Author: Huang Shiliang

I have been persuading several relatives and friends to use chatgpt, but they have always felt that there is no need to buy the paid version, and they may just be reluctant to do so.I have always said that you can use AI to help you earn back this subscription fee. I have been teaching one of them and trying to cultivate a successful case, but I have never succeeded.

Many years ago, a friend who did quantitative arbitrage sold me his strategy.The core of the PPT he talked about was a partial differential equation, which I couldn’t understand at all.But he said this is making gold from mathematics.

In 2017, the mainstream private key management method for ETH was not mnemonics, but keystore (json) files. I often imported the same set of keystore files into myetherwallet and metamask wallets to call different contracts, because the wallet functions of Ethereum at that time were different. In order to achieve arbitrage in different contracts, it was often necessary to import the same set of private keys into different wallets for use.

There was no way, the infrastructure back then was too bad.Looking back now, I didn’t encounter phishing websites or clipboard Trojans at that time, it was just smoke coming out of ancestral graves.Even if a gun is pointed at me now, I would never dare to do this kind of high-risk operation again.

Two years ago, ordi and other inscriptions became popular, and I never knew how to participate in arbitrage.Once by chance, I saw a post onBecause it is quite strange to make dex buy and sell orders for inscription-type assets. When using PSBT trading, some people may forget about it after placing the order.After that time, I spent a long time looking for garbage in the inscription graveyard, but I was so busy that I didn’t earn a few sats of BTC in the end.

The above three stories I have experienced illustrate the three thresholds for entering currency arbitrage:Mathematics is difficult, tools are difficult, and experts don’t teach (mathematical models, tool thresholds, and experience barriers).

arbitrageIt is the second most popular topic in the field of cryptocurrency, second only to currency speculation and investment. I feel that it is also an excellent entry point for most ordinary people to enter this industry, and it still is today.

In the past, there was indeed a high threshold for arbitrage.But now that AI is available, after I tried to use AI in depth to find arbitrage opportunities, it was very clear:The high walls that once blocked ordinary people are being quickly flattened by AI.

The following are my three thoughts on “How AI can restructure arbitrage”.

Threshold One: The “Disenchantment” of Mathematical Models

The biggest obstacle to arbitrage is undoubtedlyEstablishment of mathematical models.

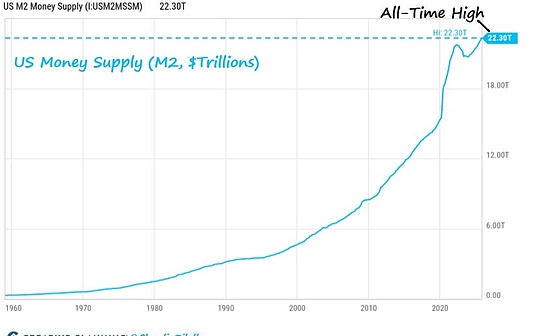

In the barbaric era of the currency circle, the arbitrage model was simple and crude.For example, the earliest exchanges used the “addition and subtraction” method: the price of exchange A is low, the price of exchange B is high, and you can make a profit by buying and selling manually.Later, futures arbitrage (perpetual contract and spot price difference), although concepts such as funding rates and leverage were introduced, it still remained at the level of “addition, subtraction, multiplication and division”.

However, as the industry evolved, complex derivatives emerged.With option synthesis, multi-angle arbitrage, on-chain and CEX, the model is becoming more and more obscure.For people without a mathematical background, just understanding “how to use Call and Put to synthesize a spot” is estimated to be difficult for 99% of people.

Now, AI has become the most powerful mathematical translator,What AI is best at is processing these logics and formulas.No matter what math problems I encounter now, I ask AI directly.

In the past, I used excel tables to calculate and verify the components of uniswap’s capital pool. Now I directly ask chatgpt and tell it the parameters and it will calculate it clearly for you immediately.

Let’s take another example from my recent research.

PolyMarket was very popular some time ago, such as the prediction of “when Trump will disclose Epstein’s list”.I was not familiar with the arbitrage model of probabilistic events, so I directly took a screenshot and sent it to AI and asked it: “What is the arbitrage space here?”

The AI gave me the answer instantly, explained to me the game relationship between “long-term probability” and “near-term probability”, what yes+no=1, and listed all the mathematical logic of how to operate under specific emergencies.

I won’t copy the AI’s reply, you can ask it yourself.

With AI, you no longer have to regret falling asleep in advanced mathematics classes during your freshman year.

Threshold 2: “Dimensionality reduction” of tools and environment construction

The second threshold isUse of technology tools.

If you experienced 2017’s ICO or 2020’s DeFi Summer, you’ll know how high the barriers to “operation” itself are.The Ethereum tools back then did not have a user-friendly UI. To call a contract, you needed to manually fill in the address and parameters; for airdrops, you needed to configure an anti-correlation fingerprint browser, IP proxy, etc.

But it’s precisely because these learning curves are so steep that the early profits are so huge.

Now with AI, all product usage problems have disappeared.If you don’t understand, ask chatgpt, the answer it gives is perfect.

In the wool-making strategy, environment construction is still a difficult point for most people, but now as long as you send the strategic intention (for example, you want to play potential airdrops in the polymarket) to chatgpt, it will generate a complete execution plan, including how to use all tools.

Now this knowledge is really at zero threshold. All you need to do is have the intention. The rest is to follow it step by step and ask the AI if you encounter something you don’t know.

You can ask AI now. Currency exchanges also have strategies similar to inviting new people and trading mining (Binance’s Alpha). Each exchange has similar invitation registration reward strategies. This strategy of consuming people is difficult to monopolize. You can ask AI how to implement it.

AI can also help with some very simple and auxiliary programming, such as writing a monitoring chain price, designing a visual data dashboard, etc. In the past, programmers may have been required to assist, but now AI has done it.

But don’t expect AI to write code for you. It is impossible to write a quantitative program to compete with various robots today. There is a high probability that AI will not allow you to quickly become a quantitative expert and a scientist on the super chain from scratch, but it is enough to allow anyone to overcome the initial obstacle of “not knowing how to do it”.

Now, AI has made technical barriers almost disappear.

Threshold Three: “Decoding” of Experience Inheritance

Arbitrage relies heavily on experience.

For example, when wbETH and ETH prices dropped dramatically on Binance on October 11, seasoned veterans would not hesitate to exchange ETH for WBETH.This kind of acumen often required “master guiding apprentice” in the past, or losing money on your own for several years.

Now, AI is the best “master”.

There are many big guys in the crypto circle who love to share, but it still takes a lot of effort to extract executable strategies from their sharings. With AI, it will be much easier to extract gold from the big guys’ words.

Every time I see a profitable sharing post on

We only need to be a diligent “porter”, read articles every day, read x, and watch group sharing, and then feed these clues that should be business secrets to AI, and it can quickly take you through most mature arbitrage logic.This kind of learning efficiency is unmatched by the traditional “master-apprentice system”.

The Last Bastion: Opportunity Discovery

Don’t mythologise AI.If AI can make money automatically, it doesn’t need you or your subscription. Why is SamAltman still asking for your $20? Otherwise, a few capital giants would have already built hundreds of intelligent agents and sucked up the market profits.

Now AI only greatly reduces the cost of execution, but it cannot replace the ability to “ask questions” and “acute perception”.AI needs you to give it instructions and tell it where to analyze.The perception of market sentiment and sensitivity to emergencies are still the living space of human beings.At the beginning of discovering opportunities, we still need to rely on our diligence. This may also be the value of our people at this stage.

It should focus on arbitrage of “non-standard products”.For those tracks that are highly standardized and have open and transparent data (such as the transfer of mainstream currencies), quantitative robots have long been out of profit, and there is no need for chatgpt to play any role.The places where profits may be left are those that mainstream strategies and big funds look down upon.

AI is a dragon-slaying knife, but if you just use it to write weekly reports, it will be scrap metal.Arbitrage competition in the context of AI is no longer about who is better at mathematics, nor about who can write smoother code; it is about competition.Who works harder to feed AI new gadgets on the market?.You don’t need to be smarter than quantitative institutions, you just need to be one step faster than those retail investors who don’t know how to use AI – even if it’s only half a step faster, the profit will be yours.

Try setting a small goal:usearbitrageEarn back your AI subscription fees.ChatGPT Pro plus Gemini Ultra costs $450 a month.Strive to give yourself another $50 salary, and find a way to steadily earn back this $500 from the market every month.