launched an in-site mint-redeem mechanism, and the arbitrage bot can effectively suppress price declines.Here is an extension to answer a question: why can it be suppressed after the site goes online? When the gas of the eth chain is high, will it be blocked differently?To be honest, this is the core question for future improvement. In fact, whoever can answer this question here does not need to look at my answer later, which means that you have graduated in the field of lending.

I thought the same way at first, and even suggested that Binance directly ask Ethena to open another channel, that is, Ethena’s funds are stored in Binance’s ceffu, that is, there is a mechanism to switch to the Ceffu-ethena account to call funds for mint and redeem in an emergency.The current mint-redeem is carried out on the chain. When the reserve pool is empty, funds are automatically transferred from CEFFU to the reserve pool. This was no problem before, but now the amount on Binance is indeed too large. When the chain is blocked, firstly, the arbitrage parties cannot circulate, and secondly, Binance’s hot wallet cannot provide hundreds of U of gas for each transaction.

However, after another in-depth communication with Binance and Ethena, we got an answer: 10m can be redeemed every 12 seconds (that is, one Ethereum block).We can adjust the upper limit of this amount on our side through multi-sig, so we can process up to 200m.Currently mint can only be minted and redeemed through smart contracts.Gas fees do not affect speed.We estimate and pay enough gas to ensure the transaction is completed within a block, as we always prefer minting/redemption to be confirmed smoothly.This cost will be passed on to users.

This is feasible, that is, when usde’s redeem product is on the binance site, the redemption fee + gas fee is automatically calculated, and the user can pay it if he or she is willing, that is, bypassing the high gas limit of binance’s hot wallet!

last words

1. As a heavy on-chain and off-chain lending user, 10.11 was the most unusual day I experienced.In fact, it was the most stressful time for me to work in the community. There was a lot of money involved. Even though I called on everyone to use VIP loans, there were always group members who used leverage trading (severely affected areas) and deposit and easy loans (slightly affected areas) due to position management and other factors. Yesterday, I coordinated and communicated with all parties to determine. Fortunately, the overall situation of BN was solved.Outside of professionalism, stay humble and have more empathy and compassion.

2. At the same time, the perspectives of loan users and contract users are different. After a difficult day, as a loan user, I received almost full compensation on the 12th, so I expressed some gratitude.Judging from the comments in the previous posts, it probably gave contract users a bad impression. This was not the original intention. I hope Haihan and your rights will be protected as soon as possible.

3. Wisdom without great enlightenment is just a long-term illness, it is all experience, it is all experience, learn to use it, and you will be better next time…It’s all wealth.And I, having been ill for a long time, became a doctor, so I hung up my pot to help the world…

4. Life requires a blunt sense, and arbitrage is probably the same. I work hard on optimization in front of the computer every day. I felt a little enlightened on 10.11. Maybe in the future, I need to discover more about the beauty of life and climb more mountains instead of web3.