Author: Prathik Desai, Source: Token Dispatch, Compiler: Shaw Bitcoin Vision

We always think that we make rational decisions when choosing a platform to do business on.We compare costs, read reviews, weigh features, and choose the platform that best meets your needs.But when you need to exchange money at the airport, that’s not the case.You’d walk towards the nearest currency exchange counter because it’s there and the sign looks legit.Convenience makes the decision for us.

This is true for almost every market we build.The success of the trading floor comes not from better prices or better technology, but from the fact that it is the place where everyone agrees to meet.Nasdaq’s success in attracting initial public offerings (IPOs) from technology and emerging consumer companies stems not from its technological superiority to the New York Stock Exchange but from its positioning itself as a place where both growth companies and their investors agree to meet.

eBay beat out many of the early auction sites not because its software was better, but because buyers and sellers agreed to transact there.

Every market starts out deserted.Participants don’t come because there are no trading opportunities.On exchanges, this manifests itself as short selling, price volatility, and poor trade execution.The platform that solves the chicken-and-egg problem first often wins everything.Platforms that rank second tend to go out of business, or stay in second place forever.

In the cryptocurrency market, we see a similar situation.Decentralized exchanges (DEX) have promised to create a world where anyone can open a market, fees are transparent, and control is not concentrated in the hands of one person.This model worked once, but then it failed.

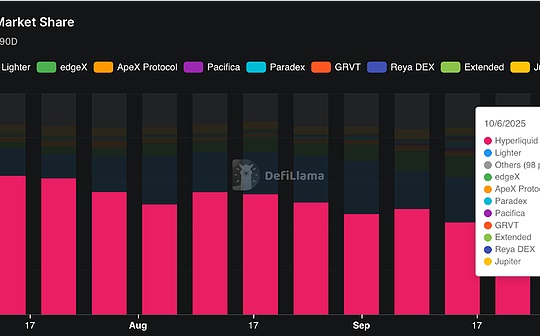

In September, DEX Hyperliquid, which dominates the perpetual contract trading field, began to lose market share.It’s not the slow erosion that giants usually do.A new platform called Aster emerged almost overnight with the backing of Binance founder Changpeng Zhao.However, the data tracking platform DeFiLlama completely eliminated Aster’s data.The platform said its trading volumes appeared to be fake.

False data isn’t even the most worrying aspect.Ironically, this happens despite the fact that every cryptocurrency transaction, wallet, and fee is traceable.Disturbingly, it is almost impossible to distinguish between an exchange that is naturally popular and one that simulates enough popularity to attract real users.The infrastructure is the same and the order books look exactly the same.The only difference is whether the user base is formed spontaneously or artificially.

This is a story about this tension: how DEXs create virality, what’s the difference between momentum and markets, and what simple tests can reveal which exchanges are worth your next trade.

Take a step back and say that.September 2025 is the month when the trading volume of the Perpetual Contract Decentralized Exchange (Perp DEX) exceeded US$1 trillion for the first time.Not the annual trading volume, but the monthly trading volume.From July to September, Perp DEX’s total trading volume was close to the total trading volume for the entire year of 2024.Until May 2024, the trading volume of these platforms was mostly less than 10% of the trading volume of centralized exchanges (CEX) such as Binance.By September 2025, this proportion will reach 20%.Today, one out of every five dollars in perpetual futures trades is conducted on transparent, auditable infrastructure.

While early Perp DEX leader Hyperliquid started the craze, it’s new entrants like Aster and Lighter that are driving the craze.

Three things collided.

Regulatory pressure has traders concerned about the hosting of centralized platforms.Tokenomics are maturing with the advent of sub-second execution speeds, well-designed mobile apps, and Binance-like interfaces.Token economics gradually evolved into a real profit machine.Convert transaction fees into token buybacks, and you suddenly have a sustainable business model: the higher the transaction volume, the higher the token value, which attracts more traders, which in turn generates more fees.

Not all platforms can keep up with the pace of exponential growth.Cracks emerge, revealing who is building for sustainability and who is simply riding on the momentum.When everyone’s business is rising, every platform looks successful.But when incentives run out, the difference becomes apparent.

Take Hyperliquid as an example.Launched in 2023, it is a custom Layer 1 blockchain built specifically for transactions.It dominated the market through much of 2025, processing $175 billion to $400 billion in transactions per month.The platform gave away 27.5% of HYPE tokens to 94,000 users and refused to accept venture capital.This move gives users ownership rather than diluting them through internal selling.This makes them stay.

Subsequently, Aster was launched in September and immediately experienced explosive growth, with transaction volume reaching $420 billion that month.The token’s valuation soared from $170 million at launch to a peak of $4 billion.Hyperliquid’s market share plummeted from 45% to 8% in a matter of weeks.

The way it works involves a massive airdrop program.In the second phase alone, 320 million tokens were distributed, with a peak value of $600 million.This motivates traders to increase trading volume, hold tokens, refer friends and accumulate points.The move worked, with trading volumes rising significantly.For a moment, Aster seemed unstoppable.

Then, it disappeared into thin air.You can no longer find these numbers on DeFiLlama, as the platform has delisted Aster, citing data fraud.

Today, Hyperliquid’s market share in Perp DEX has climbed back to 28%, but is still less than half of what it was two months ago.Lighter follows closely behind with a market share of 25%.

The incident prompts us to think about what allows some platforms to survive while others disappear.I put it into four categories.

First is mobility, it’s like gravity.

Without deep liquidity pools, traders face slippage, which is the difference between the expected price and the actual executed price.Hyperliquid built its own Layer 1, achieving a processing speed of 20,000 orders per second and a final confirmation of 0.2 milliseconds.Lighter uses ZK-rollups technology to achieve sub-5 millisecond matching speeds.But technology alone won’t solve the cold start problem: you need market makers, and without traders, market makers won’t come.Without liquidity, traders won’t come.

Hyperliquid solves this problem with its HLP pool.The HLP pool is a protocol-owned liquidity pool with an annualized rate of return of 6% to 7%, providing basic depth before the arrival of market makers.On October 11, US President Trump announced a 100% tariff on China, exacerbating trade tensions with China, and the cryptocurrency market liquidated $19 billion within 24 hours.At that time, Hyperliquid’s HLP vault made a single-day liquidation profit of US$40 million, with an annualized return of nearly 190%.

Most platforms have never solved this liquidity problem.They came online with advanced technology but empty order books.No one wants to patronize because there is nothing to trade with.

Next comes incentives.They can at least temporarily create a virtuous cycle.

The difference between a sustainable incentive and a one-time expensive gift determines sustainability.Hyperliquid’s model solves this problem by broadly distributing ownership and then allocating 93% of transaction fees to token buybacks.This way, the value of the token is directly tied to protocol usage, rather than future mining expectations.Aster airdrops tokens to users and hopes they stay.This method effectively generates trading volume.This does increase trading volume in the short term.We have been able to see long-term trends in real time.

The third is user experience.User experience determines user retention rate.

If your DEX experience is not as good as Binance, users will eventually leave.Hyperliquid’s interface might be considered a centralized exchange even to novice traders.EdgeX has launched a multi-party computation (MPC) wallet that allows users to conduct transactions without having to manage mnemonic phrases.Lighter does not charge any handling fees for retail investors.It is these small details that determine whether a trader stays or goes.Think guaranteed stops, sub-accounts for risk isolation, and user-friendly mobile apps.

The fourth is cultural power.Memes and influencers create communities.

Hyperliquid’s narrative is high-performance DeFi first, community-owned, no venture capital, and built from the ground up.The recent airdrop campaign, which distributed a collection of Hypurr Cats NFTs as rewards to early backers, demonstrates how culture can build a loyal community.Even in Aster’s case, the “CZ’s Revenge” meme stemming from Binance building infrastructure beyond the reach of regulators paved the way for its sudden surge in adoption.Lighter is positioned as “Ethereum’s perpetual contract savior,” with support from a16z and former Citadel engineers.

Cultural dynamics are crucial, as a sense of belonging is equally important to a committed community of cryptocurrency traders.In the cryptocurrency space, users don’t just choose a trading platform.They will also begin to identify with these platforms, maintain them, add tokens to their Twitter profiles, and participate in Reddit forums and Discord channels.This community culture creates organic marketing effects and user stickiness.

Those platforms that are effective satisfy all four conditions simultaneously.Aster tried to take shortcuts and relied too much on memes and incentives.When questions are raised about the reality of liquidity, everything starts to shake.

A chart posted by the founder of DeFiLlama shows that Aster’s XRP and ETH trading volume is almost exactly the same as Binance’s perpetual contract trading volume.

In contrast, Hyperliquid’s trading volume moves independently.A reliable measure is the volume to open interest value ratio.Open interest value measures the actual amount of money at risk in open positions.If the transaction volume is $10 billion, but only $250 million is locked, something is wrong.Hyperliquid’s ratio is just above 1, which implies real open interest, while Aster’s ratio is as high as 20, implying a huge discrepancy between trading volume and open interest value.

As someone who works in the cryptocurrency space, I constantly think about the difference between real growth and artificial growth.Every booming market in history has been engineered to some degree.Nasdaq was designed to compete with the New York Stock Exchange by allowing smaller companies to go public.eBay was built to solve a specific trust problem.Once you reach critical mass, growth may seem natural, but it’s actually all carefully designed.

Cryptocurrency simply makes the engineering process visible in real time.You can watch how the platform injects liquidity, incentivizes users, iterates on features, and ultimately achieves product-market fit, or fails in the attempt.

Aster is still operating.Its second phase airdropped 320 million tokens with no lock-up period, which increased selling pressure.Aster’s volume/open interest ratio is 20, which already indicates that most of the volume is not actual open interest operations.

From Aster’s case we can draw a more important conclusion: when the market operates on a transparent track, anything is possible.

For years, we have pretended that markets are neutral infrastructure, independent of the money that flows through them and who controls access to them.But markets are always tied to the systems that run them, and those systems are always tied to those who control them.We just can’t see the mechanism clearly enough to explore whether it’s important.

Now we can finally see it with our own eyes.We can verify whether the liquidity is real or whether the robot is buying and selling itself.We can observe whether the platform builds a sustainable business or executes a carefully planned exploitation plan.

Platforms that trade smoothly, have ample liquidity, slippage is not an issue, and have an interface so intuitive that you completely forget you are using cryptocurrency are likely to succeed.In the long run, they are likely to become invisible infrastructure like VISA and Mastercard.

Of course, we’re clearly not at that stage yet.But we can clearly see the elements of a successful DEX.This allows us to ask the right questions and discern which platforms are moving toward “invisibility” and which are just showing off.Over the next few years, we’ll be telling them apart.