Author: Bao Yilong, Wall Street News

In the cryptocurrency market, which is known as the “perpetual contract”, derivatives are quickly occupying the center of the stage.

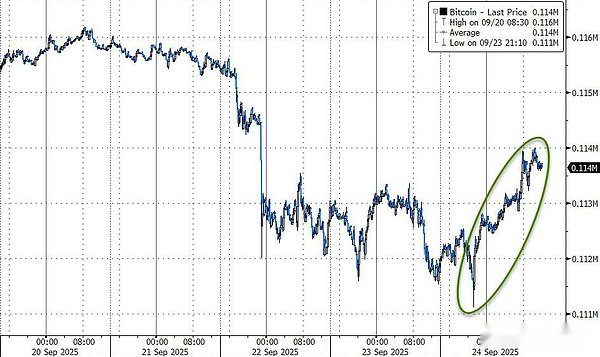

The cryptocurrency market suffered a large-scale liquidation on Monday, and more than $1.5 billion of long positions were forced to close, triggering the worst flash crash in nearly a month.Although the price of Bitcoin rebounded yesterday, mainstream currencies such as Ethereum are still consolidating at low levels, highlighting the huge impact of high leverage trading on market stability.

While volatile, the “perpetual contract”, a speculative tool that was originally popular outside the United States, is accelerating its entry into the regulated U.S. market.

Perpetual contracts are special financial derivatives, with a core feature of which is that there is no expiration date or exercise price, and traders can hold positions indefinitely.Profits and losses are entirely determined by the price changes of underlying assets such as Bitcoin, similar to an option contract that can automatically roll out.

Mainstream cryptocurrency exchange Coinbase has launched perpetual contract products to its U.S. retail customers this summer.Meanwhile, the Chicago Options Exchange global market also plans to launch such contracts in November, marking the official entry of mainstream Wall Street institutions into this high-risk game.

The Attraction of “Permanent Contract”

The most attractive thing about “perpetual contracts” is its extremely high leverage.

For example, a trader can use $500 principal to open a long position worth $5,000 through 10 times leverage.If the price of Bitcoin rises by 10%, its initial investment will double and make a profit of $500.

However, risks and returns are completely equal. If the price of Bitcoin falls by 10%, its $500 principal will be liquidated, that is, “one-click restart”.

In order to keep the contract price linked to the spot price, a “Funding Rate” mechanism has been introduced in a perpetual contract.

Typically, traders holding long positions need to pay the shorts periodically a funding rate when the contract price is higher than the spot price.This fee cannibalize the long side’s profits, and for the short side, it can become an additional income.

The popularity of perpetual contracts has exploded over the past year.

Perpetual contracts now account for about 68% of Bitcoin transactions, according to Adam Morgan McCarthy, research director at analytics firm Kaiko.In a bull market where Bitcoin prices have risen by more than 70% over the past year, traders seeking fast returns have flooded.

A new track that securities companies compete to lay out

With the popularity of perpetual contracts, mainstream trading platforms are accelerating their introduction into core markets.

Coinbase has not only opened the product to US retail customers, but its trading director Scott Shapiro said:

We do not intend to use 10x leverage as a permanent limit, and we hope to continue to push this boundary.

Other institutions are also quickly following up:

Broker Robinhood has begun providing related services to European retail traders

Crypto company Gemini even offers perpetual contract products with up to 100 times leverage.

According to Catherine Clay, Cboe’s global derivatives director, at an event, the exchange plans to officially launch a perpetual contract in November.

This is undoubtedly a lucrative business for the platform that provides these transactions.

Taking Robinhood as an example, its second-quarter financial report shows that cryptocurrency and option trading contributed nearly 80% of trading revenue, while traditional stock trading accounts for only 12%.Popular trading also helped its stock price soar more than 200% this year, successfully entering the S&P 500 this month.

Just like many speculation activities, the dealer may be the real winner in this game.