Source: Bitcoin Fortress, compiled by Shaw bitchain vision

introduce

Whenever Tuur Demeester publishes a new research paper, the Bitcoin world pays attention.His records since his early report at Adamant Research in 2012 and his influential Bitcoin Reformation in 2019 have always highlighted major turning points in the development of Bitcoin.

In “How to Layout the Bitcoin Boom (2025 Edition)” written in collaboration with Unchained, Demeester noted,Bitcoin is in a historic bull market and there is still huge room for growth in the future.The report is backed by compelling data, unique charts and keen macroeconomic analysis, and boldly predicts that the price of Bitcoin will reach more than $500,000 per coin in this cycle.However, it not only provides price forecasts, but also provides investors with a practical framework for asset allocation, asset custody, and long-term strategies.

1. Strong in the middle of the cycle, not fanatic

A key topic of the report is that Bitcoin has not yet reached the peak of the cycle.On the contrary, on-chain indicators indicate that they are in the mid-cycle stage, when optimism is widespread, but far from reaching the level of fanaticism.

-

Changes in net holdings of HODLandNet Unrealized Profit Margin (NUPL)Both show that investors are firm in holding positions and do not show excessive greed.

-

Even major shocks like Mt. Gox’s compensation in July 2025 and the clearing of 80,000 Bitcoins have almost no impact on the market.

This shows that the hype phase—i.e., “scenic tourists’ funds”—has not yet arrived.

2. Bullish target price: $500,000 and above

Demeester predicts that this cycle will have a 4 to 10-fold upside, meaning that the price of Bitcoin will be expected to reach more than $500,000 during this cycle.

-

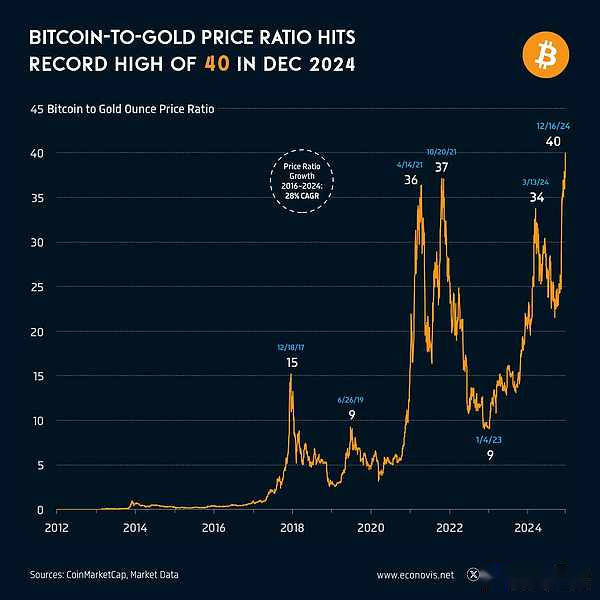

The transaction price of Bitcoin is36-40 oz golden range(about 1 kg).

-

Breakthrough of this resistance may push Bitcoin price to the equivalent353 ozThe value of gold (about 10 kg) is calculated at the current price of gold, i.e. each BitcoinNearly $1 million.

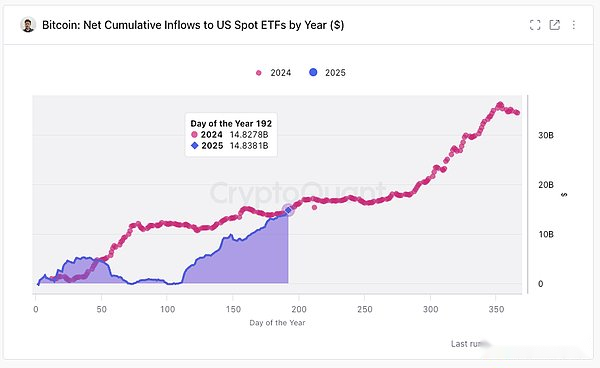

3. ETF funds flow: institutional funds are in full swing

The launch of the spot Bitcoin Exchange Trading Fund (ETF) is a watershed moment, directly introducing institutional funds into Bitcoin.

-

ETF currently holds a contract1.4 million Bitcoins.

-

Inflows per day in 2025 exceed$194 million, among which BlackRock, Fidelity and Ark contributed the most.

-

The net inflow of funds per week has exceeded$2 billion, confirming that Bitcoin has become an institutional-level asset.

This creates a stable demand basis that did not exist in previous cycles.

4. Macro Wind: Why the World Needs Bitcoin

The rise of Bitcoin is due to the global economic situation:

-

Continuous inflation: The government depreciates its currency at a rate of 10-15% every year.

-

Financial vulnerability: Unsustainable deficits and debt crisis have undermined people’s confidence in fiat currency.

-

Fund rotation: Funds are withdrawing from bonds and real estate sectors toward highly liquid and scarce Bitcoin.

-

Sovereign Signal: The U.S. National Strategic Bitcoin Reserve and the GENIUS Act mark Bitcoin’s entry into the policy circle.

Bitcoin is not only seen as an investment, it is also increasingly regarded as a currency lifeboat.

5. Bitcoin is better than altcoins

Demeester’s position is to firmly support only Bitcoin:

-

Bitcoin has unparalleledCurrency robustness, cybersecurity and institutional trust.

-

The altcoins are “poor quality”, speculative, and ultimately just interfering factors.

-

Bitcoin should be consideredThe basic layer of currency Internet.

6. Allocation and Hosting Guide

Practical advice for this report:

-

Hold 5% BTC= Systematic insurance.

-

Hold 10–20% BTC= Extreme confidence.

-

Hold 20–50% BTC= A bet for high confidence, early retirement.

About Hosting: Demeester emphasizes that multi-signature collaboration setup is the ideal balance between sovereignty and security, especially for new investors.

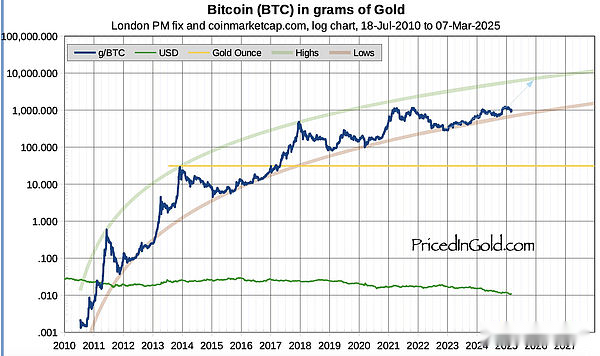

7. Gold to Bitcoin Ratio: Intuitive Reference

The gold to Bitcoin ratio provides a powerful perspective for understanding how Bitcoin is moving.

-

At its peak, a bitcoin is equivalent to about 41 ounces of gold.

-

In 2025, Bitcoin’s return rate is slightly lower than gold—Bitcoin’s return rate is about 22-32%, while gold returns are 28-29%.

-

If the price comparison between Bitcoin and gold can be broken1 kg/piece, will mark the complete monetization of Bitcoin, when its price is expected to break through$945,000.

Conclusion: A critical moment of growth

Tuur Demeester’s 2025 report is both a roadmap and a rallying call.His core proposition is:

-

We’re atThe mid-term of the cycle, not the peak.

-

passInstitutional funds introduced by ETFsWill change the game.

-

Macro ConditionsThe global monetization process of Bitcoin is accelerating.

-

Gold to Bitcoin RatioIt shows that Bitcoin’s reaching over $500,000 is not a speculation, but a practical prospect.