Author: Prathik Desai, Source: Token Dispatch, Compiled by: Shaw Bitchain Vision

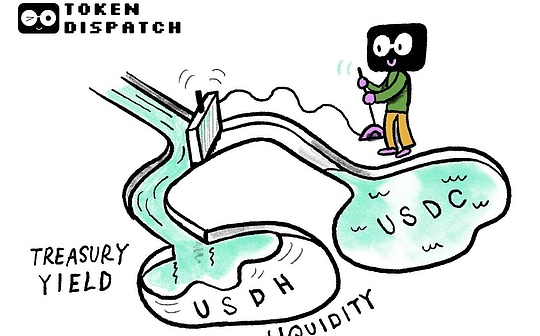

Hyperliquid processes $375 billion in transaction volume per month.On September 5, it decided to launch its own stablecoin and issued an announcement on Discord.In this way, USDH was born.

The Hyperliquid Foundation will not develop itself, but will build it together with the community.Each team will compete for issuance opportunities.

Stablecoins are the largest asset in the field of decentralized finance (DeFi), and their importance is self-evident.Whoever controls the stablecoins will control the channels for capital flow, the income from billions of deposits, and the track of compliance.

Why launch your own stablecoin?

Currently, Circle’s USDC supports more than 93% of stablecoin liquidity on Hyperliquid, with a market cap of approximately $5.54 billion.These balances generate revenue for Circle through Treasury and repurchase agreements, with revenue totaling US$1.7 billion in 2024, accounting for about 99% of its total revenue.

Every time you trade on Hyperliquid, the exchange charges a transaction fee, but all the USDC earnings you deposit will go to Circle.

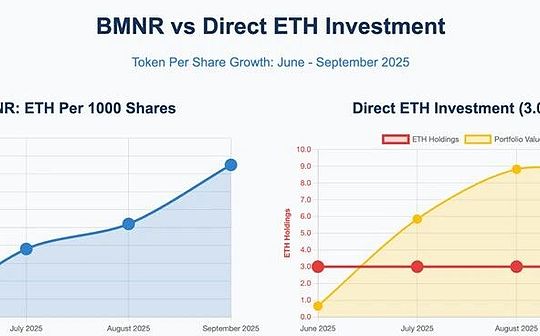

The 10-year Treasury yield is 4.051%, which means millions of dollars in loss of earnings.

It is roughly estimated that transferring this liquidity to native stablecoins can bring about $220 million in revenue each year.Currently, the money benefits Circle shareholders, not Hyperliquid token holders.For a protocol that is always committed to self-sufficiency, this loss of value has become unnecessarily unabashed.

Rather than taking a direct approach to addressing this vulnerability, Hyperliquid turned to the community.

Instead of quietly signing an agreement with a certain issuer, it established a process similar to a public auction.Any team can submit a proposal and validators on the network will vote for the scheme they tend toward.Even so, the selected issuer must win the Gas auction to deploy the contract on-chain.

Hyperliquid reduces the handling fees of spot stablecoin trading pairs by 80%, attracting traders to the USDH-operated market.In addition, it has lifted the licensing restrictions on quoting assets, which means that any stablecoin can compete, but its supporters must pledge and bear the risk of a substantial cut in the event of anchoring failure.

For exchanges known for their decentralized spirit, Hyperliquid strives to make the entire process look democratic.

Melee

On the day the proposals began to be submitted one after another, I browsed Hyperliquid’s Discord channel.In less than an hour, a group called Native Markets released a plan.Some people think it’s too fast, as if they’ve known this request long ago.

Native Markets’ publicity focuses on complying with the stablecoin GENIUS Act and promises to split reserve earnings: half is used to buy back Hyperliquid’s HYPE tokens and the other half is used to fund promotions.

They proposed a reserve custody by BlackRock and a coin infrastructure provided by Stripe’s Bridge.The rapid submission of the proposal made it popular in terms of early responses, but it also became the first target to be questioned.

Soon after, Paxos joined the competition.

Paxos has a prominent reputation in the stablecoin industry, so there is no need to repeat it.It has issued PYUSD for PayPal and issued USDP under New York regulation.Paxos’ strategy is simple: support USDH with cash and US Treasury bonds and use 95% of the proceeds to HYPE buybacks.The subtext is obvious to the community: if Hyperliquid needs regulatory support, Paxos is the partner they need.

DeFi native project Frax has adopted a community-first approach: minting USDH based on its frxUSD reserves, allowing users to redeem across chains and returning 100% of the proceeds to the ecosystem, whether through HYPE rewards, rebates, or direct payments.

Agora, backed by VanEck, proposed giving every penny of net income to Hyperliquid, a promise so generous that people can’t help but wonder what their motivations are.

Sky, the team behind DAI’s rebranding, later joined in with $8 billion in balance sheet strength and promised to bring USDH yields to 4.85%, higher than U.S. Treasury bonds (4.051%) by integrating it into its own system.

Ethena has also joined in, the synthetic stablecoin company has established partnerships with BlackRock, Anchorage Digital and Securities.

The bidder lineup is varied, and everyone has come up with unique solutions to help Hyperliquid plug huge loopholes and control its liquidity.

If Paxos is the regulated representative, then Frax is the community’s bet.Native offers self-developed solutions, while Ethena brings innovations that drive it to become the fastest-growing stablecoin.

Not everyone is satisfied with the process.

A developer once created a stablecoin called “Hyperstable”. He mentioned that he had applied for the code “USDH”, but was rejected by the foundation.So he chose “USH” and worked around it.Seeing this code suddenly enabled by the official project, it felt like it was betrayed.

“…The game started a few months ago, but now the goal post has shifted…” he wrote.

The developer’s dissatisfaction reflects a broader level of uneasiness in my opinion.If governance can be so arbitrary, smaller developers may hesitate and are reluctant to invest.

Others on Discord questioned the timing of the Native Markets proposal, calling it evidence of insider advantages.Meanwhile, Jan van Eck, a company that supports Agora, insists on X that they are focused on long-term development and expressed dissatisfaction with the so-called “strike up in groups.”

Economic logic of proposals

However, the economic logic of the stablecoin proposal cannot be ignored.If Hyperliquid successfully migrates most of its USDC balance to USDH, the resulting revenue stream may be comparable to the annual earnings of many mid-sized exchanges.For HYPE holders, this could create a new form of earnings, distributed through repurchases or rewards, depending on which issuer wins.

For Circle, this means it loses more than 10% of its revenue.

Stablecoins have long been advertised as neutral utility, but the incident reveals that they are actually competitive profit centers.This battle is no longer just a battle between Tether and USDC, and DeFi platforms are now beginning to reflect on why they shouldn’t leave their benefits to themselves.

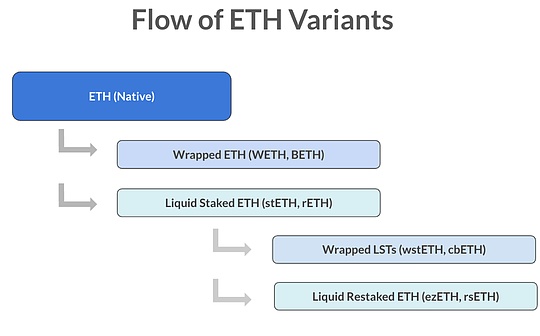

This is also related to a broader trend I have been observing.

Stripe’s Bridge positiones itself as the infrastructure for any issuer who wants to launch a compliant stablecoin, and already supports mUSD in the MetaMask program.PayPal launched PYUSD last year.Now, even wallet and payment companies are pursuing their own brand USD.They are all pursuing the same goal: to control internal liquidity and the benefits it brings.

Hyperliquid is not an alien trying to find another way.It is following the paths many other companies have taken, realizing that to control the user experience, it is necessary to control the flow of funds therein.

The regulatory impact is quite large.

The Crypto Asset Market Regulation (MiCA) in Europe is now in effect and anyone who issues electronic currency tokens will need to obtain a license and undergo strict reserve management.In the United States, the GENIUS Act would prohibit the payment of income directly to holders, forcing people to adopt innovative solutions such as buybacks or validator allocations.

Paxos and Agora have their own hosting agencies and licenses representing one end; while Frax and Sky are more experimental and representing the other.Validator votes will essentially indicate how much risk the Hyperliquid community is willing to take in regulatory terms.

I no longer think this is just a competition to issue stablecoins, but a referendum on how DeFi can mature in the future.

In addition to the incremental revenue that USDH can generate, ongoing community activities show how communities negotiate fairness, transparency, and consistency when rewards are control over their own currency.

If Hyperliquid can successfully launch a project that meets regulatory requirements, maintains user confidence, rewards token holders, and does not alienate builders, it will set a precedent for other projects.

However, the cost of failure is huge.Once a mistake occurs, it will confirm the view of all skeptics: when the risk is too high, decentralized governance will shake.

Currently, USDH is still waiting.The proposal is online and validators are considering it, and discussions on Discord continue as more bidders join the competition.

If USDH can be established, it would be a strong proof enough to show that the agreement can ultimately capture the value that has been slipping through its fingers.