Author: Dr. MR.JC Block; Source: X, @blockphd7

If you stay in this industry for a long time, you will find an interesting phenomenon: the more king-level projects with a halo and valuations of billions, the easier it is for them to capsize in the most basic gutter.

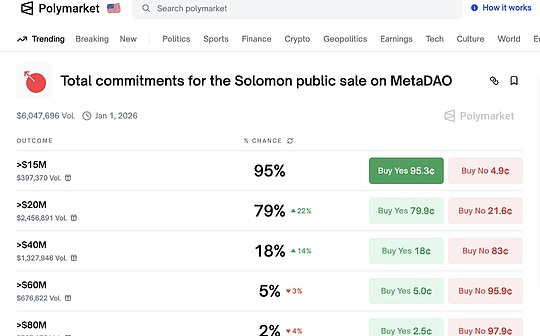

Yesterday, the much-anticipated MegaETH staged an absurd drama with the entire network watching.The originally planned USDC pre-deposit expansion activity was strictly planned, but due to a technical error, the quota was “snatched” in advance. The upper limit of Cap passively soared from 250 million, and finally had to be emergency circuit breaker.

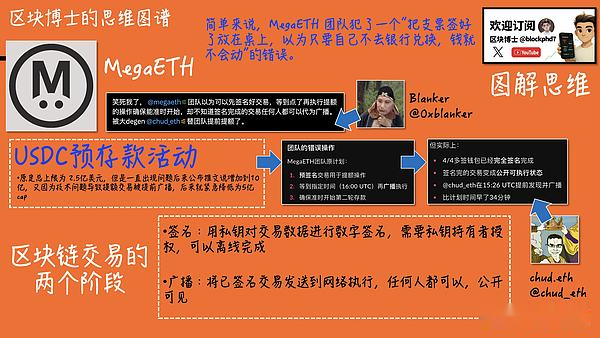

Many people treat it as a melon, but what I saw was a vivid road show of the Web3 Dark Forest Law.In order to explain it clearly, I reviewed the technical logic of the whole thing and made a “Thinking Map” (see the picture at the end of the article).

1. Core misjudgment: Treating the blockchain as a centralized server

The mistake the MegaETH team made this time, in a popular saying, is: “They signed the check and placed it on the park bench, naively thinking that as long as they did not go to the bank, the money would not move.”

In their original plan, the expansion operation was divided into three steps:

-

Multi-signature wallet signs in advance.

-

Wait until the specified time (16:00 UTC).

-

Official click to send (Broadcasting).

This is no problem in the server logic of Web2. The authority is in my hands. If I don’t click Send, the request will not be executed.But in the underlying logic of Web3, these are completely different things.

2. Technical breakdown: Signing does not mean sending a letter, but signing is a commitment

In the diagram, I specifically broke down the difference between “Signing” and “Broadcasting”. This is the cognitive gap that is most easily overlooked by many developers who have just transitioned from the traditional Internet.

Signature (stamped): You use your private key to encrypt and approve the transaction data.It’s like stamping a check.Once completed, this string of data will have legal effect at the code level.

Broadcast (delivery): It is to send the data to the miner node.It’s like dropping a letter into the mailbox.

Here comes the key point: The blockchain network (post office) only recognizes whether the seal is authentic or not, and does not care who threw the letter in.

MegaETH’s mistake was that they completed the signing in advance, and through unknown means (possibly API leaks or testnet synchronization) this string of “signed raw transaction data” was exposed to the public network.So, a top Degen with a keen sense of smell like @chud_eth picked up this “check”.He took a look and said, “Hey, have you gathered all the signatures? Since you won’t send it, let me click and send it for you.”

The result is: without official operation, passerby A directly performs the contract interaction on behalf of the project party.

3. Macroeconomic Enlightenment: Operational safety concerns hidden by high valuations

What does this mean for MegaETH?

To put it mildly, it was an operational accident, which caused a slight loss of face and forced Cap to urgently adjust to cope with the sudden flow of funds.On a larger scale, it exposed the team’s immaturity in operational security.

The narrative of MegaETH is very grand: real-time blockchain, sub-10ms latency, and 100,000 TPS.They have first-class academic backgrounds and the endorsement of Vitalik Buterin.But academic attainments are not equal to practical engineering capabilities.The data run through in the laboratory and the actual combat in the “dark forest” full of MEV robots, hackers, and arbitrageurs are two completely different dimensions.

I was actually lucky to be beaten by @chud_eth this time.Because he only performed the operation in advance for the official, rather than exploiting loopholes to steal funds.What if this happens in its core sequencer logic?

For us investors, this is not only a melon, but also a signal.It reminds us that while pursuing high FDV and high-tech narratives, we must always be vigilant about the project implementation capabilities of the project party.

The phrase Code is Law is not only a belief, but sometimes also a cruel judgment.It doesn’t care what time you “intended” to start, it only executes the instructions it sees.

This time, MegaETH paid the “tuition” fairly.I hope this will allow this high-performance public chain, which carries the hope of the whole village, to truly learn to respect the market and the underlying common sense before the main network is officially launched.

Attached picture: Disassembly chart of MegaETH signature accident and blockchain transaction principle

The core points of the latest official announcement are summarized as follows::

Good intentions do bad things: In order to ensure that the amount will be raised (to $1 billion) on time at 00:00 on November 26, the official cleverly signed the transaction data in advance.

Low-level mistakes: Ignore the common sense that “anyone can send signed transactions”, resulting in signature data being leaked/monitored.

Passive sneak away: On-chain player @chud_eth got the data and broadcast it in advance for the official, causing the quota increase to take effect before the scheduled time.

final situation: The quota was seized in advance, and the official had to issue a document acknowledging this “technical rollover” accident.

One sentence summary: The official wanted to “stuck” the operation, but ended up leaving the “starting gun” on the starting line, and it was picked up by a passerby and fired early.Increasing the quota made the project team sweat. They didn’t want to tire themselves out, so they didn’t mention the quota.