Source: Galaxy; Compiled by: Bitchain Vision

Note: This article was written before the market crashed on October 11.

introduction

For the second time since June, Binance’s BNB Smart Chain has surpassed all other blockchains in transaction volume.Memecoin trading has been the main driver of BNB chain DEX trading volume.At the same time, the chain’s native Gas token BNB has also broken through all-time highs and has just surpassed XRP in market capitalization, becoming the top three crypto assets, behind Ethereum’s Ethereum and, of course, Bitcoin.

Binance founder Changpeng Zhao has been a key driver of this surge in activity, frequently tweeting about individual memecoins, promoting BNB’s perpetual contracts platform Aster, and appearing in an X Spaces broadcast titled “BNB Super Cycle” on October 8.It attracted thousands of live listeners and amplified the claim that BNB’s recovery was a full-cycle ecosystem return.

Key points of this article

* BNB broke out to new all-time highs and is currently trading around $1,250.

* CAKE, the native token of the PancakeSwap protocol on BNB Chain, has also been cracked.

* BNB Chain’s memecoin launch platform Four.meme surpassed Solana’s Pump.fun in revenue in 24 hours.

* BNB Chain daily fees have topped $5 million, up from under $500,000 in August.

* This is an increase of more than 1,000%.

* BNB Chain’s daily DEX trading volume reaches over $6 billion, while Solana’s trading volume is approximately $5.5 billion.

* Artemis data shows that the BNB chain has seen net inflows of more than $182.6 million in the past three months.

* All of this makes BNB Chain a challenger to Solana and Hyperliquid in the memecoin and perpetual contract verticals respectively.

“BNB meme szn” tweet posted by CZ on October 7

BNB has surged approximately 133% over the past six months, far outpacing BTC.Meanwhile, CAKE is also up about 146%, indicating that trading and on-chain activity are returning to the Binance ecosystem.

The move also reflects the success of PancakeSwap’s token economics, which uses a buy-back and burn model.The decentralized exchange aims to reduce net supply by approximately 4% per year, with burns funded by platform revenue.The protocol’s ultimate goal is to reduce the total CAKE supply by approximately 20% by 2030, providing one of the clearest deflationary frameworks among major decentralized exchange tokens.BNB Chain’s surge in decentralized exchange trading volume and user activity has clearly helped PancakeSwap achieve its goals.

BNB price chart, October 7

Price of CAKE, the native token of BNB Chain’s leading DEX PancakeSwap, October 7

Brief description of BNB smart chain architecture

BNB Chain was launched by Binance in 2020 and is the execution layer of the BNB Chain ecosystem.Initially called BSC (Binance Smart Chain), it was intended to create a fast, low-cost, EVM-compatible blockchain to complement the exchange’s Binance Chain.Binance Chain only handles simple asset issuance and transfer, but does not support smart contracts.

In 2022, Binance renamed the entire network stack to the BNB chain, positioning it as a more decentralized ecosystem, and using BNB (formerly “Binance Coin”, now “Build and Build”) as its gas fee and governance token.The architecture initially consists of two core layers: BNB Beacon Chain (governance and staking layer) and BNB Smart Chain (BSC, execution layer).

However, by 2024, Binance completed BNB chain integration, deprecating the beacon chain and integrating its governance and staking functions into the BNB Smart Chain.

BSC validators recently proposed cutting gas fees in half (from 0.1 gwei to 0.05 gwei) and reducing block times from 750 ms to 450 ms.This would bring the average transaction cost down to approximately $0.005, bringing transaction fees on the BNB Smart Chain closer to Solana levels.

Recently, the generation of the $ASTER token and speculation surrounding a possible AsterDEX airdrop have led to a surge in inflows and activity in the ecosystem.CZ heavily promoted it on X (formerly Twitter), even declaring “BNB meme szn.”DefiLlama recently removed AsterDEX’s perpetual trading volume from its platform, citing the data provider’s suspicions of fake trading by linking Binance and Aster’s trading volumes.

Hyperliquid has proven that a successful Perp DEX product can be highly profitable in the cryptocurrency space, and pump.fun has proven its excellence as a low-friction launch platform.Now, Changpeng Zhao seems keen to enter these two markets, and he is fully prepared.AsterDEX has the full support of YZI Labs and is competing for Hyperliquid’s market share.Four.meme, billed as the “BNB version of Pump.fun,” has just surpassed Pump and fellow launch platform Axiom in 24-hour revenue, and has seen a surge in user activity as traders scramble to bridge assets from Solana to BSC.

Daily Income: Pump.fun and Four.meme

As of this writing (October 8), Four.meme has surpassed Pump.fun in 24-hour revenue, at $1.4 million, compared to Pump’s $1.14 million.

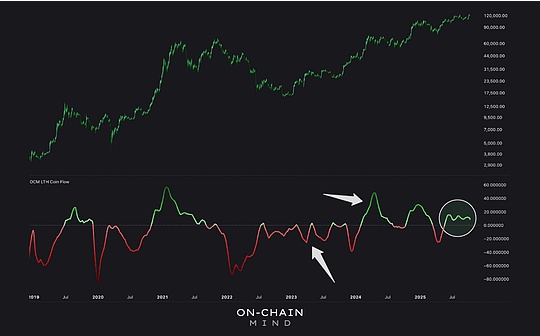

As user activity increases, the daily handling fees of the BNB chain have also surged.Fees have soared from less than $500,000 in August to more than $5 million on October 8, an increase of more than 1,000%.

The BNB chain’s DEX trading volume (over $6 billion) has surpassed Solana (approximately $5.5 billion).This is noteworthy because in April, Solana’s trading volume was less than $1 billion.Aggressive marketing and incentives are having the desired effect.

Net inflow of funds

Data from Artemis (as of October 7) shows that the BNB chain has seen net inflows of more than $182.6 million in the past three months.This compares to more than $118 million in net inflows for Solana and more than $41 million for Avalanche.

BNB chain

Solana: Notably, the largest capital outflow from the Solana bridge has been to BNB Chain, with $46 million migrating there from Solana alone in the past three months.

Why is it important

BNB Chain’s market share highlights a reality: Brand and narrative remain crucial in the cryptocurrency space, at least in the short term.Changpeng Zhao’s reinvigoration (from declaring a “BNB Super Cycle” to promoting certain memes) has established the BNB chain as the hottest center of activity in the space right now.

For example, the market value of the token “Binance Life” launched on October 4 exceeded $500 million.But on Solana, you don’t see that at all.Even the current best-performing new token, Solana, has struggled to surpass $20 million in market capitalization.

It’s easy to forget that during the previous U.S. administration, Changpeng Zhao served four months in prison and Binance paid $4 billion to settle federal charges.After being released from prison, he kept a low profile for a time.But in mid-September, Changpeng Zhao updated his X account and changed his profile from “ex-@binance” to “@binance”.That’s consistent with his profile before 2024, suggesting he’s dealing with a more relaxed regulatory environment under the Trump administration.Binance is seeking to relax its enforcement provisions in the United States, and YZi Labs has raised a new $1 billion fund for the development of the BNB ecosystem.Binance strikes hard.

From a broader perspective, the exchange-driven ecosystem is experiencing a resurgence.Mantle is openly emulating BNB’s strategy through Bybit.As BNB Chain has proven, having both exchange liquidity and execution layers can be an unbeatable combination.Coinbase has hinted that it is about to issue a BASE token, which may indicate that it realizes the benefits of adopting a similar vertical integration model to obtain more liquidity.

As with these surges, the next question is durability.If Four.meme, Aster, and PancakeSwap can maintain trading volume without external incentives, then the BNB Super Cycle may become more than just a meme.