Author: danny; Source: X, @agintender

Question: What is the limit of human sight?Some people say it is the end of the world, because it can see the sun, moon and stars; some people say it is close, because a leaf can blind one’s eyes.Looking at different things from different angles will always give people unexpected inspiration and surprises.Today we will speculate on what happened on 10.11 from the perspective of the mechanism of “leverage sum and liquidation sum”?

This article has no conclusions, no sides, only different perspectives.If you’re ready, give me 10 minutes.

statement:

-

I can sympathize with everyone’s dissatisfaction. This article will discuss it in the form of a verbal essay and try to put it into this context.

-

This article is neither right nor wrong, nor does it take sides. It just starts from another perspective – looking at the problem dialectically from the perspective of mechanism. It just provides another perspective to discuss the mechanism behind it.

1. Financial skills and leverage of market makers

I have previously written about how market makers (using call options) use coins borrowed from the project side to make markets?

I figured it out, it’s probably time to update to a new version.

As mentioned above, due to the setting of the call option and the market environment where the currency is at its peak, one of the best solutions for market makers is to get the borrowed currency from the project side, sell the borrowed currency at the beginning of the launch, when the liquidity is the most abundant (leave some for market making), and buy it back at a low point.

This model has two conditions. The first is that liquidity must be sufficient; the second is that there is no third-party supervision, that is, the exchange does not care.

As everyone knows what happened after that, the market environment (spot) took a turn for the worse, lack of liquidity, and Binance’s supervision, so this not-so-bumpy road slowly dimmed, or in other words, it didn’t dare to make a big splash.But does this operation leave market makers with nothing to do?Apparently not.They are eyeing contract deals.

The problem is, they only have a lot of tokens in their hands, and the contract transactions of altcoins only recognize U. What should they do?

So, they focused on Binance’sCross Margin Leverage/Financial Management/Unified Account, we can ignore all the functions here and focus only on the use of collateral.This collateral module supports market makers or large investors to pledge nearly 200 types of assets listed on Binance as margin to trade spot/contract/options.It’s just that different altcoins have different mortgage rates, which will be mentioned later when giving examples.

So how to do it?

Take ATOM (full position leverage) as an example

I borrowed 1 million ATOMs from the ATOM Foundation, one ATOM = 5u.

As a casual example, reserve 200,000 ATOM for daily market making, and then pledge the remaining 800,000 ATOM (“collateral”). Assume that the market price is 4 million U, and the available quota is 1,120,000 (200,000 *100% + 200,000*80% + 200,000*70% + 200,000*50% +….)

Use an official (unified account) example to illustrate:

There are two variables here, one is the change in the value of the collateral, and the other is the change in the value of the transaction.

The rest of the operations depend on their own skills. Trader A will open a short position in the contract, and then control the spot supply to make profits; Trader B will open a long position in the contract, and then control the contract price to make profits, and so on.

Why is the pledge rate so low?——This principle is the same as the contract margin. The larger the amount, the risk increases exponentially.In addition, the liquidation of collateral is also calculated based on the “marked price” rather than the market price.

Binance’s official statement on contract liquidation:

2. How does collateral trigger liquidation and liquidation?

The collateral of the unified account/financial management/leverage is not settled based on the value of a single target/collateral, but based on the equity and margin ratio of the entire account/position.

Here we use a unified account as an example for demonstration:

Unified account margin rate uniMMR = Unified account adjusted equity / Unified account maintenance margin amount

The specific calculation method is more complicated. Essentially, the value of all collateral/positions must be greater than the margin requirement.I won’t go into other cross-position leverage/liquidation/liquidation of financial management one by one. Here I will only introduce the key points:

When the unified account maintenance margin rate is lower than/equal to 1.2, the account will enter “frozen mode” (cannot open a position), and when it is lower than/equal to 1.05, the account will be forcibly closed.(This information is very crucial!! We will test it later)

Similarly, cross-margin leverage/financial management also has similar procedures when liquidating.

Regardless of the method of collateral, there are two main ways to close a position: closing the transaction at the market price or canceling the existing order.

3. The capital efficiency hammer of large investors and giant whales

In addition to market makers, there are also institutions, whales and large investors who also adopt this financial management/full position leverage/unified account model.

Just think about it, if you were a firm believer in ATOM, what would you do if you held 10 million ATOM?Will you pledge these 10 million ATOMs, make revolving loans, and open contracts – that is, buy at all kinds of bargains, buy at the bottom, and keep buying at the bottom, maybe not only buying ATOMs, but also buying projects in the ATOM ecosystem, some even hedging, and then hold on until the dream of the copycat bull market comes, and become famous in one battle?

This is not a fable, this is a real OG story (now a tragedy)

But unfortunately, your position has become terminally ill during the constant tossing, and at this time, heavy rains and landslides have arrived.

4. 1011 Review

Now everyone goes back to that dark and windy night on October 11th (taking ATOM spot as an example)

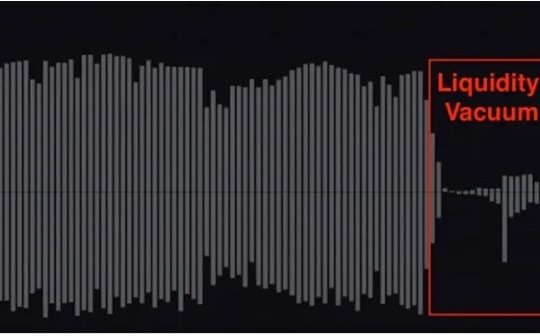

The price of ATOM has started to fall since 5 o’clock, and the volume chart below has also begun to increase in volume, but the price has basically stabilized at around 3.7-3.8, proving that there is still liquidity.

The market began to fall at 5:13, with a sharp drop in volume, and the next bar fell after the end of the previous bar. This should be a sign that the arbitrage liquidation robot has started to work.The collateral of large investors/giant whales began to be liquidated (this also explains why the spot and contract trends are basically the same).The liquidation robot will directly take the large account’s collateral (ATOM) in the form of market orders until the liquidation work is completed.

How do you come to the conclusion that the liquidation robot is the initiator?

As of 5:19, there was still liquidity on the orderbook (the trading volume was also very high), but at 5:20, the orderbook basically fell into a vacuum, hitting 0.001.

ATOM spot trend chart

ATOM futures trend chart

But looking back at the contract trading, the lowest price here at 5:20 is 1.4. If it is a futures-spot arbitrage order, the futures and spot prices should be similar, and the ATOM of 0.01 is a price that rational traders will not trade.Only ruthless liquidation robots can accomplish this with “ruthlessness”.(The liquidation robot handles “collateral”, that is, spot)

In other words, it was the unwillingness and greed of the big investors/whales that caused this situation, and the liquidation robot completed the killing.

As for why Binance’s ATOM spot experienced a brief “liquidity vacuum state”?

I irresponsibly speculate,This should be caused by the main market-making account’s leverage/financial management/unified account maintenance margin ratio falling below the threshold (being liquidated and unable to open new positions), triggering the account’s “frozen” state, forcing the cancellation of original order book orders, and inability to provide normal liquidity..

Attached: Price charts of WBETH and BNSOL

The timing of the liquidity vacuum is basically between 5:43 and 5:44. It is speculated that the main market maker of these two currency pairs should be the same account, and at this time, the financial management/leverage/unified account fell into a “liquidation/freeze” state and was unable to provide liquidity normally.

WBETH price chart

BNSOL price chart

postscript

I actually hesitated for a long time whether to post this article. After all, posting it at this time will add fuel to the fire and it is very likely to be targeted. It may even be labeled as “anti-thief”, “BNx dog”, “land washing” and “collecting money”. However, I feel that all parties involved in this matter are unfair.

After thinking for a long time, I wrote this colloquial + verbal article for your reference.

Attached is ATOM’s risk insurance fund chart. On 10.11 alone, the risk insurance fund lost US$150 million. (According to 5x leverage, the nominal price is US$750 million.) Only when liquidity is sufficient, the exchange can make a steady profit without losing money. In extreme circumstances, the exchange’s losses are also huge.In terms of motivation, there is really no need for them to deliberately cut off liquidity.

Finally, I am also a victim and am defending my rights, but I have not received compensation yet.

I posted this article just because I want to be a rational rights defender and give everyone another perspective.