Author: Grayscale Research; Compiled by: Bitchain Vision

Key points of this article:

* Solana is a smart contract platform blockchain known for the depth and diversity of on-chain activity.It currently leads in terms of users, transaction volume, and transaction fees—arguably the three most important metrics for measuring blockchain activity.

* As a fast and low-cost blockchain for everyone, it hosts many industry-leading applications, covering decentralized finance, consumer/social applications, and physical infrastructure projects.We believe Solana offers one of the best new user experiences in cryptocurrency thanks to its efficient design.

* The SOL token is currently valued at approximately $119 billion, making it the fifth largest crypto asset by market capitalization (excluding stablecoins) and the third most liquid crypto asset.Since 2023, SOL has significantly outperformed other similar assets, with holders earning a nominal return of approximately 7% through staking.

* Grayscale Research believes that Solana’s diverse on-chain economy lays a solid foundation for SOL’s valuation and creates the necessary conditions for future growth.

From a purely technical perspective, Solana is a decentralized computer network that processes transactions and records them sequentially into the blockchain.But that description is like saying Manhattan is an island with roads and buildings.Solana is a vibrant community and on-chain economy: an invisible metropolis of millions of users, conducting thousands of transactions per second and interacting with a huge variety of applications.Solana is a financial marketplace for cryptocurrencies.

The SOL token is a digital commodity that facilitates network operations and provides an investment avenue for the growth of the Solana ecosystem (Figure 1).Currently, SOL is the fifth largest crypto asset by market capitalization (excluding stablecoins) and the third most liquid asset by average daily trading volume.

Figure 1: SOL is the fifth largest cryptoasset by market capitalization

Suitable for everyone

Solana, along with Ethereum, BNB Chain, Tron, Cardano, Sui and other networks, belongs to the smart contract platform cryptocurrency segment (Figure 2).Within this group, Solana stands out for the depth and diversity of its on-chain activities.Today, it leads in terms of users, transaction volume, and transaction fees.Blockchain is a network technology, which means, generally speaking, bigger is better: more users and more economic activity generally equates to higher network value.These are not the only important considerations, but it is on these core blockchain fundamentals that Solana stands out among its peers.

Figure 2: Solana is the leader in on-chain activities

Smart contract blockchains are networks that host applications, and Solana hosts a number of industry-leading applications covering an impressive range of capabilities.These applications include:

1. Raydium is a decentralized exchange (DEX) and a core component of Solana’s decentralized finance (DeFi) infrastructure.Year-to-date, Solana DEX has surpassed $1.2 trillion in trading volume, more than any other blockchain ecosystem.Jupiter, Solana’s leading DEX aggregator, is also the cryptocurrency industry’s largest aggregator by trading volume.

2. Pump.fun, a memecoin launch platform and social application.Pump.fun has about 2 million monthly active users and generates about $1.2 million in daily revenue.

3. Helium is a decentralized physical infrastructure (DePIN) project focusing on mobile hotspots.Helium allows users to contribute network capacity to build a nationwide network of mobile access points.These services are often cheaper than centralized alternatives, and Helium currently has 1.5 million daily active users, 112,000 hotspots, and partnerships with major telcos such as AT&T and Telefonica.

These examples represent just a few of Solana’s more than 500 unique applications.As a general-purpose blockchain with nearly all the features of other major networks, Solana ranks third in non-fungible token (NFT) transactions, fifth in stablecoin transaction volume, and seventh in tokenized assets.Other recent use cases that have gained trade include the trading of collectible Pokémon cards and the on-chain issuance of tokenized shares.

Measuring the Solana ecosystem should consider the transaction activity of both the blockchain itself and the applications it hosts.Despite changes over time, the Solana ecosystem generates approximately $425 million in monthly fees and more than $5 billion in annualized revenue (Figure 3).We believe that fees are the most direct indicator of overall demand for a blockchain and its applications, and the data shows that demand for Solana is huge.

Figure 3: The Solana ecosystem now generates significant fees

go your own way

Solana stands out in a crowded market by offering fast, cheap transactions, a compelling new user experience, and (in our opinion) going its own way.

The network generates new blocks every 400 milliseconds, and transactions are finalized in approximately 12-13 seconds.In addition to high throughput, transaction costs have also remained relatively low: so far this year, users have paid an average of just $0.02 in transaction fees.Solana uses a technology called local fee markets, which limits fee competition to specific popular apps.Partly due to this feature, the median daily transaction fee this year is just $0.001 (or one-tenth of a cent).Solana’s speed and cost-effectiveness compare favorably with other smart contract platforms, although some are even faster and cheaper, including Sui (Figure 4).Alpenglow, the upcoming Solana upgrade, is expected to reduce final confirmation times to 100-150 milliseconds.

Figure 4: Solana offers relatively fast and cheap transactions

Solana has arguably one of the best new user experiences in cryptocurrency.This is partly due to its speed, low transaction costs, and rich applications.Additionally, Solana’s “monolithic” rather than layered design (avoiding the need to bridge assets between network components), and superior wallet infrastructure led by Phantom.Solana has also experienced fewer network outages in recent years—a critical feature for every user.

Additionally, Solana pursues a unique growth strategy, which may help create competitive barriers over time.Smart contract blockchains can be thought of as software-based computers, and today the dominant architecture for these “computers” is the Ethereum Virtual Machine (EVM)—the system used by Ethereum and many other smart contract platforms, including BNB Chain, Polygon, and Avalanche.EVM-based applications can be easily ported from one EVM chain to another.In contrast, Solana uses a unique architecture called the Solana Virtual Machine (SVM).SVM-based applications cannot be easily transferred to non-SVM blockchains, which may lead to sticky demand.

Today, there are over 1,000 full-time developers working on Solana and SVM-based applications, and over the past two years, the number of developers focusing on Solana has grown faster than any other smart contract platform (Figure 5).Over time, this human capital can contribute to Solana’s continued innovation.

Figure 5: Solana has the second largest developer ecosystem after Ethereum

What can’t kill you…

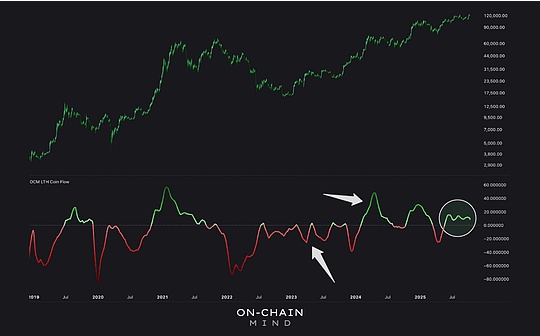

During the last cryptocurrency cycle, the price of the SOL token fell from a peak of nearly $260 in November 2021 to just $2 in December 2022.For a time, Solana was associated with failed cryptocurrency exchange FTX, which funded Solana and contributed some development resources.Perhaps unsurprisingly, many casual observers were uncertain about Solana’s future following FTX’s bankruptcy, even though a large number of SVM developers remained at the time.However, beginning in late 2023, the SOL token began to recover.Since then, it has significantly outperformed the FTSE/Grayscale Smart Contract Platform Cryptocurrency Industry Index (Figure 6).

Figure 6: SOL outperforms peers since 2023

Currently, the supply of SOL tokens is growing at about 4% to 4.5% per year.All else being equal, this could be seen as a cause of dilution for token holders.However, depending on network conditions, SOL stakers can earn a nominal return of approximately 7%.Therefore, the “real” (inflation-adjusted) return earned by SOL stakers is approximately 2.5% to 3% (Figure 7).Currently, approximately two-thirds of outstanding SOL tokens are staked.

Figure 7: SOL stakers can earn a nominal return of approximately 7%

Smart contract platform tokens like SOL are digital commodities that provide utility within their network and may earn additional financial rewards (e.g., staking rewards).Their value is related to the size of the network.Like other smart contract platform tokens, the investment thesis for the SOL token focuses on the potential growth in the size of the Solana network.Like any other asset, prices don’t always change as fundamentals change.However, we believe that if the Solana network grows over time—if it has more users, processes more transactions, and earns more fees—investors can expect the SOL price to rise.

Competitive dynamics

Solana does a great job of realizing its vision, which we interpret as a fast, cheap blockchain open to everyone.However, its specific design choices leave room for competitors to capture or retain market share in certain use cases.

For example, other blockchains sometimes offer faster and/or cheaper transactions by operating a more centralized network (e.g., using only a small number of active network nodes).Even though centralization may bring risks, users may favor this convenience.Other blockchains may compete with Solana by keeping their networks permissioned (i.e. only allowing approved users and/or approved activities).This may have advantages in some situations.Because Solana is a permissionless network—all are welcome to join—it is as much a hub for high-tech startups as it is for speculative retail trading.

On the other hand, the SOL token may be less suitable as a long-term “store of value” monetary asset than Bitcoin or Ethereum.This partly reflects SOL’s higher nominal supply inflation: scarcity is a key characteristic of any long-term store of value.But a more important factor may be the network’s ability to withstand third-party interference.For digital assets to serve as long-term stores of value, users need to have confidence that they will be able to trade them in almost all future scenarios.One way to support this outcome is to keep node requirements low so that the network remains highly decentralized and easily replicable.Solana’s efficiency comes at the expense of relatively high hardware and bandwidth requirements, so many network nodes are run in data centers.Theoretically, over time this could become a source of centralization and serve as a vector for third parties to interfere with the network.

That being said, these are complex and unresolved questions, and investors’ views on how cryptoassets can serve as long-term stores of value may change over time.

in conclusion

Blockchains are not businesses, and blockchain tokens are not stocks—they are digital commodities with practical value in a decentralized network environment.Nonetheless, we can still analyze the fundamentals of blockchain and make token investments based on them.We believe that the three most important metrics for measuring on-chain activity are users, transaction volume, and transaction fees.Based on these metrics, Solana is the leading network for on-chain activity today.Other blockchain fundamentals may also have a significant impact on token prices, and the Solana network also faces strong competitors.But the depth and diversity of Solana’s on-chain economy provide a solid foundation for SOL’s valuation and, in our view, are necessary for further growth in the future.