author:Anthony Pompliano, Founder and CEO of Professional Capital Management; Compiled by: Bitchain Vision

The time for Bitcoin to shine.This is the conclusion I came to after delving into the fundamentals of Bitcoin and the current financial environment over the weekend.

How high will Bitcoin rise in the next 8-12 weeks?No one can say it, but I think people have been coaxed to sleep for too long.Now it’s time to start setting off fireworks.

Let’s dig into some data.

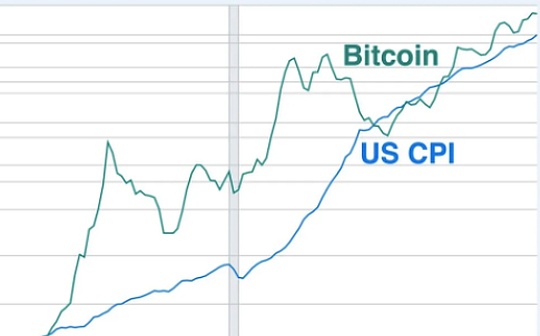

Bitcoin and CPI are closely linked from around 2023

First, James Lavish said:“If you say you don’t believe in Bitcoin, it’s like, you don’t believe in inflation.”

Although Bitcoin has been tracking CPI trends until 2023, the data on the charts look like there is a lot of noise.butSince around 2023, Bitcoin and CPI have been closely linked.This tight correlation suggests that investors are using Bitcoin as an inflation hedge asset.

“Devaluation Transaction”

JPMorgan analysts now call Bitcoin and gold a “depreciation transaction.”They wrote:

“We define it as a transaction that ‘reflects multiple factors’ which in conversations with clients include increased geopolitical and policy uncertainty, uncertainty in the long-term inflation context, concerns about ‘debt depreciation’ caused by the ongoing high government deficits in major economies, concerns about the independence of the Federal Reserve, weakened confidence in fiat currencies in certain emerging markets, and wider diversified investments away from the dollar.”

This makes sense, right?Investors are worried that governments around the world have too much debt, so countries and central banks have to devalue their currencies to avoid defaults.In this case, holding the US dollar would be a failed strategy.

Creative Planning’s Charlie Bilello stressed that “Gold (+48%) and Bitcoin (+31%) are the top performing major assets so far in 2025. We’ve never seen both assets ranked first and second in any year.”

Many people think that past performance does not predict future performance.It is true, but global structural trends show that both Bitcoin and gold will go higher.

Felix Jauvin of Forward Guidance wrote:

“Every country is turning to ‘overheating’.We will expand the deficit as much as possible and try to get rid of debt.Central banks are abandoning control of inflation and fiscal dominance is coming.Nominal assets will perform well, and depreciation hedging instruments will perform even better.The world of 2010-2020 is no longer there.Reset your prior knowledge.Let’s go.”

If you have been following the Internet for the past decade, these are nothing new.Bitcoin holders and their senior gold holders have been clamoring for years to currencies depreciate.But what’s different today is that large financial institutions have already provided credibility for this argument.

Taking Morgan Stanley as an example, Ash Crypto wrote:

“Morgan Stanley’s $1.3 trillion Global Investment Commission recommends allocating 2-4% of its client portfolio to cryptocurrencies and says Bitcoin is a scarce asset that rivals digital gold.”

BTC Archive also noted, “Morgan Stanley said that if its 16,000 financial advisers who manage $2 trillion want to invest in Bitcoin and cryptocurrencies, Morgan Stanley will ‘back’ them.”

So, what should you learn from traditional companies that embrace Bitcoin?Big companies understand that “currency depreciation transactions” will not disappear.Why?Vijay Boyapati gave a good explanation for this, writing:In the global financial asset family, the two closest brothers (gold and BTC) are now sending the same message: global currency depreciation has reached an irreversible level.”

The investment philosophy of the old world

Irresistible.To some of you, this may sound a bit exaggerated, but I don’t think it’s totally wrong.An entire generation of investors realize that a large part of the financial returns in the market are simply currency devaluation.If this is the main driver of returns, then all the investment philosophy you learned from the old world is worthy of questioning.

Opening Bell’s Phil Rosen is a great example by placing the S&P 500 in Bitcoin instead of US dollars.

The US dollar-denominated S&P has risen more than 100% since 2020.This is great, right?But don’t worry.Pricing on limited and robust monetary assets such as Bitcoin, the same index fell nearly 90% in the same period of time.

In short, your frame of reference is really important.

If you can’t beat it, you have to buy it

So, as I’ve been saying latelyBitcoin is the lowest rate of return.If you can’t beat it, you have to buy it.I think the next 12 weeks will be very interesting for Bitcoin holders.

Interest rates are falling.Currency depreciation is accelerating.Institutional investors are embracing depreciation transactions.Bitcoin ETFs have set a record inflows.Retail sentiment is rising as investors believe in the argument that “the fourth quarter is good for Bitcoin”.The M2 money supply is expanding rapidly.

Gold prices have risen by more than 50% this year.Now it’s Bitcoin’s turn.Hold your Bitcoin as the market is about to rise wildly.