Author: Marcel Pechman, Source: Cointelegraph, Compiler: Shaw Bitcoin Vision

Summary of key points

-

Bitcoin derivatives and cautious interest rate expectations have dampened sentiment, but improving liquidity conditions have enhanced upside potential.

-

Regulatory easing and MSCI’s review of Bitcoin Treasury Reserve companies may increase risk appetite, supporting a more optimistic medium-term outlook for Bitcoin.

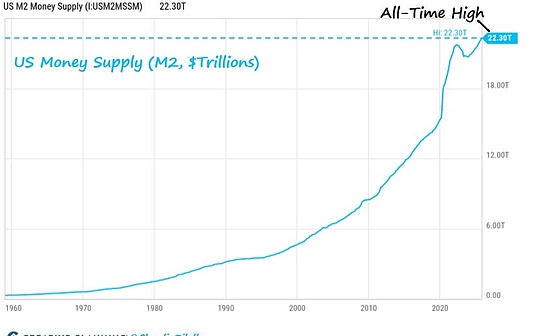

Bitcoin has been suppressed below $92,000 recently, down 22% in the past 30 days, but that may soon change.Bulls expect governments to expand the money supply to support the economy and combat growing fiscal deficits, while bears often cite weak labor market indicators and growing concerns about artificial intelligence investment trends as supportive factors.

There may be truth to both views, and the recent short-term weakness could ultimately set the stage for a more sustained Bitcoin rally.Four factors will help determine how quickly prices can return to the $11,2000 level of four weeks ago.

iShares TIPS Bond ETF (red) vs. Bitcoin/USD (blue).Source: TradingView

The iShares TIPS Bond ETF, which tracks U.S. Treasury Inflation-Protected Securities, resumed its upward momentum on Thursday after retesting support at $110.50.The ETF typically moves higher when investors anticipate rising inflation, a backdrop that tends to favor Bitcoin as traders seek other hedging tools.

Bond futures data from CME’s FedWatch tool suggests traders see a 78% chance the Fed will keep rates at or above 3.50% by Jan. 26, up from 47% on Oct. 24.Lower interest rates generally benefit companies that rely on leverage and tend to stimulate consumer demand for credit.

U.S. dollar-denominated consumer loans issued by commercial banks.Source: Federal Reserve

The U.S. government is shut down until November 12, and the uncertainty caused by this may prompt the Federal Reserve to keep interest rates unchanged in December.Therefore,Traders are keeping a close eye on the U.S. Bureau of Labor Statistics’ November employment report due out on December 16, and the Fed’s preferred inflation measure, which will be released on December 26November core personal consumption expenditures (PCE) index.

Can the Fed spark Bitcoin’s next rally?

A major shift may occur in the first half of 2026.Federal Reserve Chairman Jerome Powell’s term ends in May, and U.S. President Donald Trump has made clear his preference for nominating a candidate who supports an easy monetary policy stance.No date has been announced for the nomination, a process that typically involves months of Senate hearings and votes.

Bloomberg also reported that U.S. regulators have finalized a rule that will reduce capital requirements for large banks by January 1, 2026.These developments could be a catalyst for risk assets like Bitcoin, as the Trump administration has signaled plans to stimulate economic growth by expanding government borrowing, including the “Big and Beautiful Act” proposed in July.

In addition to macroeconomic factors, two developments within the Bitcoin ecosystem may also influence its price to return to the $100,000 mark.In October, MSCI Indexes said it was consulting investors on whether to exclude Bitcoin treasury and other digital asset reserve companies from the index.The final decision is expected to be announced on January 15.

According to Bloomberg, passive funds tied to Strategy (MSTR) have market exposure of nearly $9 billion.Strategy founder and chairman Michael Saylor said: “Strategy is neither a fund, nor a trust, nor a holding company. We are a publicly listed operating company with a $500 million software business and a unique financial management strategy.”

Deribit Bitcoin 30-day options (put-call) delta spread.Source: laevitas.ch

Bitcoin derivatives have continued to come under pressure over the past four weeks,The premium of a put option (sell option) is 10% higher than a call option (buy option) of the same contract.Given the $22.6 billion in Bitcoin options expiring on December 26, traders may be waiting for premiums to fall back to 5% or lower before regaining confidence.

Overall, Bitcoin’s return to $110,000 is still possible, thoughThis target is more likely to be achieved in the first half of 2026.