Author: zhiyuan sun, cointelegraph; compilation: Deng Tong, Bit chain vision world

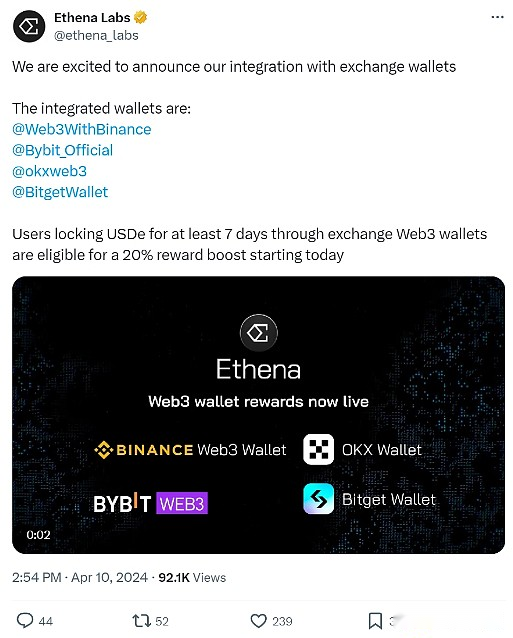

As of April 10,Ethena Labs is integrated with the centralized trading wallets of Binance, Bybit, OKX, and Bitget.

Ethena developers said:“Starting today, users who locked USDE through the WEB3 wallet are qualified to get 20% of the rewards for at least 7 days.” Incentive measures issued in the form of “Ethena Interest” can be converted into its native ENA token at the end of each event.In order to earn interest rates, users must first deposit Ethena USDE stable coins into their exchange wallets, connect to Ethena decentralized finance (DEFI) protocol, and pledge their assets.As of the release, the total locking value of the agreement was US $ 2.274 billion and annualized revenue was 178 million US dollars.

Source: Ethena Labs

The ecosystem rewards of the protocol have attracted quite a lot of attention and use.According to the blockchain analysis company LOOKONChain, since Ethena Stake, the top 10 wallets have extracted and pledged a total of 37.5 million ENAs ($ 51 million).

On March 8th, less than a month after the launch of the USDE stablecoin, Ethena became the most income decentralized application in the cryptocurrency sector, and its USDE’s annual yield (APY) was as high as 67%.The agency of this protocol is currently 24%of its stable currency.However,Income is not without risk, because it depends on the return of the complicated Ethereum derivatives to pay the promise.

Due to concerns about its high returns, Ethena Labs founder Guy Young pointed out in an interview on February 2.Comparing it with the failed Terra stabilized coin Terrausd (USS) is just a “subconscious response”, the company’s income is organic and sustainable.Young said: “The most important point we try to make everyone understand is that Anchor’s income is completely fabricated.”Come income “

at the same time,The publicly verified Ethena yield comes from the Ethereum consensus layer inflation awards, the execution costs paid to the Ethereum pledged, the maximum extraction value cost obtained by the Ethereum pledged, and the transaction revenue provided by Ethena Labs.SpecificallyWhen the company receives a multi -inch mortgage asset for casting USDE, a short derivative is opened.The value difference between the price difference or two positions will be paid to the USDE holder as the income.