Recently, the Hong Kong Securities Regulatory Commission (SFC) once again revealed a group of suspicious virtual asset trading platforms and warned the public.This conveys a clear signal to the market: the Hong Kong government is paying close attention to the latest developments in the cryptocurrency field, strictly cracking down on illegal financial activities to ensure the fairness and transparency of the market.

Since 2021, SFC has disclosed a total of 39 suspicious platforms related to the encryption market, and the exchanges MEXC and Bybit have also been listed.What is a suspicious virtual asset trading platform defined by the Hong Kong Securities Regulatory Commission, and why are these platforms warned?

What is “suspicious” virtual asset trading platform?

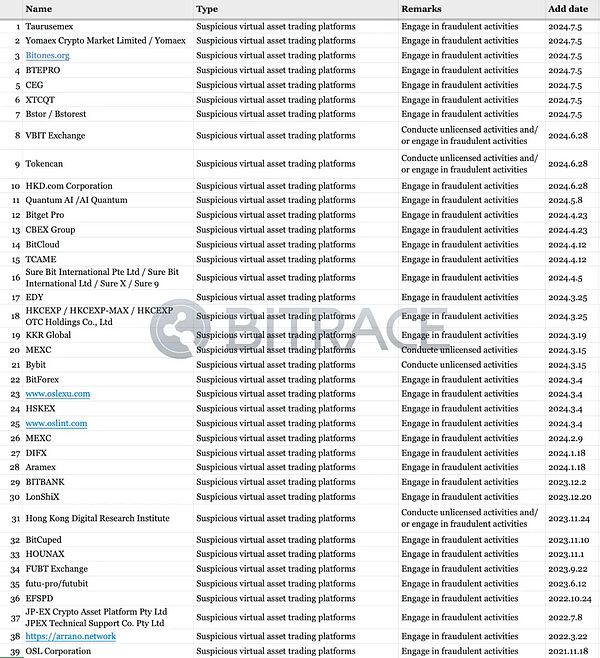

Bitrace divides SFC’s suspicious platforms into three categories: a platform established to carry out fraud activities, a platform with real business but some business involves fraud, and a platform with real business without licenses.

>

This table is organized according to the warning list disclosed by SFC

1. The platform established to carry out fraud activities

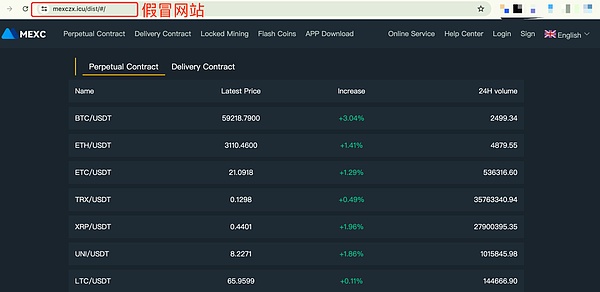

Such platforms were warned by the Hong Kong Securities Regulatory Commission because of the official exchanges and fabricated information on the official exchanges and fabricated the information of false enterprises.Taking the platform of counterfeit MEXC as an example, the website claims that it is a virtual asset trading platform entity and is suspected of running a counterfeit website as shown in the figure to engage in fraud.The victim was required to deposit funds to the designated bank account for investment purposes, but encountered difficulties when withdrawing funds.

>

The counterfeit MEXC website on the SFC website

In the past, such websites have frequently appeared frequently in financial management fraud in investment and financial management with “foreign exchange investment” and “cryptocurrency quantitative investment”.loss.

2. There is a platform for real business but some businesses involve fraud

The typical representative of such platforms is JPEX.The Hong Kong Securities Regulatory Commission pointed out last year that the cryptocurrency trading platform JPEX claimed that it had obtained an investment from a Hong Kong listed company and claimed that it had obtained a license to operate a virtual asset trading platform and was suspected of false publicity.The next day, JPEX restricted the user’s withdrawal with a high handling fee.In addition, the exchange provides extremely high returns for some of its products, but some investors complain that they fail to successfully extract virtual assets or account balances, and eventually quickly thunder.

>

Such institutions are often not only used to perform fraud activities, and they usually have normal main business, but in the process of some business activities, intentionally or unintentionally violates the bottom line of law.

3. There is a platform that has not obtained a license for real business

According to information disclosed on the official website of SFC, the official exchanges MEXC and Bybit launched business with Hong Kong investors as the sales target without obtaining any licenses of the Hong Kong Securities Regulatory Commission.20, 21).

Although this does not mean that the business activities of related trading platforms in other regions are not compliant, it still causes negative damage to relevant brands in public opinion. It can be seen that compliance is the operating cornerstone of the centralized trading platform.

Is Hong Kong’s regulatory policy effective?

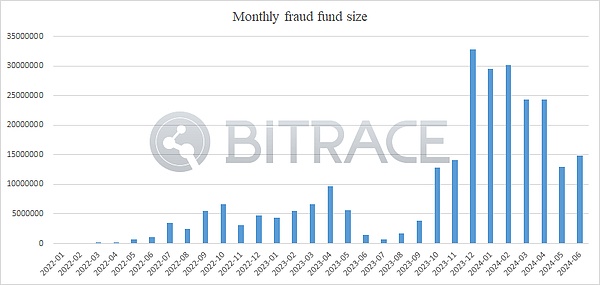

Bitrace has been paying attention to the market format of Hong Kong’s virtual asset trading market for a long time. According to the fund risk audit of the local VAOTC group business address, the size associated with the fraud funds (USDT) associated with fraud funds (USDT) associated with fraudulent activities in the Hong Kong cryptocurrency market through overseas transaction channels has already beenAfter the first quarter of 2024, it decreased significantly, and the current monthly capital scale was halved by half compared to the high.

>

The reason may be that on February 8, 2024, the Hong Kong government intends to set up a virtual currency off -site trading platform (VAOTC) license system, requiring all VAOTC to apply for licenses from the customs, which has led to squeeze out some risk funds.The intervention of local supervision has promoted the maturity of the cryptocurrency market in Hong Kong.

At the end

The Hong Kong Securities Regulatory Commission is gradually building a compliant cryptocurrency supervision environment to provide investors with security guarantees and promote the industry to develop in a more mature and standardized direction.For local operators who are interested in compliance, this will also be a good time to build brand trust and business security.